Coupang (NYSE:CPNG) Valuation Check After Recent Share Price Pullback

Coupang stock update

Coupang (NYSE:CPNG) has been drawing investor attention after recent share price moves, including a return of about 5.1% over the past year, a decline of roughly 13.8% over the past month, and a drop of nearly 27.8% over the past 3 months.

See our latest analysis for Coupang.

With the share price at $23.37, Coupang’s short term share price returns over the past week and month have been weak, while its 1 year total shareholder return of 5.1% points to momentum that has cooled recently.

If Coupang’s recent pullback has you reassessing growth ideas, it can be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

Coupang reported 9.97% annual revenue growth and 35.13% annual net income growth, yet its share price declined 27.8% over the past three months. Is this weakness a potential entry point, or is the market already pricing in future growth?

Most Popular Narrative: 35.5% Undervalued

With Coupang last closing at $23.37 and the most followed narrative pointing to a fair value near $36, the gap between price and narrative value is wide.

The analysts have a consensus price target of $34.181 for Coupang based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $26.2.

Want to see what is behind this valuation gap? Revenue scaling, margin shifts, and a higher future earnings multiple all sit at the core of this narrative.

Result: Fair Value of $36.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if Developing Offerings continue to post heavy losses or if high technology and logistics spending holds margins down for longer than analysts expect.

Find out about the key risks to this Coupang narrative.

Another angle on valuation

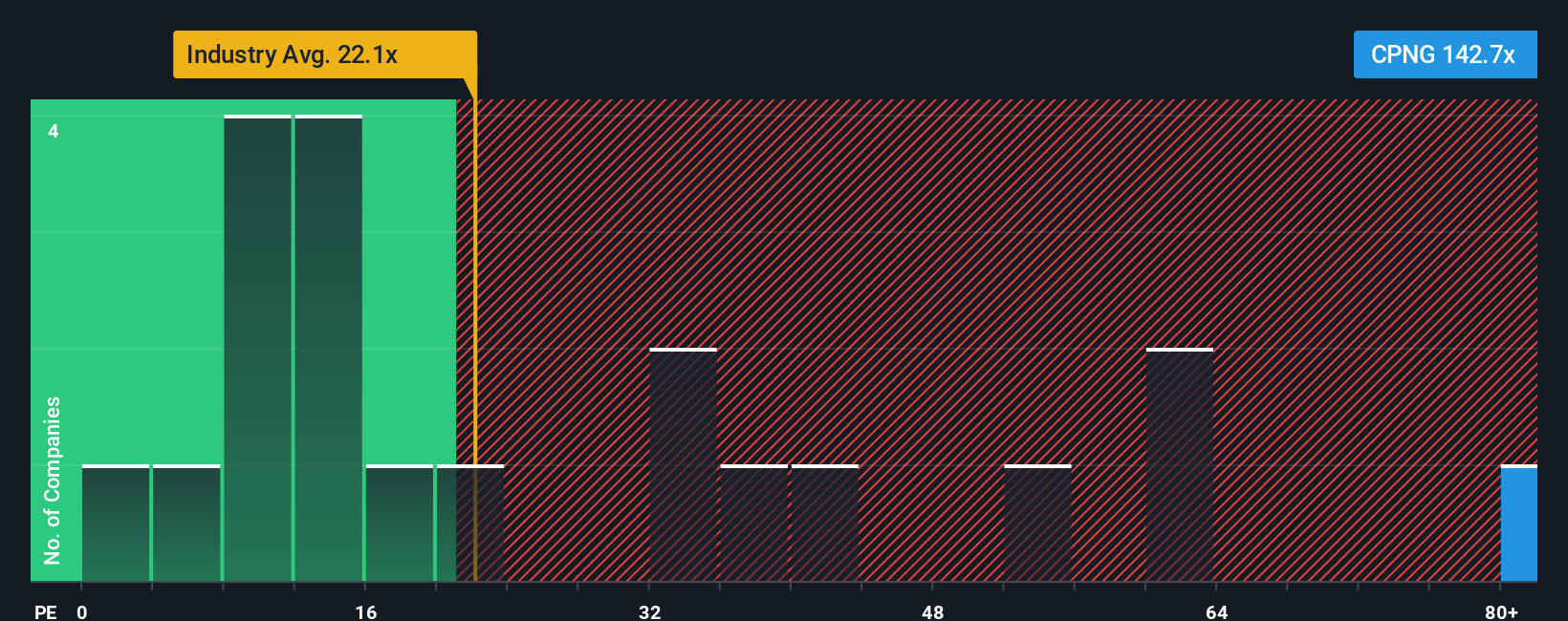

The narrative model suggests Coupang is undervalued, yet its current P/E of 109.5x is far higher than the global Multiline Retail average of 19.4x, its peer average of 32.6x, and even the SWS fair ratio of 37x. That kind of gap can mean higher valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can spin up a custom Coupang view in a few minutes, starting with Do it your way.

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself a few minutes to scan other opportunities with different return drivers so you are not relying on a single story.

- Chase potential value by screening for companies trading at a discount using these 870 undervalued stocks based on cash flows that might fit your return and risk preferences.

- Tap into cutting edge themes in artificial intelligence with these 25 AI penny stocks if you want exposure to businesses using AI in their core offerings.

- Build a portfolio with income in mind by checking out these 14 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal