A Look At Five9 (FIVN) Valuation After Steep Recent Share Price Weakness

With no single headline event setting the tone, Five9 (FIVN) is drawing attention largely because of its recent share performance, including negative returns over the past year and past 3 months, and its current valuation metrics.

See our latest analysis for Five9.

The recent 1 day share price return of a 6.18% decline and 7 day share price return of a 5.69% decline at a last close of $18.81 extend a weaker trend, with the 1 year total shareholder return sitting at a 54.31% loss and longer term holders also facing large negative total returns. This suggests momentum has been fading as investors reassess growth prospects and risk around the current valuation.

If Five9’s recent moves have you rethinking your tech exposure, it could be a good time to scan high growth tech and AI stocks that are catching attention right now.

So, with Five9 trading at $18.81 after steep 1-year and multi-year total return losses, and with some valuation metrics suggesting a large discount to certain estimates, is this punished software name now mispriced, or is the market already factoring in future growth?

Most Popular Narrative: 44.8% Undervalued

With Five9 last closing at $18.81 and the most followed narrative pointing to a fair value of about $34.05, the gap between price and projected value is wide enough to catch attention.

Strategic deepening of partnerships with leading technology companies (e.g., Salesforce, Google Cloud, ServiceNow, Epic) enhances Five9's go-to-market reach and integration opportunities, accelerating international expansion, client diversification, and potential channel-driven revenue lift.

Want to see what kind of revenue growth, margin profile, and future P/E multiple have to line up for that valuation to make sense? The story ties recurring AI driven revenue, rising profitability, and a richer earnings multiple into one tight set of forecasts, but the exact assumptions might surprise you.

Result: Fair Value of $34.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative also leans on assumptions that could be challenged if competitive pressure intensifies or leadership transitions unsettle execution and revenue stability.

Find out about the key risks to this Five9 narrative.

Another View: Earnings Multiple Paints a Tougher Picture

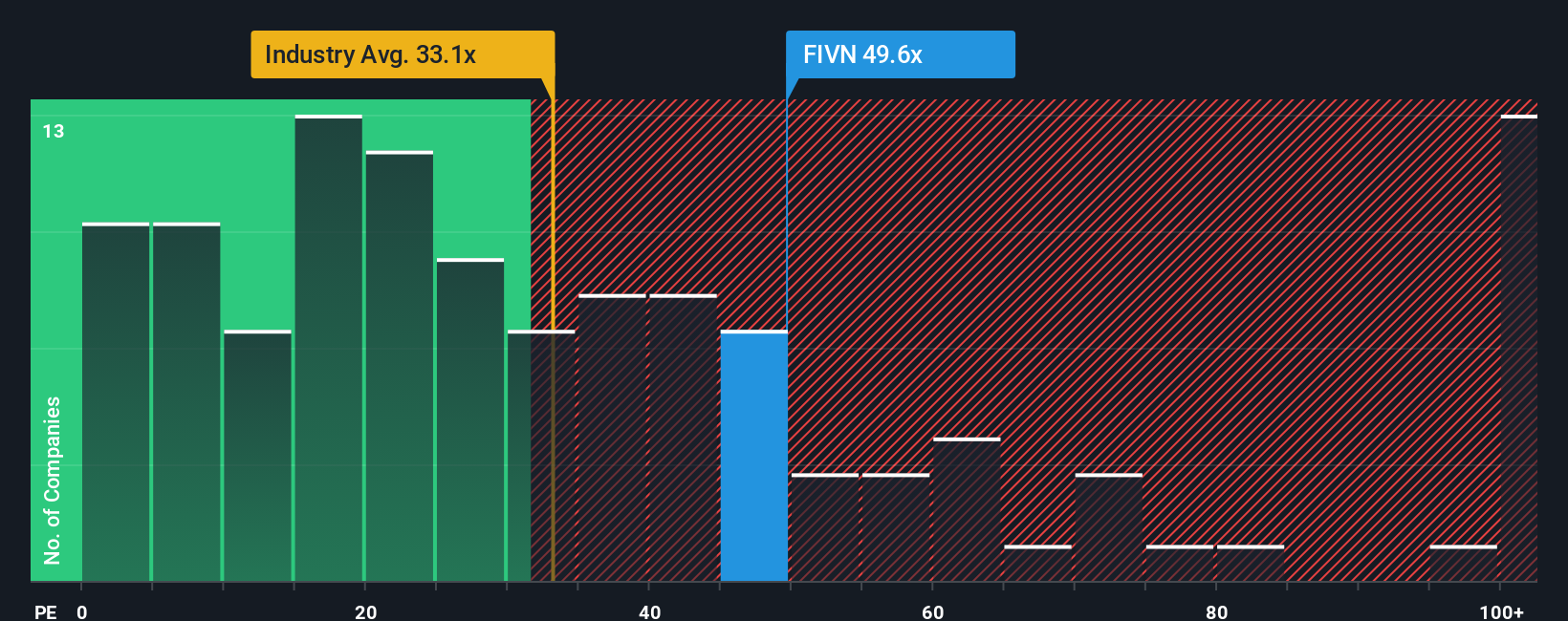

While the popular narrative points to undervaluation, the current P/E of about 47x tells a different story. It sits well above the US Software industry at 31.7x, peers at 23.6x, and even above a 34.1x fair ratio that the market could eventually lean toward. This raises clear valuation risk. If sentiment cools further, would investors still pay this kind of premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you think the current story misses something, or you simply prefer to weigh the numbers yourself, you can pull the inputs together and shape a complete view in just a few minutes, then Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Five9 has you rethinking your next move, do not stop here. Use the tools at your fingertips to line up fresh ideas before the crowd catches on.

- Target potential value gaps by scanning these 870 undervalued stocks based on cash flows that may be trading below what their cash flows imply.

- Spot fast moving opportunities in emerging technology by checking out these 25 AI penny stocks that sit at the front of the AI rollout.

- Strengthen potential income in your portfolio by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal