UK Penny Stocks To Watch In January 2026

The UK stock market has faced recent challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking potential growth opportunities. While the term 'penny stocks' might seem outdated, these smaller or newer companies can offer a blend of affordability and growth potential when they are backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.265 | £489.8M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.94 | £156.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.135 | £17.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.71 | $412.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.865 | £78.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.53 | £185.3M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.525 | £73.63M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Gattaca (AIM:GATC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gattaca plc is a human capital resources company offering contract and permanent recruitment services across private and public sectors, with a market cap of £32.69 million.

Operations: Gattaca's revenue is primarily derived from its Infrastructure (£147.63M), Defence (£101.98M), Energy (£58.98M), Digital Technology (£41.45M), Mobility (£22.64M), Commercial & Professional (£12.28M), Gattaca Projects (£11.86M) and International segments (£2.09M).

Market Cap: £32.69M

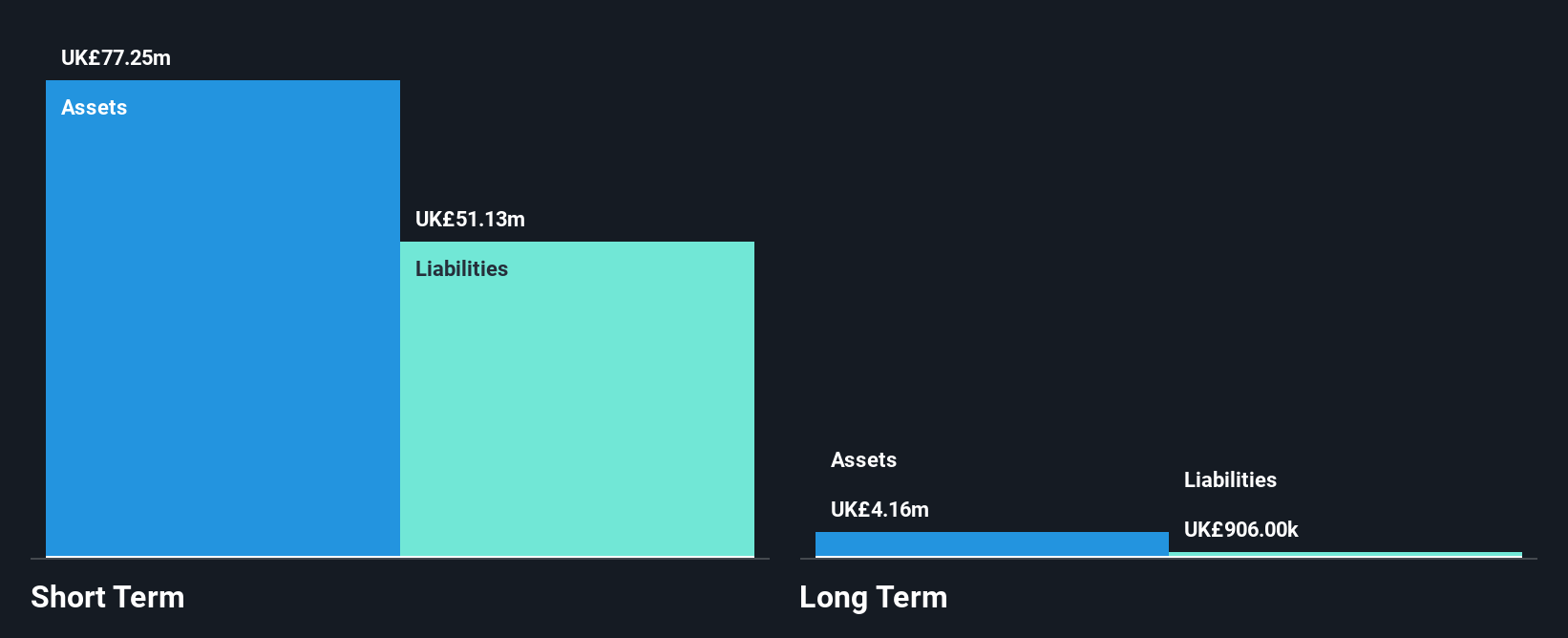

Gattaca plc, with a market cap of £32.69 million, has shown robust earnings growth of 142.1% over the past year, significantly outpacing the industry average of 1.7%. Despite being debt-free and having stable weekly volatility at 7%, its return on equity remains low at 6.3%. The company recently reduced its final dividend to 2 pence per share, aligning with its strategy to distribute approximately half of profits as dividends. While insider selling has been significant in recent months, Gattaca's short-term assets comfortably cover both short and long-term liabilities, indicating financial stability amidst ongoing profit growth challenges.

- Click here to discover the nuances of Gattaca with our detailed analytical financial health report.

- Gain insights into Gattaca's outlook and expected performance with our report on the company's earnings estimates.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £164.38 million.

Operations: The company generates revenue of $72.9 million from its production activities.

Market Cap: £164.38M

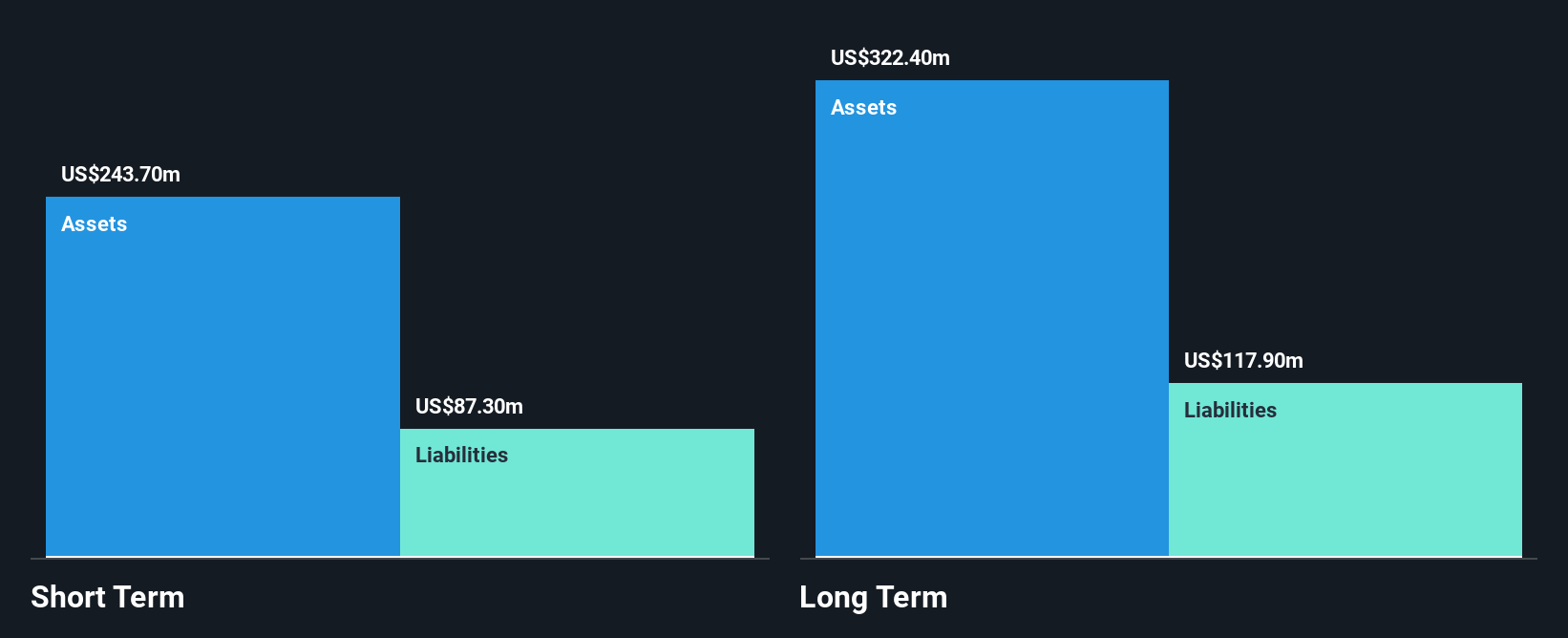

Genel Energy plc, with a market cap of £164.38 million, has maintained stable production levels despite recent disruptions, achieving gross production of around 80,000 bopd. The company is unprofitable but has ample cash reserves exceeding its total debt and a cash runway extending beyond three years even if free cash flow decreases. Its short-term assets of $243.7M cover both short and long-term liabilities comfortably. Recent management changes include the retirement of Chair David McManus due to ill health. Although earnings are forecasted to grow significantly at 78.64% annually, the company remains unprofitable with negative return on equity at -13.33%.

- Get an in-depth perspective on Genel Energy's performance by reading our balance sheet health report here.

- Evaluate Genel Energy's prospects by accessing our earnings growth report.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq with a market cap of £380.45 million.

Operations: The company's revenue is derived entirely from its exploration and production activities in the oil and gas sector, amounting to $163.17 million.

Market Cap: £380.45M

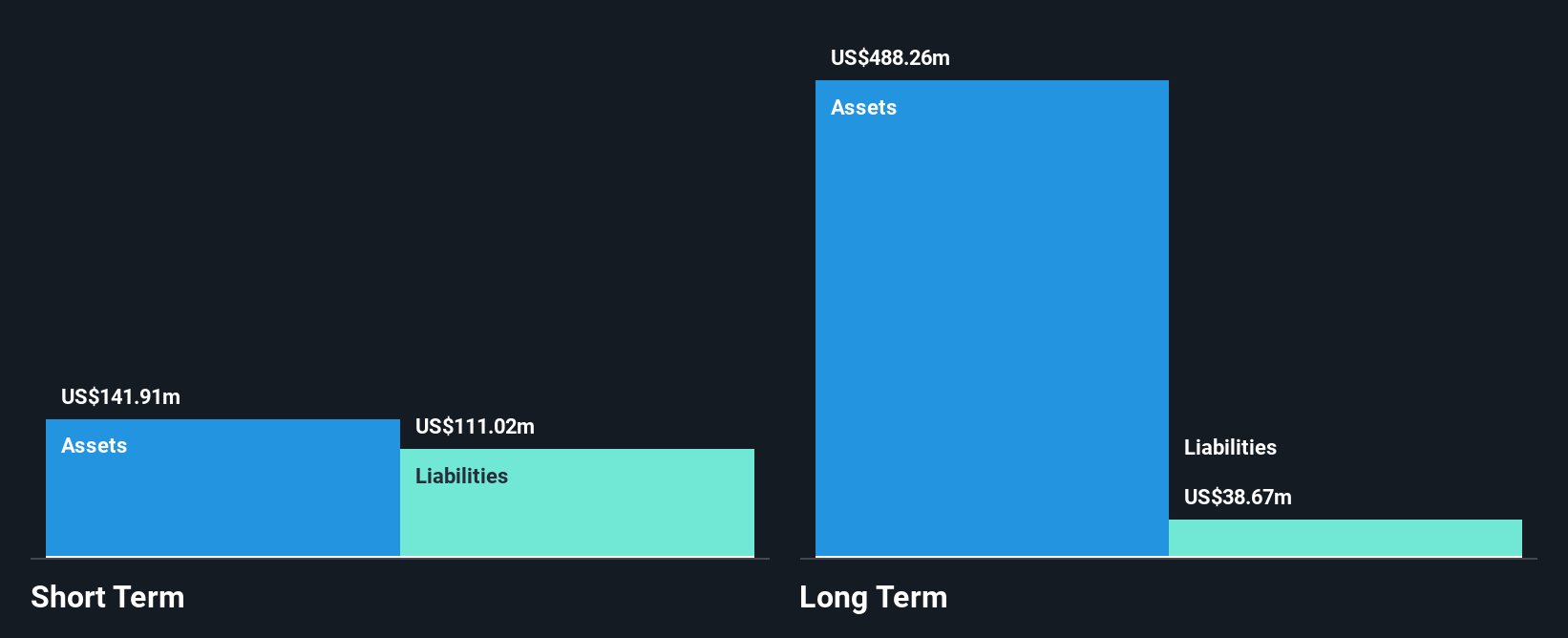

Gulf Keystone Petroleum Limited, with a market cap of £380.45 million, operates in the Kurdistan Region of Iraq and generates US$163.17 million in revenue from oil and gas activities. Despite being unprofitable with losses increasing at 10.4% annually over five years, the company is debt-free and analysts expect earnings to grow by 59.99% per year. Its short-term assets of $141.9M exceed both short- and long-term liabilities, indicating financial stability despite profitability challenges. The management team is experienced with an average tenure of 4.4 years, though the board is relatively new with an average tenure of 2.5 years.

- Take a closer look at Gulf Keystone Petroleum's potential here in our financial health report.

- Understand Gulf Keystone Petroleum's earnings outlook by examining our growth report.

Make It Happen

- Click here to access our complete index of 293 UK Penny Stocks.

- Contemplating Other Strategies? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal