Assessing First Majestic Silver (TSX:AG) Valuation After Recent Share Price Swings

First Majestic Silver (TSX:AG) has drawn investor attention after recent share price swings, with returns ranging from a 3.7% decline over the past week to a gain of 24.6% in the past 3 months.

See our latest analysis for First Majestic Silver.

Against this backdrop, the recent 7 day share price return of a 3.6% decline and 90 day share price return of 24.6% suggest momentum has cooled in the very short term but remains supportive when you zoom out. At the same time, the 1 year total shareholder return of 166.2% and 3 year total shareholder return of 90.7% hint that investors have been reassessing both growth potential and risk around silver focused producers.

If you are looking beyond precious metals for what is moving next, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

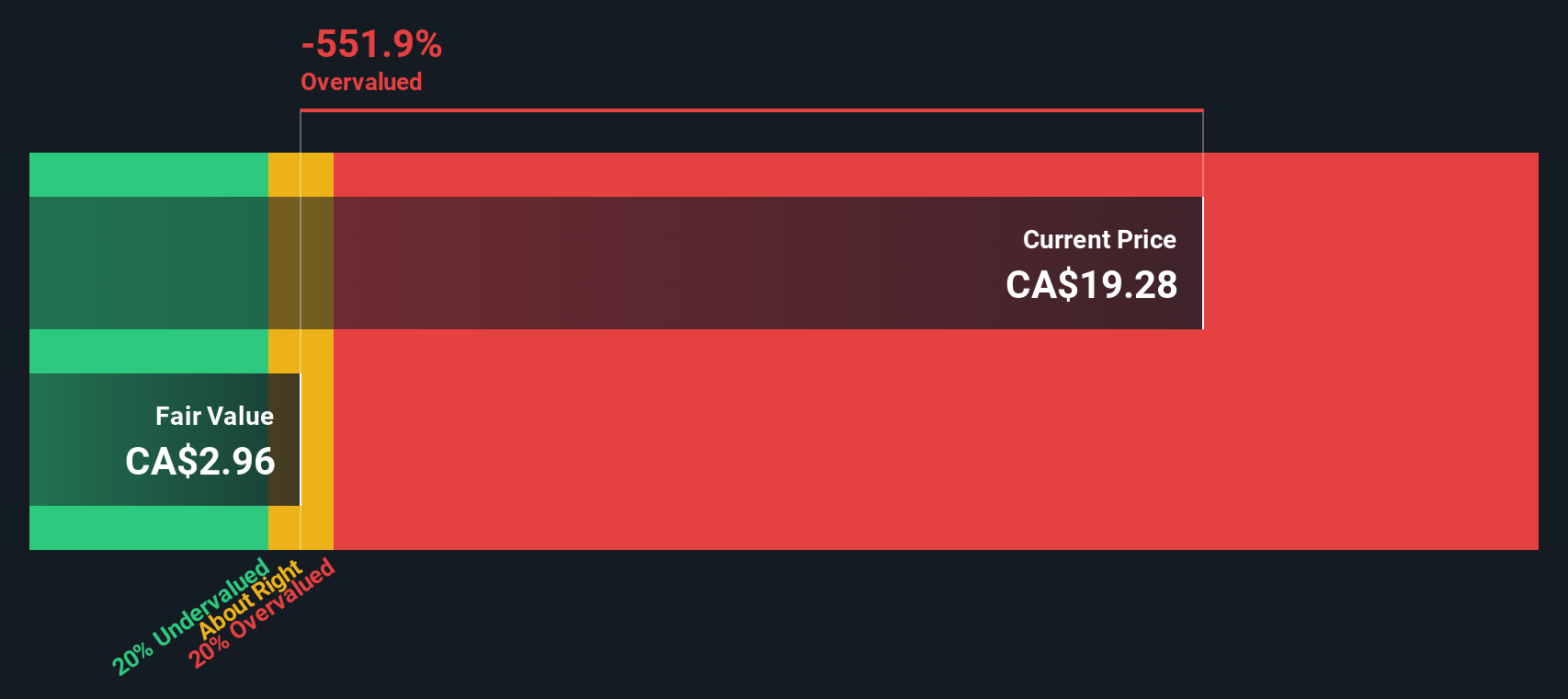

With the shares trading at CA$22.06, an intrinsic value estimate that is 18% higher, and analyst targets sitting above the current price, you have to ask: is First Majestic still undervalued, or is future growth already priced in?

Most Popular Narrative Narrative: 5% Overvalued

With First Majestic Silver closing at CA$22.06 against a narrative fair value of CA$21.00, the current share price sits slightly above that framework.

The analysts have a consensus price target of CA$13.875 for First Majestic Silver based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $94.0 million, and it would be trading on a PE ratio of 77.3x, assuming you use a discount rate of 6.5%.

Want to see what sits behind that rich earnings multiple and revenue ramp up? The narrative leans on rising margins, higher volumes and a compressed P/E a few years out. Curious which of those drivers does the heavy lifting in the fair value math?

Result: Fair Value of $21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh the risk that high exploration and development spending, or Mexico focused operational and regulatory issues, could squeeze margins and unsettle earnings.

Find out about the key risks to this First Majestic Silver narrative.

Another View: DCF Points To A Different Story

That 5% overvalued narrative is only one lens. Our DCF model, which projects cash flows and discounts them back using a required return, suggests a fair value of CA$26.89 per share. On that basis, First Majestic at CA$22.06 screens as undervalued. This presents investors with two perspectives to consider when forming their own view.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Majestic Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Majestic Silver Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a complete narrative in just a few minutes, starting with Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at one stock, you risk missing other opportunities, so keep pushing your research wider and let data driven screens spark your next move.

- Spot potential bargains by scanning these 870 undervalued stocks based on cash flows that the market may be pricing conservatively based on their cash flows and fundamentals.

- Ride powerful technology shifts by checking out these 25 AI penny stocks that are tied to artificial intelligence themes across different industries.

- Target income focused opportunities by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal