What Southern Copper (SCCO)'s Tight Supply Tailwind and Cycle-Linked Dividend Policy Means For Shareholders

- In recent months, Southern Copper has benefited from firm copper prices and tight global supply, as investor interest in copper exposure has increased.

- An important angle is how Southern Copper’s low-cost operations and dividend policy linked to the commodity cycle position it amid these tighter market conditions.

- We’ll now explore how tighter copper supply and renewed investor confidence may influence Southern Copper’s existing investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Southern Copper Investment Narrative Recap

To own Southern Copper, you need to believe in copper’s long term role in electrification while accepting exposure to commodity cycles and project execution risks. The recent boost in copper-focused investor interest supports the near term catalyst of firm pricing, but it does not remove key risks around potential trade friction and cost inflation, which still look central to the story.

The company’s recent series of dividend increases, including the move to a US$0.90 quarterly cash dividend and small stock dividend in late 2025, is particularly relevant here. It underscores how Southern Copper’s payout is tied to the copper cycle, reinforcing both the appeal of current cash returns and the sensitivity of those payouts if pricing or operating conditions become less favorable.

Yet investors should also be aware that if US and China trade tensions escalate, the impact on copper demand and Southern Copper’s margins could...

Read the full narrative on Southern Copper (it's free!)

Southern Copper's narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028. This requires 3.1% yearly revenue growth and about a $0.7 billion earnings increase from $3.6 billion today.

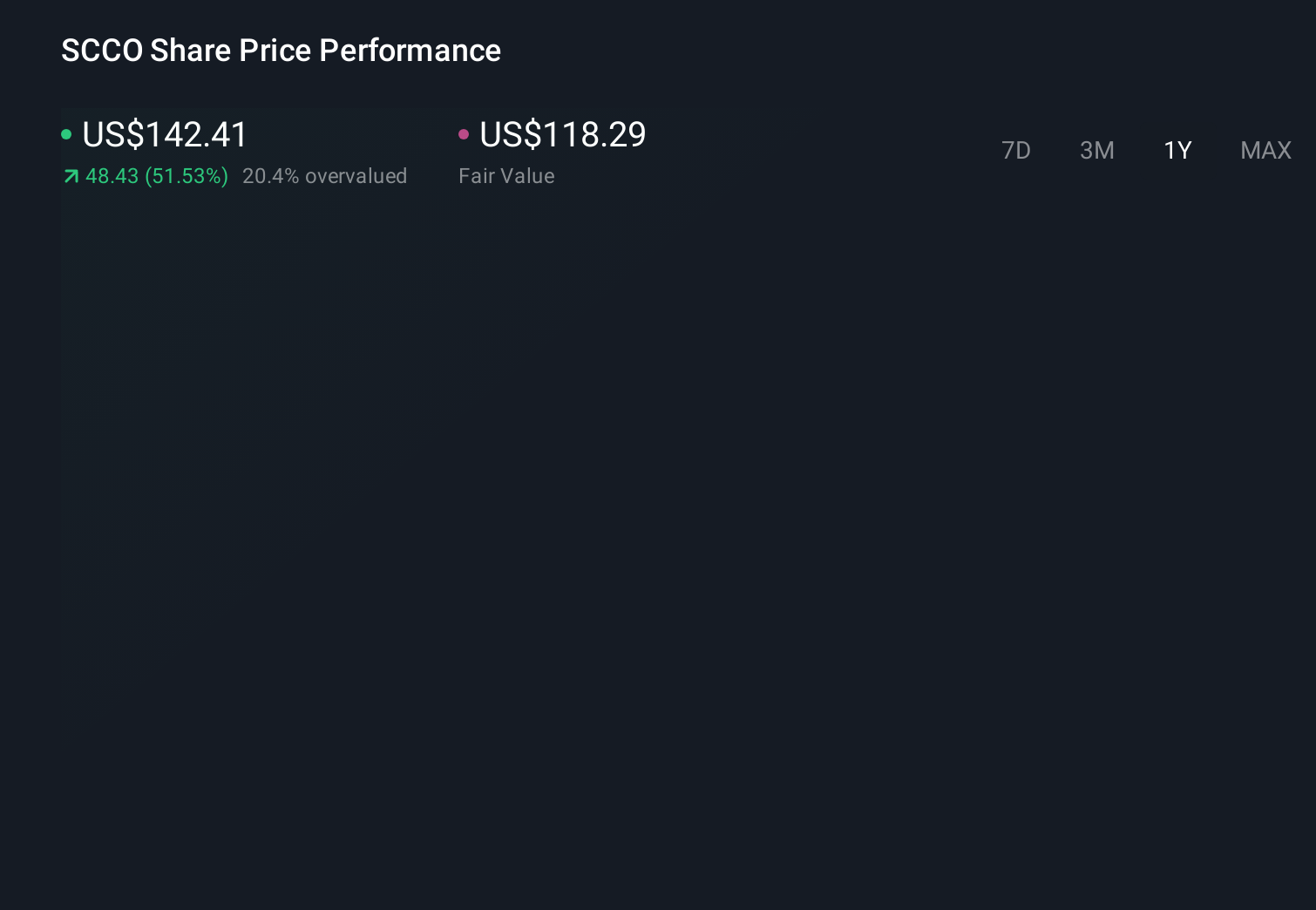

Uncover how Southern Copper's forecasts yield a $118.29 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from about US$96.43 to US$172.32, highlighting very different views on upside from here. You should weigh these opinions against the ongoing risk that trade policy shifts and tariffs could unsettle copper demand and Southern Copper’s earnings profile over time, and consider how different scenarios might affect your expectations.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth as much as 16% more than the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal