Assessing Equinox Gold (TSX:EQX) Valuation After Strong 1 Year Shareholder Returns

Equinox Gold stock: recent performance snapshot

Equinox Gold (TSX:EQX) has caught investor attention after recent share price moves, with a 1 day return of -2.33% and a 1 year total return of 158.44% prompting closer scrutiny of its valuation.

See our latest analysis for Equinox Gold.

While the share price has eased slightly in the last month, recent 90 day share price returns of 17.82% combined with a 1 year total shareholder return of 158.44% suggest momentum has been strong over a longer stretch.

If Equinox Gold has you watching the gold space more closely, it may be a good moment to broaden your view with other materials names and fast growing stocks with high insider ownership.

With CA$2,296.36m in revenue, CA$62.21m in net income and a value score of 5, plus a modelled intrinsic value suggesting a 59.89% discount, is Equinox Gold mispriced, or is the market already baking in future growth?

Most Popular Narrative Narrative: 14.6% Undervalued

The most followed narrative sets Equinox Gold's fair value at CA$22.05, which sits above the last close of CA$18.84 and frames an undervaluation story built on future cash generation.

Recent street research has highlighted a significant shift in sentiment among analysts covering Equinox Gold, as reflected in multiple rating upgrades and increased price targets. Analysts are revising their outlooks in response to the company’s evolving financial and operational profile.

Curious what kind of revenue build, margin expansion, and future earnings multiple are needed to back this higher value? The full narrative spells out those assumptions in detail.

Result: Fair Value of $22.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if ore grades at key mines stay below plan, or if community and regulatory issues cause fresh delays and higher costs.

Find out about the key risks to this Equinox Gold narrative.

Another angle on valuation

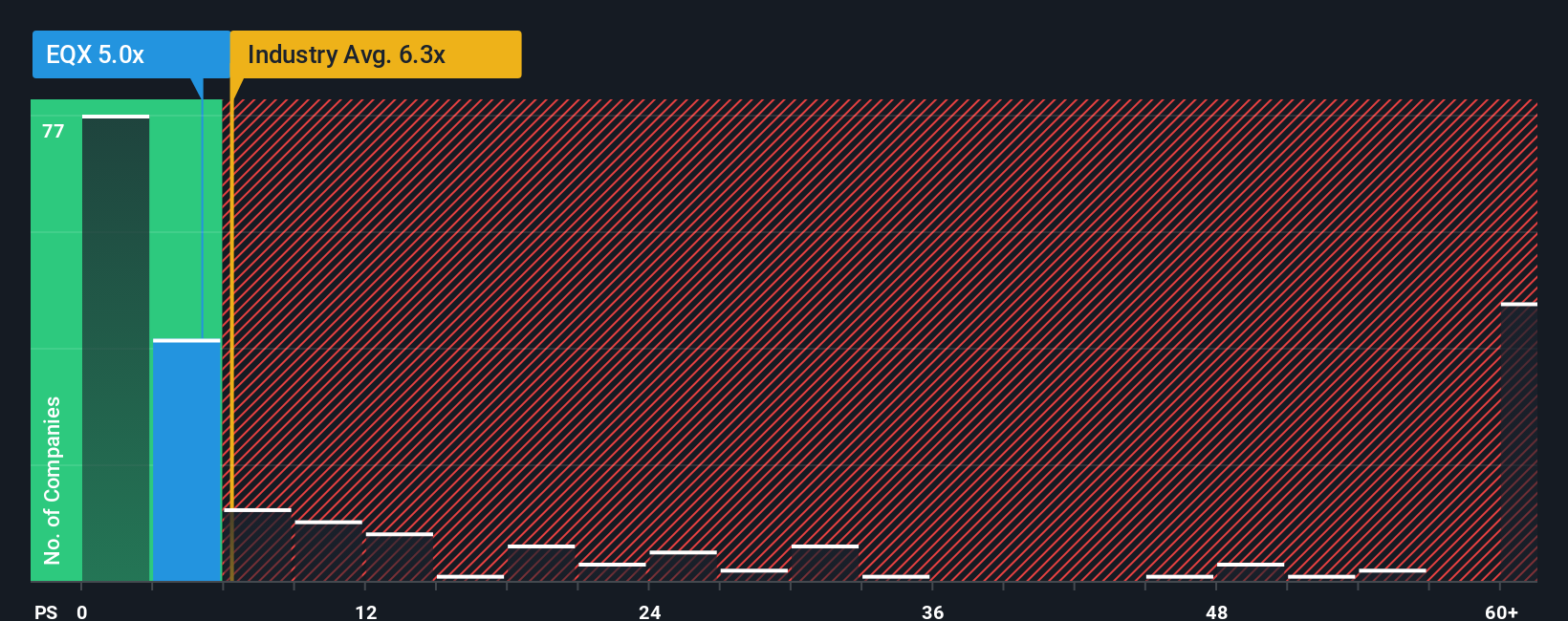

So far the story has leaned on future cash flows to argue Equinox Gold looks mispriced. If you switch to a simple P/S lens, the picture is less straightforward. The current P/S of 4.7x sits slightly above a fair ratio of 4.4x, yet below the Canadian metals and mining average of 7.3x and a peer average of 9.2x. This points to less room for error if expectations slip but also some relative value compared with other names. Which signal do you trust more when the next set of results lands?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinox Gold Narrative

If the story so far does not line up with your own view, or you would rather lean on your own research and assumptions, you can build a personalised Equinox Gold narrative in just a few minutes with Do it your way.

A great starting point for your Equinox Gold research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Equinox Gold has sharpened your interest, do not stop here. Use the tools at your fingertips to pressure test other ideas before the market moves on.

- Spot potential value early by scanning these 3564 penny stocks with strong financials that pair smaller size with stronger fundamentals.

- Ride the AI wave more selectively by focusing on these 25 AI penny stocks that already back their story with financial strength.

- Hunt for mispriced opportunities using these 870 undervalued stocks based on cash flows that screen for businesses trading below their cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal