Assessing Carlyle Group (CG) Valuation As Abingworth Leadership Shifts Toward Biotech And Pharma Deals

Carlyle Group (CG) is drawing investor attention after Abingworth, its life sciences arm, reshaped leadership and added Travis Wilson as Managing Director focused on clinical co development and biotech and pharma buyout opportunities.

See our latest analysis for Carlyle Group.

The latest leadership moves in life sciences come as Carlyle’s share price sits at US$60.86, with a 30 day share price return of 6.57% and a 1 year total shareholder return of 18.57%. The 3 year total shareholder return of 107.74% and 5 year total shareholder return of 118.51% point to momentum that has built over time rather than faded recently.

If this kind of specialist deal making interests you, it could be a good moment to widen your watchlist and consider healthcare stocks as a source of potential next ideas.

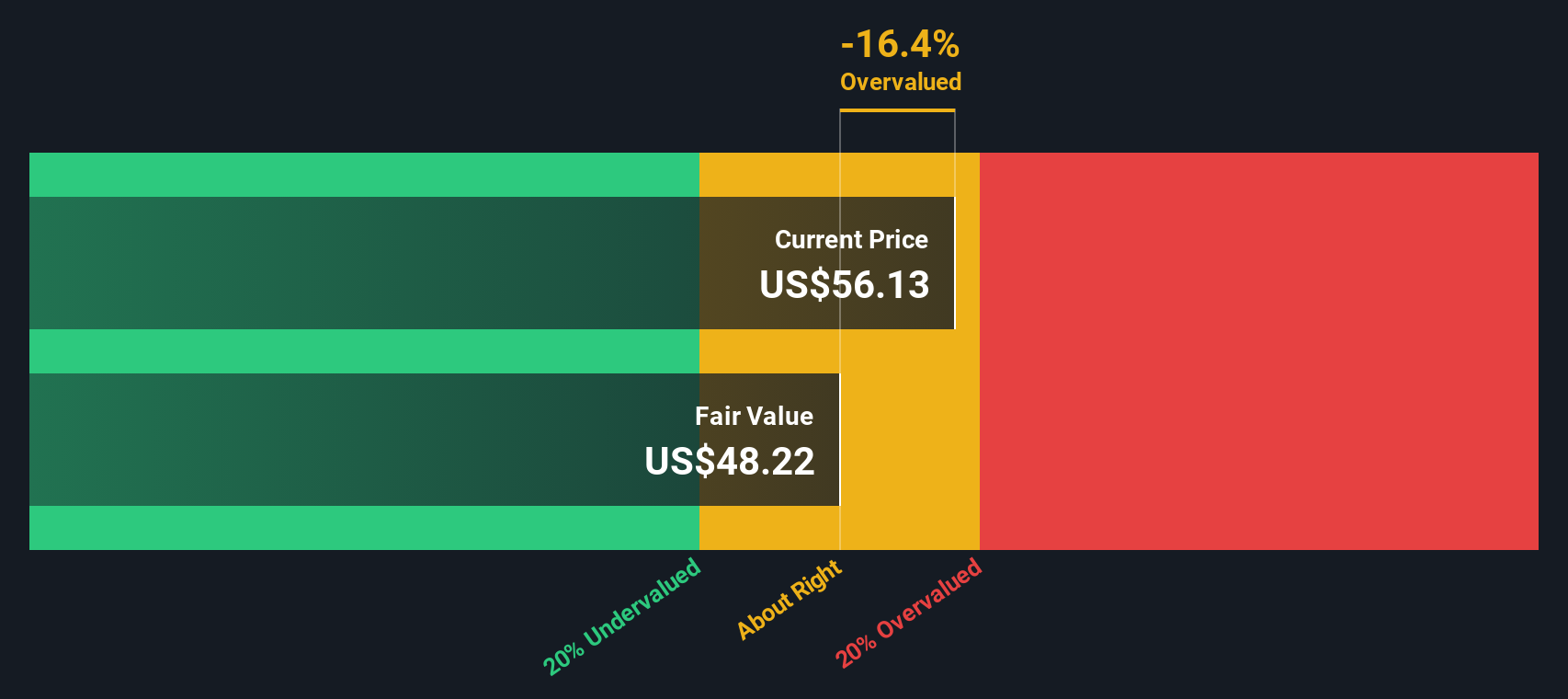

With Carlyle trading at US$60.86 and sitting around 9% below the average analyst price target, plus solid recent shareholder returns, you have to ask: is there still value on the table here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 8.2% Undervalued

With Carlyle closing at US$60.86 against a fair value estimate of about US$66, the most followed narrative sees some room between price and fundamentals.

Persistent growth and strong investment performance in the secondaries/co-investment and perpetual capital strategies, coupled with innovation in capital markets activities, are increasing Carlyle's earnings stability and potential for margin expansion by reducing reliance on episodic fundraising or realization cycles.

Curious what sits behind that valuation gap? The narrative leans on brisk top line expansion, fatter profit margins, and a future earnings multiple that still looks restrained. Want to see how those moving parts stack up to reach that fair value number?

Result: Fair Value of $66.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained fee pressure from intense competition, as well as higher financing costs for leveraged deals, could quickly narrow that apparent valuation gap.

Find out about the key risks to this Carlyle Group narrative.

Another Angle On Value

Our DCF model presents a very different picture compared to the 8.2% undervalued narrative. Based on these assumptions, Carlyle at US$60.86 appears significantly above an estimated fair value of US$23.17. This indicates notable downside risk if cash flows develop in line with those assumptions. Which perspective do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carlyle Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carlyle Group Narrative

If you think the numbers tell a different story, or you prefer to test the assumptions yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your Carlyle Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Carlyle has caught your eye, do not stop here. Put a few more names on your radar so you are not relying on a single idea.

- Spot potential mispricing by scanning these 870 undervalued stocks based on cash flows that appear attractively priced based on their projected cash flows.

- Tap into long term themes by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain, payment infrastructure, and digital asset ecosystems.

- Zero in on income potential with these 14 dividend stocks with yields > 3% that offer yields above 3% and may suit a cash flow focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal