Assessing Avnet (AVT) Valuation After Recent Share Price Rebound And Cooling Momentum

Avnet (AVT) is back on investors’ radar after recent share price moves. This is prompting a closer look at how its current valuation lines up with its fundamentals and recent return profile.

See our latest analysis for Avnet.

The latest 1 day share price return of 2.62% to US$49.34 comes after a softer patch that includes a 90 day share price return decline of 3.90%, while the 5 year total shareholder return of 46.24% shows longer term holders have still seen meaningful gains. This suggests recent momentum has cooled compared with its longer history.

If Avnet has you reassessing opportunities in tech hardware and components, it could be a good moment to scan high growth tech and AI stocks for other ideas across different parts of the electronics and AI supply chain.

With Avnet trading at US$49.34, sitting near analyst targets and carrying a solid 5 year return record, the key question now is simple: is there still upside on the table, or is future growth already priced in?

Most Popular Narrative: 6.9% Undervalued

With Avnet’s fair value in the narrative set at US$53 against a last close of US$49.34, the story points to modest upside and leans heavily on future earnings and margin shifts to get there.

With improving book-to-bill ratios, a stabilizing inventory environment, and a strong commitment to operational efficiency (cost control and optimized capital allocation), Avnet is set to translate industry tailwinds into higher earnings and cash flow, supporting future shareholder returns through buybacks/dividends and potential multiple expansion.

Curious how a low current margin profile, ambitious profit uplift and a lower future P/E expectation all reconcile into that fair value? The full narrative walks through the revenue path, profit step up and capital return assumptions that need to line up for US$53 to make sense.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story could easily stall if EMEA demand stays weak or if ongoing gross margin pressure and higher operating costs weigh more heavily on earnings than expected.

Find out about the key risks to this Avnet narrative.

Another View: What The P/E Ratio Is Saying

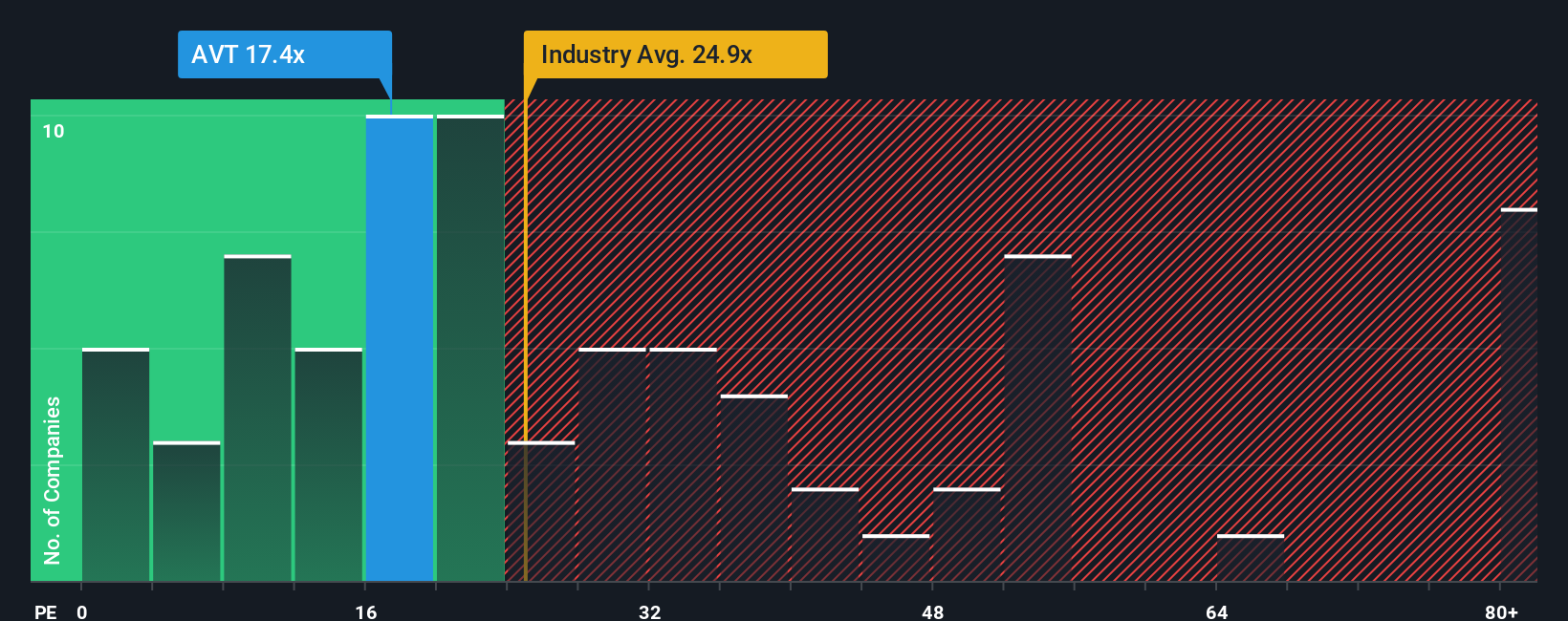

That 6.9% undervaluation story leans on future earnings and margin improvement, but the current P/E of 17.2x adds a different twist. Avnet trades a little higher than its peer average of 16.3x, yet sits well below both the US Electronic industry at 24.7x and its own fair ratio of 35.7x. In plain terms, the market is pricing Avnet more cautiously than the fair ratio suggests, while still asking investors to pay a small premium to peers. Is that a sign of hidden opportunity, or a signal to be more demanding about future execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avnet Narrative

If you look at these numbers and come to a different conclusion, or just want to stress test the assumptions yourself, you can build a complete narrative, your way, in just a few minutes with Do it your way.

A great starting point for your Avnet research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investing Move?

If Avnet has sharpened your thinking, do not stop here. Your next strong idea could be sitting in a corner of the market you have not checked yet.

- Spot potential value early by scanning these 3564 penny stocks with strong financials that pair low share prices with financial strength you can track in one place.

- Ride secular tech trends by checking these 25 AI penny stocks that plug into artificial intelligence themes across different parts of the market.

- Target price and cash flow alignment by reviewing these 870 undervalued stocks based on cash flows that our models flag as trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal