Assessing FedEx (FDX) Valuation After Recent Share Price Strength And Earnings Narrative Shifts

FedEx (FDX) is back in focus after recent trading, with the stock last closing at $293.13. For investors, the key question is how current performance metrics line up with the company’s earnings power.

See our latest analysis for FedEx.

Recent trading has been relatively firm, with a 30 day share price return of 6.9% and a 90 day share price return of 21.0%, while the 1 year total shareholder return of 9.5% and 3 year total shareholder return of 64.8% suggest momentum has been building over a longer horizon.

If FedEx’s move has you looking beyond a single name, this could be a good moment to scan auto manufacturers for other transport related ideas that might suit your watchlist.

With FedEx trading close to its US$300 analyst price target and only a small intrinsic discount indicated, the key question is whether today’s valuation still offers upside potential or whether the market is already pricing in future growth.

Most Popular Narrative: 6.5% Overvalued

FedEx’s narrative fair value of about US$275 per share sits below the last close at US$293.13, which puts the current valuation under a bit more scrutiny.

The analysts have a consensus price target of $264.25 for FedEx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $320.0, and the most bearish reporting a price target of just $200.0.

Curious how modest revenue growth, improving profit margins and a higher future earnings multiple still point to FedEx trading rich to fair value? The full narrative lays out the earnings bridge, the margin assumptions and the payout to shareholders that need to line up for today’s price to be justified.

Result: Fair Value of $275.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points, including freight softness and the loss of the United States Postal Service contract, that could undermine the current earnings narrative.

Find out about the key risks to this FedEx narrative.

Another View: Earnings Multiple Sends a Different Signal

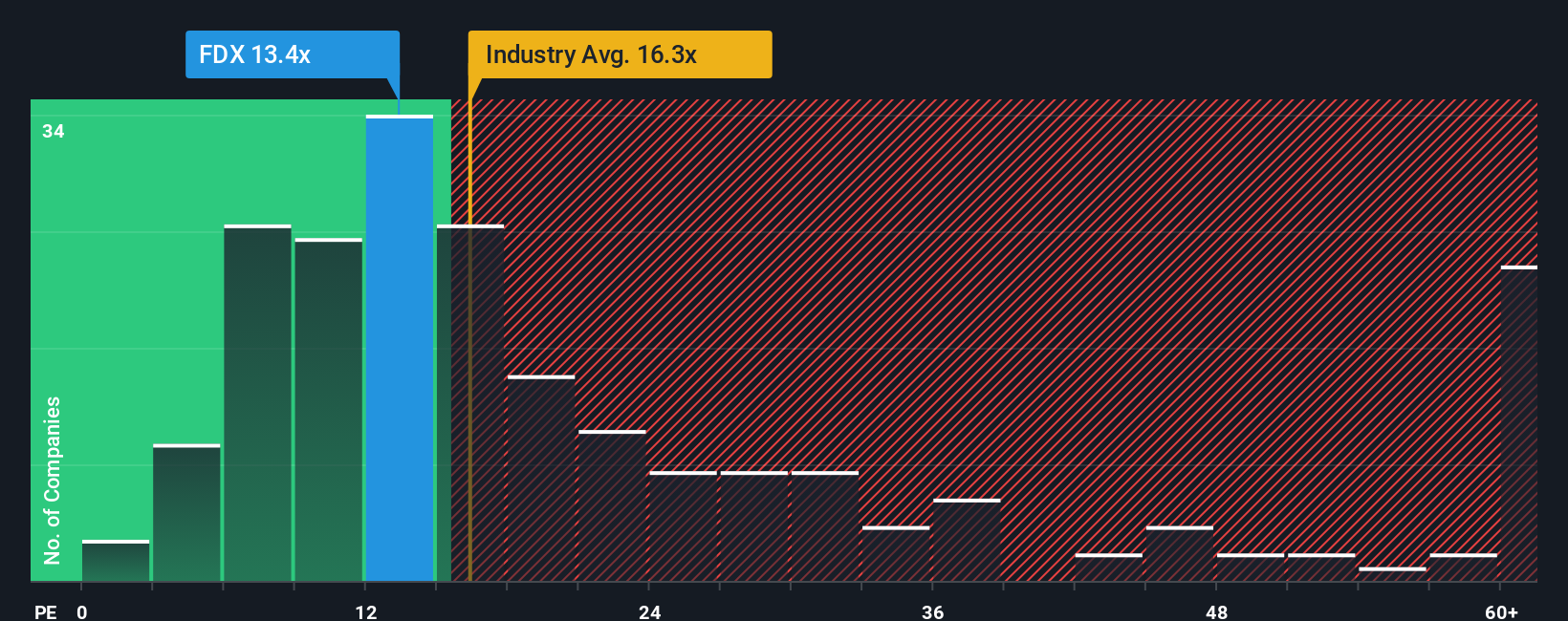

While the narrative fair value points to FedEx looking about 6.5% rich, the company’s current P/E of 15.9x tells a slightly different story. It sits below peer averages at 21.3x and in line with the global logistics group at 15.9x, and below a fair ratio of 20x, which suggests the market is not paying up for its earnings to the same extent as many competitors. For you, that gap can look like a valuation buffer or a sign that investors are still cautious. Which side of that tradeoff do you think fits your risk tolerance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FedEx Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a custom FedEx thesis in just a few minutes: Do it your way.

A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If FedEx has sharpened your focus, do not stop here. Broaden your watchlist with other angles on growth, value and income using targeted stock ideas.

- Hunt for value-focused opportunities that line up with your return goals by checking out these 870 undervalued stocks based on cash flows built around discounted cash flow potential.

- Spot potential income payers that fit a yield focused approach by reviewing these 14 dividend stocks with yields > 3% tailored for investors who want regular cash returns.

- Explore developments in digital assets by scanning these 79 cryptocurrency and blockchain stocks for companies associated with cryptocurrencies and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal