Assessing REV Group (REVG) Valuation After Strong Recent Share Price Momentum

REV Group (REVG) has been on many investors’ radar after its recent share price moves, with the stock’s 1 day, week, month, and past 3 months returns drawing closer attention to its valuation.

See our latest analysis for REV Group.

Beyond the recent bounce, REV Group’s 30 day share price return of 10.46% and 12 month total shareholder return of 85.62% point to strong momentum building around the US$62.29 share price and its perceived prospects.

If REV Group’s move has you looking wider, this could be a good moment to check out aerospace and defense stocks as you scan for other specialty and mission critical vehicle names.

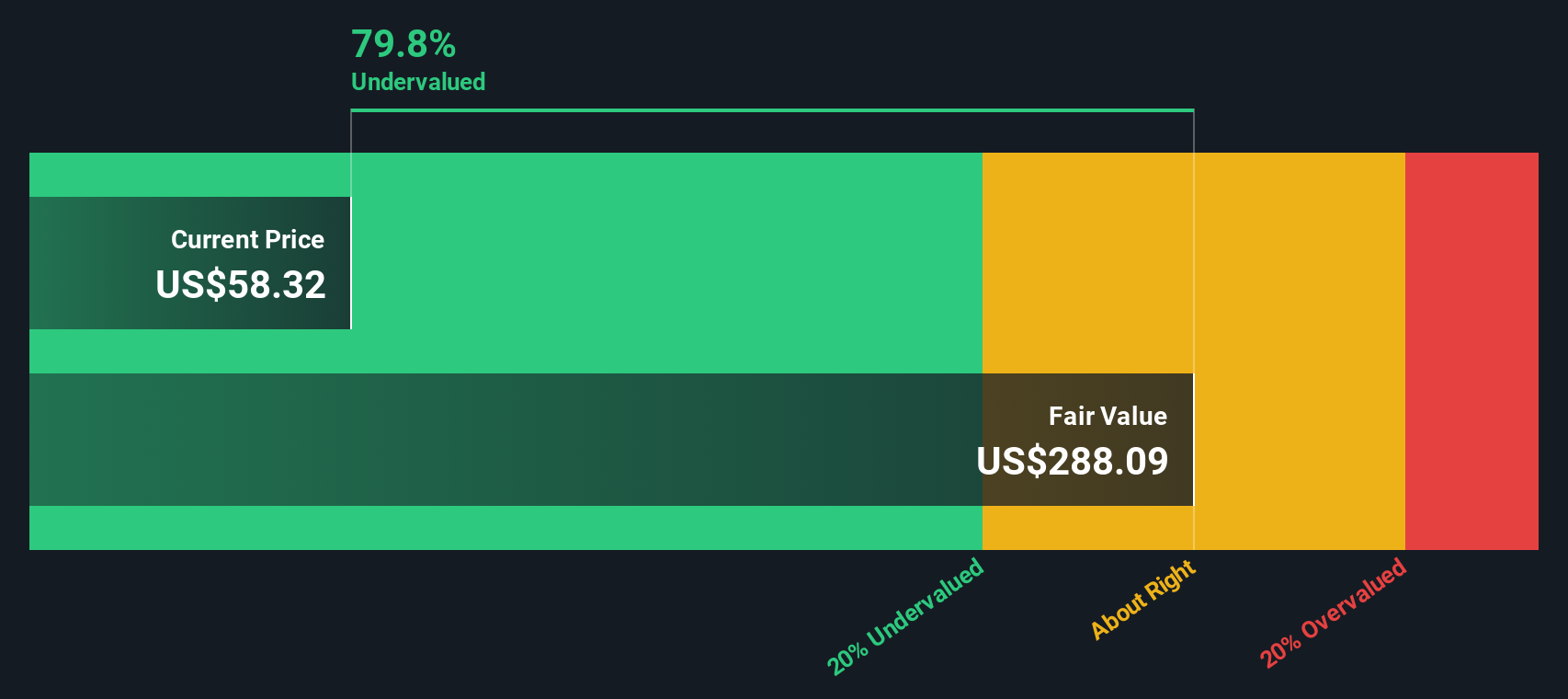

With REV Group trading around US$62.29, an indicated 30.45% intrinsic discount and only a small gap to the US$66 price target, the key question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 3.5% Overvalued

Compared with the last close at US$62.29, the most followed narrative pegs REV Group’s fair value just above that level at about US$60.20.

A strategically large, multi-year backlog in the fire and ambulance divisions provides earnings protection while allowing pricing actions and favorable product mix to be realized over time, buffering against near-term economic uncertainty and driving steady earnings and margin expansion.

Curious what justifies paying up here? The narrative leans heavily on faster earnings growth, richer margins, and a leaner business mix. Want the full playbook behind that pricing power and profit trajectory? The detailed projections sit inside that fair value model, not in today’s share quote.

Result: Fair Value of $60.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could crack if inflation and tariffs keep pressure on costs, or if the Terex merger stumbles and brings weaker margins or more dilution than expected.

Find out about the key risks to this REV Group narrative.

Another View: SWS DCF Points To A Very Different Price

Our DCF model lands in a very different place, with a fair value estimate of about US$89.56 per share. Against the current US$62.29 price, that implies REVG trades at roughly a 30% discount. If the cash flow math is right, is the market being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out REV Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own REV Group Narrative

If the fair value calls here do not quite match your view, you can stress test the numbers yourself and shape a custom thesis in minutes, Do it your way.

A great starting point for your REV Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If REV Group has sharpened your focus, do not stop here. Use the Simply Wall Street Screener to quickly uncover fresh ideas that fit the way you invest.

- Target potential growth stories early by scanning these 3564 penny stocks with strong financials that already show stronger financial foundations than many micro caps.

- Spot companies riding the AI wave in healthcare by reviewing these 29 healthcare AI stocks shaping diagnostics, treatment support, and medical data tools.

- Strengthen your search for reliable income by filtering for these 14 dividend stocks with yields > 3% that might suit a yield focused watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal