Assessing On Holding (NYSE:ONON) Valuation After Mixed Shareholder Returns And Premium P/E Multiple

Event context and recent performance

On Holding (NYSE:ONON) is back on many watchlists after a mixed stretch, with the stock roughly flat over the past week, a small decline over the past month, and a double digit gain in the past 3 months.

See our latest analysis for On Holding.

At a share price of $46.95, On Holding has a 1 year total shareholder return of 14.04% decline but a 3 year total shareholder return of 145.55% gain, suggesting long term momentum, while recent sentiment has cooled as investors reassess growth potential and risk.

If On's recent swings have you thinking about what else is out there, this could be a good moment to check out other fast growing stocks with high insider ownership that might be gaining traction.

With revenue of $2.88b, net income of $224.2m and a share price at $46.95, the big question is whether On is still trading below its estimated worth or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 24.4% Undervalued

With On Holding last closing at $46.95 against a narrative fair value near $62, the current setup depends on how earnings power evolves over time.

The company's ability to launch and quickly scale new product franchises (nine now above 5% of revenue), and to expand beyond running into tennis, trail, lifestyle, and fast-growing apparel, demonstrates product innovation and diversification that supports both average selling price increases and higher future revenue per customer.

Want to see what is built into that higher price tag? The narrative focuses on rapid top line expansion, rising margins, and a richer earnings multiple. Curious how those pieces fit together into one valuation story?

Result: Fair Value of $62.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic setup can crack if premium pricing starts to bite into demand, or if heavy spending on new regions and categories squeezes margins harder than expected.

Find out about the key risks to this On Holding narrative.

Another angle on valuation

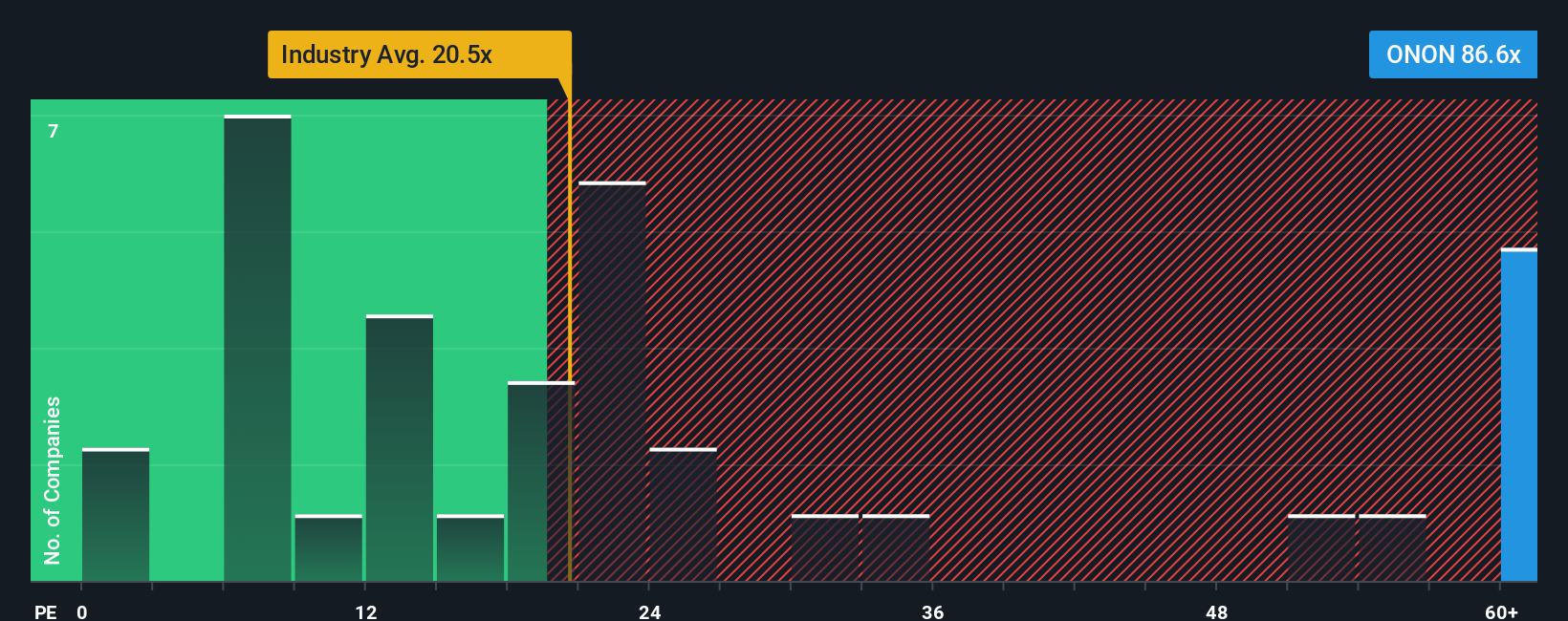

The first narrative leans on a fair value of about $62, but the earnings multiple tells a different story. On Holding trades on a P/E of 55.3x, compared with a fair ratio of 30.8x, the US Luxury industry at 20x, and peers at 28.3x. That is a wide premium for you to weigh up. Is this a cushion of quality or room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If this view does not quite match yours, or you prefer to lean on your own checks, you can build a tailored On Holding thesis in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Looking for more investment ideas?

If On Holding has your attention but you want a wider set of options, this is the moment to line up a few fresh ideas for your watchlist.

- Spot potential value plays early by scanning these 870 undervalued stocks based on cash flows that might be pricing in more cash flow strength than the market currently recognizes.

- Tap into long term tech themes by checking out these 25 AI penny stocks that could benefit from broader adoption of artificial intelligence across industries.

- Build a portfolio with income in mind by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal