Reassessing Trupanion (TRUP) Valuation After Mixed Share Price Momentum And Lofty P/E Premium

Trupanion’s recent performance in focus

Trupanion (TRUP) has been on investors’ radars after a mixed run in the stock, with a small gain over the past month but a negative total return across the past 3 months and past year.

See our latest analysis for Trupanion.

The recent 30 day share price return of 0.73% contrasts with a 12.06% decline over 90 days and a 23.65% drop in the 1 year total shareholder return. This suggests that momentum has been fading even as expectations around growth and risk keep shifting.

If Trupanion’s recent swings have you reassessing your watchlist, it could be a good moment to widen the lens and look at fast growing stocks with high insider ownership as potential ideas.

With Trupanion posting US$1,399.759m in revenue and US$15.459m in net income, plus a sizeable gap to the average analyst price target of US$54.75, you have to ask: is there real upside here, or is the market already pricing in future growth?

Most Popular Narrative: 34.2% Undervalued

With Trupanion’s fair value narrative sitting above the last close of US$37.20, the key question is how those expectations are being built.

Improved underwriting discipline, focus on higher lifetime value pets, and optimization of acquisition channels are driving higher-quality book growth and supporting strong free cash flow, setting up for scalable and more profitable expansion in coming years.

Curious what kind of revenue growth, margin lift and earnings path are baked into that fair value? The narrative leans on punchy earnings compounding, modest top line growth and a rich future profit multiple. Want to see how those ingredients combine into the current fair value call?

Result: Fair Value of $56.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story can fray if Trupanion leans too heavily on price rises instead of subscriber growth, or if faster growing rivals squeeze its customer acquisition and margins.

Find out about the key risks to this Trupanion narrative.

Another view: what the P/E is telling you

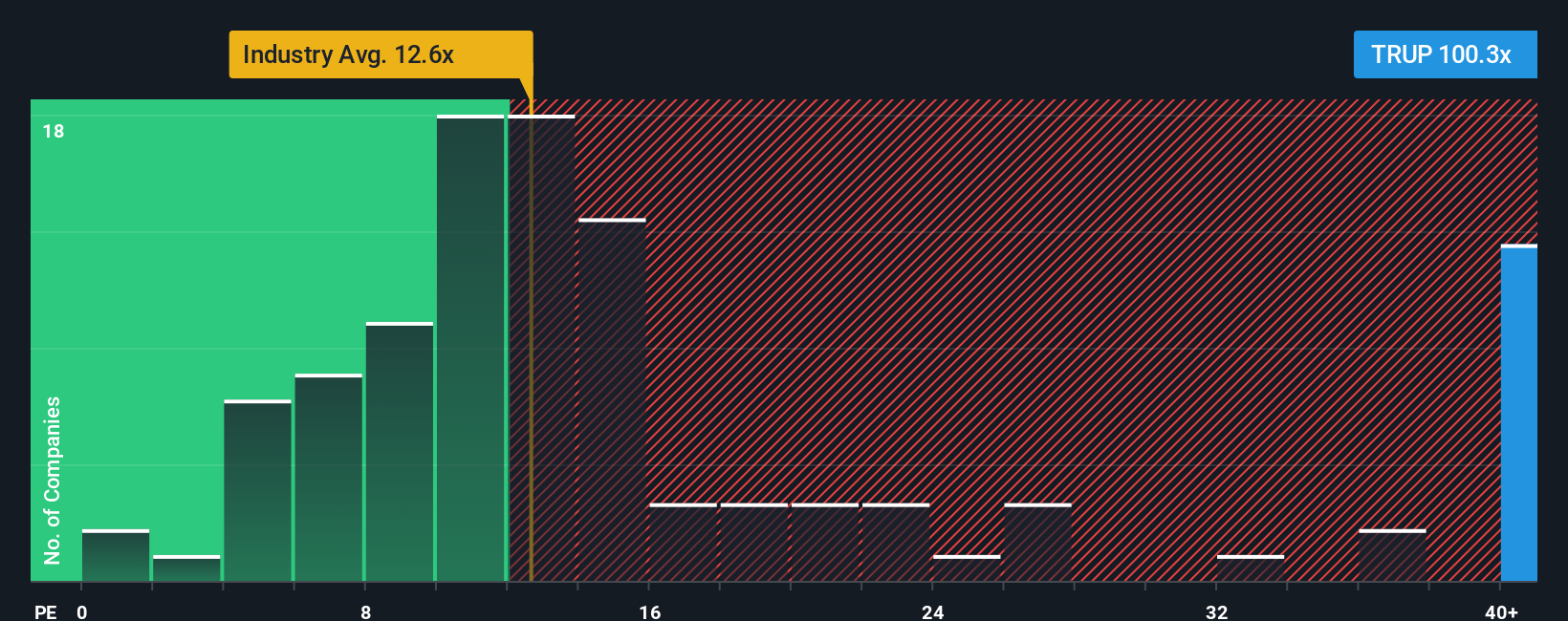

The fair value narrative leans on earnings growth and a rich future multiple, but the current P/E of 104x paints a very different picture. Compared with the US Insurance industry at 12.9x, peers at 11.9x, and a fair ratio of 21.7x, Trupanion looks priced at a hefty premium.

That gap suggests less room for error if earnings or growth assumptions slip, and less obvious room for upside if everything goes right. The key question is whether you think the market will keep paying this kind of premium over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trupanion Narrative

If you think the current story misses something, or you prefer to work from your own numbers, you can build a custom view in minutes with Do it your way.

A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Trupanion is on your radar but you want a broader watchlist, now is the time to line up a few more candidates before the next move.

- Target income-focused opportunities by scanning these 14 dividend stocks with yields > 3% to find options that aim to balance yield with underlying business quality.

- Spot potential value candidates early by checking out these 870 undervalued stocks based on cash flows identified using cash flow driven criteria.

- Get ahead of the next tech shift by reviewing these 25 AI penny stocks that link artificial intelligence themes with listed companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal