Sanrui Smart GEM IPO submitted for registration to raise 768.88 million yuan

The Zhitong Finance App learned that on January 5, Nanchang Sanrui Intelligent Technology Co., Ltd. (abbreviation: Sanrui Intelligence) applied for the Shenzhen Stock Exchange GEM IPO review status to “submit registration”. Cathay Pacific Haitong Securities is the sponsor and plans to raise 768.88 million yuan.

According to the prospectus, Sanrui Intelligence is a manufacturer of drone and robot power systems. Its main business is R&D, production and sales of drone electric power systems and robot power systems, and actively lays out electric vertical take-off and landing vehicle (eVTOL) power system products.

In terms of drone electric power systems, the company's products include all types of electric power systems such as motors, electronic speed regulators, propellers, and integrated power systems. The terminals are used in various vertical segments such as agriculture, forestry and plant protection, industrial inspection, surveying and mapping geographical information, express logistics, emergency rescue, security monitoring, etc. The products can be applied to various types of drones such as multi-rotor, fixed wing, and compound wing.

The company's products are sold to more than 100 countries and regions in Asia, Europe, America, Africa, and Oceania. The downstream direct sales customers are scattered and cover a large number of customers. Customers with sales exceeding 1 million include well-known customers in the drone field such as Aerospace Electronics (600879.SH), Zongheng (688070.SH), Huazue Navigation (300627.SZ), and Japan's NTT (9432.T).

In terms of robot power systems, the company established its own brand CubeMars in 2018, focusing on the field of robot joints. Currently, it has developed and produced all core components such as motors, drive plates, and planetary reducers in robot power modules in-house. The company's products can be used in many emerging fields such as humanoid robots, exoskeletons and wearable devices, and quadruped robots.

The prospectus indicates risk. During the reporting period, the company's direct materials accounted for 76.28%, 75.43%, 74.76% and 72.67% of the main business costs respectively, which is relatively high. If the price of major raw materials rises sharply in the future, it will put a certain amount of cost pressure on the company, which in turn will affect the company's operating performance.

After deducting the issuance fee, all of the funds raised in this offering are intended to be used for projects related to the company's main business. The details are as follows:

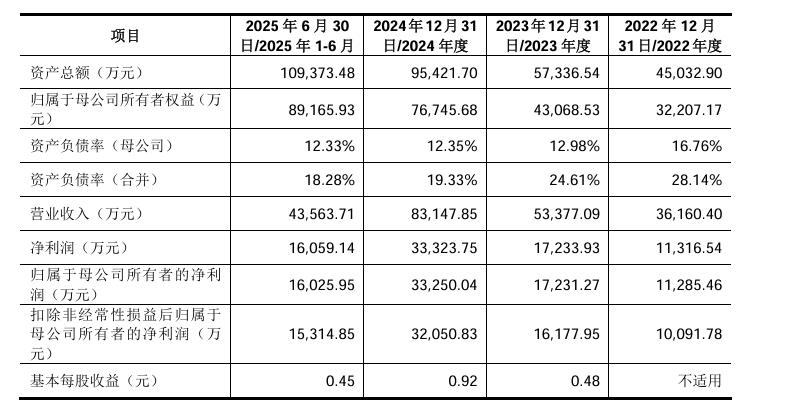

On the financial side, in 2022, 2023, 2024, and January-June 2025, Sanrui Intelligence achieved operating revenue of approximately 362 million yuan, 534 million yuan, 831 million yuan, and 436 million yuan respectively; for the same period, net profit was approximately RMB 113 million, RMB 172 million, RMB 333 million, and RMB 161 million, respectively.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal