Assessing W.W. Grainger (GWW) Valuation After Recent Share Price Consolidation

With no single headline event driving attention, W.W. Grainger (GWW) has come into focus as investors reassess its recent share performance, current valuation signals and the role of its industrial distribution business.

See our latest analysis for W.W. Grainger.

Recent trading has been a bit soft, with a 7 day share price return of 2.19% and a 1 day move of 0.52% at a latest share price of $1,003.81. That sits against a mixed picture where the 30 day share price return is 2.90%, the 90 day share price return is 4.69%, the year to date share price return is flat, the 1 year total shareholder return is 3.91% lower and the 3 and 5 year total shareholder returns of 84.98% and 170.77% still point to strong longer term compounding.

If Grainger has you thinking about where else to look in industrials and related areas, it can help to widen the lens and check out fast growing stocks with high insider ownership.

With shares around $1,003 and a value score of 1, plus only a small gap to the average analyst target of $1,053, the key question is simple: is Grainger quietly undervalued here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 4.7% Undervalued

At a last close of $1,003.81 versus a narrative fair value of about $1,053.47, the current setup hinges on how you view future earnings power and the required 7.99% discount rate.

The acceleration of digital transformation in B2B/industrial commerce is expanding the addressable market for Grainger's online platforms (especially Zoro and MonotaRO). This is driving faster-than-industry top-line gains, operating leverage, and margin expansion as e-commerce penetration rises.

Curious what kind of revenue growth, margin profile, and future P/E this narrative needs to support that fair value gap? The full story connects all three in detail.

Result: Fair Value of $1,053.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value gap depends on digital growth translating into real earnings, while ongoing tariff, pricing and LIFO pressures could still squeeze margins and sentiment.

Find out about the key risks to this W.W. Grainger narrative.

Another Angle On Value

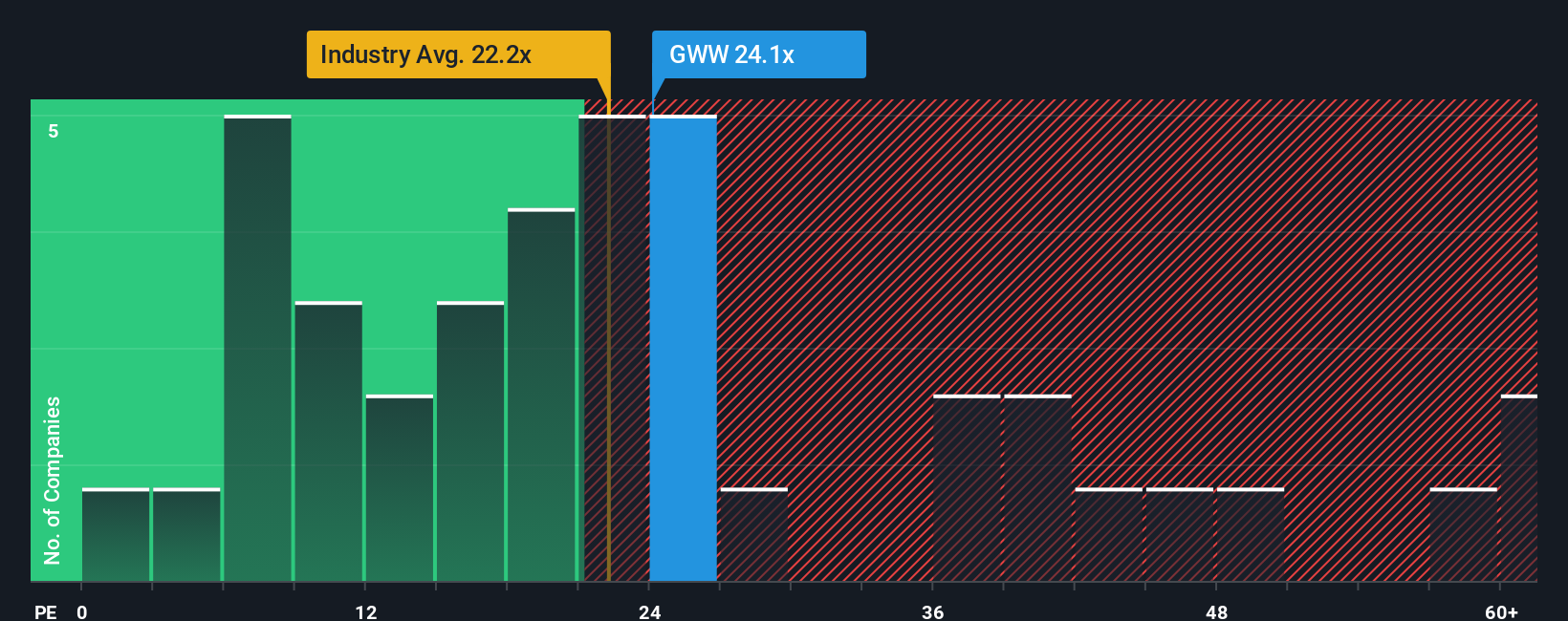

That 4.7% narrative discount paints W.W. Grainger as slightly undervalued, but the P/E story is tougher. At 27.6x earnings versus 20.5x for the US Trade Distributors industry and 22.4x for peers, the shares trade at a clear premium, even if they sit close to a fair ratio of 27.9x. Is that premium a source of comfort, or does it create a margin for disappointment if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W.W. Grainger Narrative

If you see the assumptions differently, or simply want to put your own stamp on the numbers, you can rebuild this story yourself in minutes with Do it your way.

A great starting point for your W.W. Grainger research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Grainger is on your radar, do not stop there. Broaden your watchlist with a few focused stock ideas that match how you like to invest.

- Target potential mispricings by scanning these 870 undervalued stocks based on cash flows that align with your preferred quality and risk profile.

- Ride the AI wave thoughtfully by checking out these 25 AI penny stocks tied to real business use cases rather than just hype.

- Strengthen your income stream by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% and may complement your total return goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal