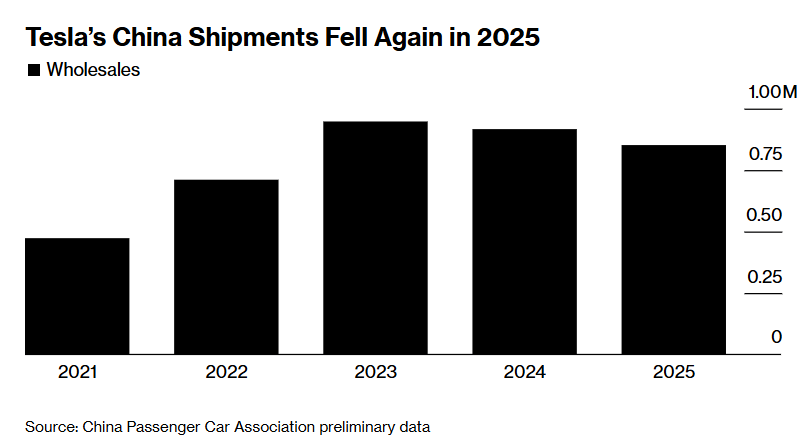

AI and robots have big dreams, but electric cars are realistic: Tesla (TSLA.US)'s market in China has been shrinking for two consecutive years

The Zhitong Finance App learned that although the scale of shipments picked up slightly in December, global electric vehicle leader Tesla (TSLA.US)'s factory shipments in China still declined significantly in the full year of 2025 compared to 2024. The world's largest car company, led by Elon Musk, the richest man in the world, is struggling at a time when global sales are slowing down significantly, and has lost its dual position as the number one electric vehicle market share in the world and the number one electric vehicle market share in China.

As China's most famous electric vehicle manufacturers such as BYD, “Wei Xiaoli”, and Xiaomi continue to launch new models with novel features, competition in the Chinese electric vehicle market is becoming increasingly fierce. Tesla has lost the double title of the Chinese market and the world's largest electric vehicle manufacturer, and has been surpassed by BYD.

According to preliminary statistics from the China Passenger Vehicle Association, Tesla shipped 851,732 electric vehicles from its Shanghai Super Auto factory last year, down about 7% from the same period last year. Of these, the number of vehicles in December was 97,171 in a single month, and this is only the fourth month in 2025 to show a year-on-year growth rate.

It is worth noting that the latest statistics do not break down the share of exports in Chinese shipments, but most of these vehicles are sold locally in the Chinese market.

The picture above shows that Tesla's annual shipments in the Chinese market declined again in 2025.

According to the electric vehicle sales/shipment caliber for the full year of 2025, Tesla has relinquished the “No. 1 electric vehicle (EV/pure electric BEV) ranking in the world” to BYD. Many media and research institutes have made this latest conclusion based on annual delivery/sales data.

The sharp decline in the Chinese market for two consecutive years highlights the difficult challenges Tesla may face in one of its biggest demand markets for a long time.

Although the market's outlook on Tesla's valuation and basic outlook has completely shifted to FSD fully automatic driving, Robotaxi (fully unmanned autonomous taxi) based on Tesla's exclusive AI supercomputing system, and the Tesla AI humanoid robot called “Optimus Prime,” Tesla's electric vehicle sales and the fundamentals of the automobile business have not been weakened to the point where they are insignificant. It is still the backbone of current cash flow and balance sheet, and the foundation of the closed loop of FSD data and fleet size (Robotaxi will eventually also fall into large-scale vehicle production capacity and operation).

More realistically, while “Tesla's growth narrative shifts,” the market will still use delivery, vehicle gross profit, price competition, and regional share to calibrate short-term profit and valuation safety margins — so the impact of sales on fundamentals is more like changing from “the only main line” to “chassis and constraints”: sales/gross profit determines the “fault tolerance ratio between cash and investor capital,” while FSD/Robotaxi/Optimus determines “the upward imagination of valuation and the ceiling of the basic situation in front of Tesla.”

In recent weeks, many media and seller analysts have bluntly stated that Tesla can still maintain high valuations in the context of declining deliveries, mainly by investors and “Musk followers” betting on its potential “platform-level” incremental profit pool on autonomous driving and robotics; even Tesla's own more conservative outlook on delivery has been interpreted by some Musk followers as “the short-term weakening of the automobile business is still heavily betting on autonomous driving/robotics to generate revenue on a large scale.”

However, this does not mean that the automobile business is unimportant; rather, the marginal pricing factor of stock prices is more biased towards “when, with what regulatory path, and on what scale can commercialize driverless cars and robotaxis.”

Previously, this large car company headquartered in Austin, USA, saw a jump in deliveries in the third quarter, mainly because American consumers actively snapped up electric vehicles before a critical US electric vehicle subsidy expired; however, as countries around the world, including the US, cut back on their electric vehicle policy support, Tesla continued to face the challenge of weak demand. Furthermore, although Musk has stepped down from his high-profile rebellious role in Western politics, weak consumer demand is still a headwind factor dragging down Tesla's global sales.

In a difficult year (that is, 2025), Tesla relinquished the title of “the world's largest electric vehicle manufacturer” to BYD, headquartered in China. Needless to say, the competition Tesla is facing in the Chinese market for electric vehicles is intensifying. Emerging electric vehicle manufacturers such as Xiaomi, are continuously winning the favor of Chinese consumers by introducing new electric vehicle models for future technology and emphasizing highly intelligent driving functions.

The electric vehicle products launched by Xiaomi directly target Tesla Model 3 and Model Y. According to statistics from the China Automobile Technology Research Center and Bloomberg Intelligence, the YU7 sports utility vehicle (or YU7 SUV) launched by Xiaomi has even reached the sales data of Model Y in China in some months; for example, in November, the Xiaomi YU7 sold 33,591 units, while the Model Y sold 33,935 units.

Preliminary statistics from the China Passenger Vehicle Association also showed that in December 2025, wholesale sales of new energy vehicles across the country — including plug-in hybrid vehicles and pure electric vehicles — increased slightly by 4% year-on-year to 1.57 million units.

According to Bloomberg Intelligence's calculations based on association data, sales of new energy vehicles in China increased sharply by about 25% throughout the year. The Passenger Vehicle Association will release the final sales data for the full year 2025 later this month.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal