Rocket Lab (RKLB) Valuation Check After 54.9% One Month Share Price Surge

Rocket Lab (RKLB) has drawn fresh attention after a sharp move in its share price, with 1 day, 1 week, month and past 3 months returns all showing positive momentum for the stock.

See our latest analysis for Rocket Lab.

The latest 1 month share price return of 54.91% and 1 day move of 8.93% come on top of a very large 3 year total shareholder return, suggesting momentum has been building rather than fading recently.

If Rocket Lab’s recent move has you thinking about the broader space and defense theme, it could be a good moment to look at aerospace and defense stocks as well.

With Rocket Lab up 54.9% in a month and trading above the current analyst price target, the key question now is whether the stock is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 22.3% Undervalued

According to KiwiInvest, the narrative fair value of US$98 per share sits above Rocket Lab’s last close at US$75.99. This sets up a valuation gap that hinges on long run growth, margins and capital needs.

"Rocket Lab has achieved revenue of $436m through 16 annual launches of its Electron rocket, alongside its rapidly expanding 'Space Systems' segment. Roughly 1/3 of revenue comes from its low-cost rocket launches, with the remaining 2/3 of revenue coming from selling the satellites used in those launches to its customers."

Curious how this valuation gets to a higher share price? It is based on rapid revenue compounding, a step change in profit margins and a future earnings multiple usually reserved for mature tech leaders. Want to see how those pieces fit together over the next decade in this narrative?

Result: Fair Value of $98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this storyline still leans heavily on Neutron reaching commercial scale and Rocket Lab turning a US$197.6m net loss into durable profitability.

Find out about the key risks to this Rocket Lab narrative.

Another Angle On Valuation

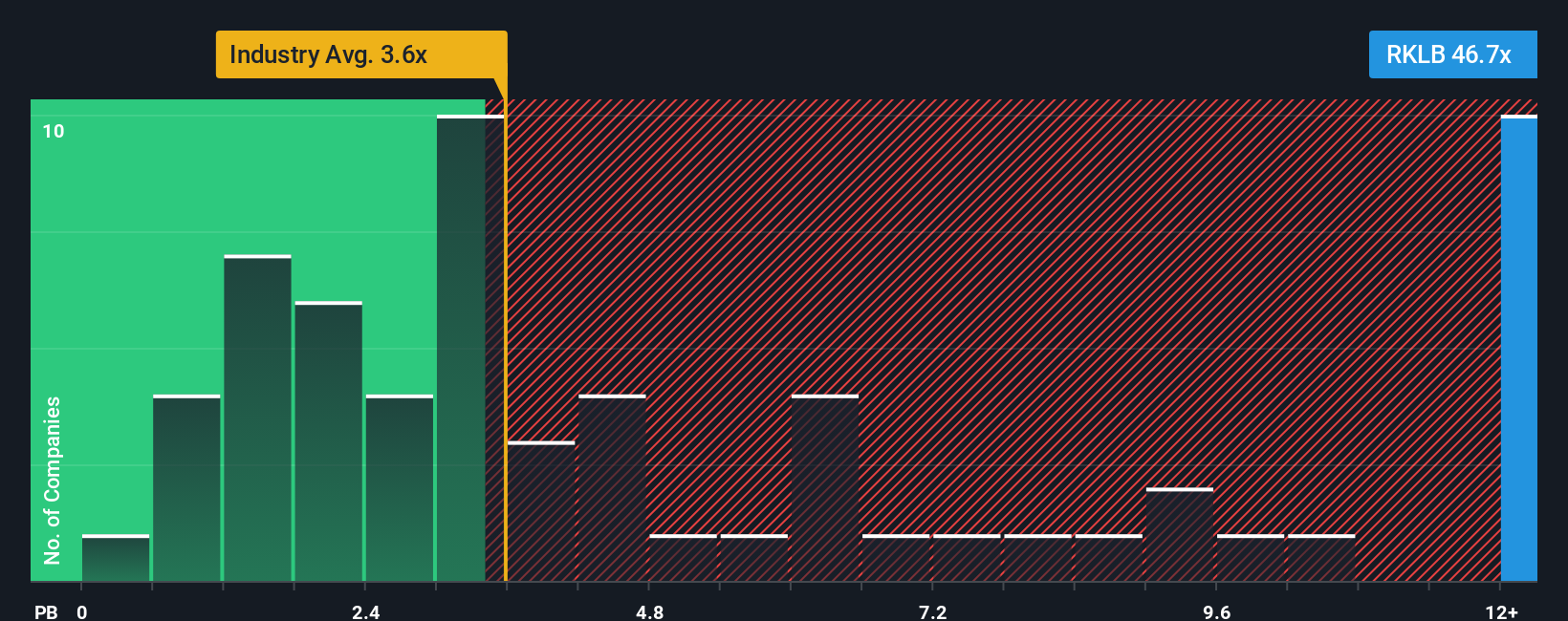

KiwiInvest’s fair value of US$98 points to upside, but our multiples view paints a tougher picture. Rocket Lab trades on a P/B of 31.7x, compared with 9.2x for peers and 3.8x for the wider US Aerospace & Defense group. This suggests expectations are already very high. How comfortable are you paying that kind of premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Lab Narrative

If you think the assumptions here are off, or you simply prefer to weigh the numbers yourself, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Rocket Lab has sparked your interest, do not stop there. Use the Simply Wall St Screener to spot other opportunities that might fit your style and risk level.

- Target reliable income by scanning these 14 dividend stocks with yields > 3% that focus on regular cash returns rather than just share price moves.

- Capitalize on emerging tech trends by tracking these 25 AI penny stocks that tie artificial intelligence to real business models.

- Hunt for potential mispricings by sorting through these 870 undervalued stocks based on cash flows where market expectations and underlying cash flows may not fully line up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal