ConocoPhillips (COP) Valuation Recheck After Recent Share Price Strength

Why ConocoPhillips Is Back on Investors’ Radar

ConocoPhillips (COP) has drawn fresh attention after recent share price gains over the past week and month, prompting investors to reassess how its current valuation lines up with its earnings and cash generation profile.

See our latest analysis for ConocoPhillips.

Recent share price strength, including the 3.30% 1 day share price return and positive 7 day move, comes against a mixed backdrop where the 1 year total shareholder return is close to flat but the 5 year total shareholder return is strong.

If ConocoPhillips has you looking closer at energy exposure, it could be a good moment to broaden your search and check out aerospace and defense stocks as a different angle on cyclicals.

So with ConocoPhillips trading around $96.70, showing steady recent gains, a value score of 3, and an estimated intrinsic discount near 38%, should you view this as an undervalued entry point, or as a situation where the market is already pricing in future growth?

Most Popular Narrative: 13.9% Undervalued

With ConocoPhillips closing at $96.70 versus a narrative fair value of $112.37, the widely followed view frames the stock as trading at a discount and then builds a case around future cash generation to justify that gap.

The company's expanding LNG portfolio and progress on large-scale liquefaction projects (notably in Qatar, Port Arthur, and Willow) are set to capture significant market share from robust global gas demand, especially as natural gas solidifies its role as a "transition fuel"; these projects are expected to drive a substantial free cash flow inflection and topline revenue expansion through 2029.

Want to understand why a relatively modest revenue growth profile is still tied to a much higher future earnings base and richer P/E multiple projections? The narrative leans heavily on margin expansion, capital intensity fading, and a future valuation level that currently sits above the broader US oil and gas peer group. Curious how those moving parts combine to support a fair value well above today’s share price without assuming aggressive growth rates?

Result: Fair Value of $112.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on large, capital-heavy projects staying on track and on planned $5b asset sales actually closing on attractive terms in a changing buyer market.

Find out about the key risks to this ConocoPhillips narrative.

Another Angle: What The P/E Is Saying

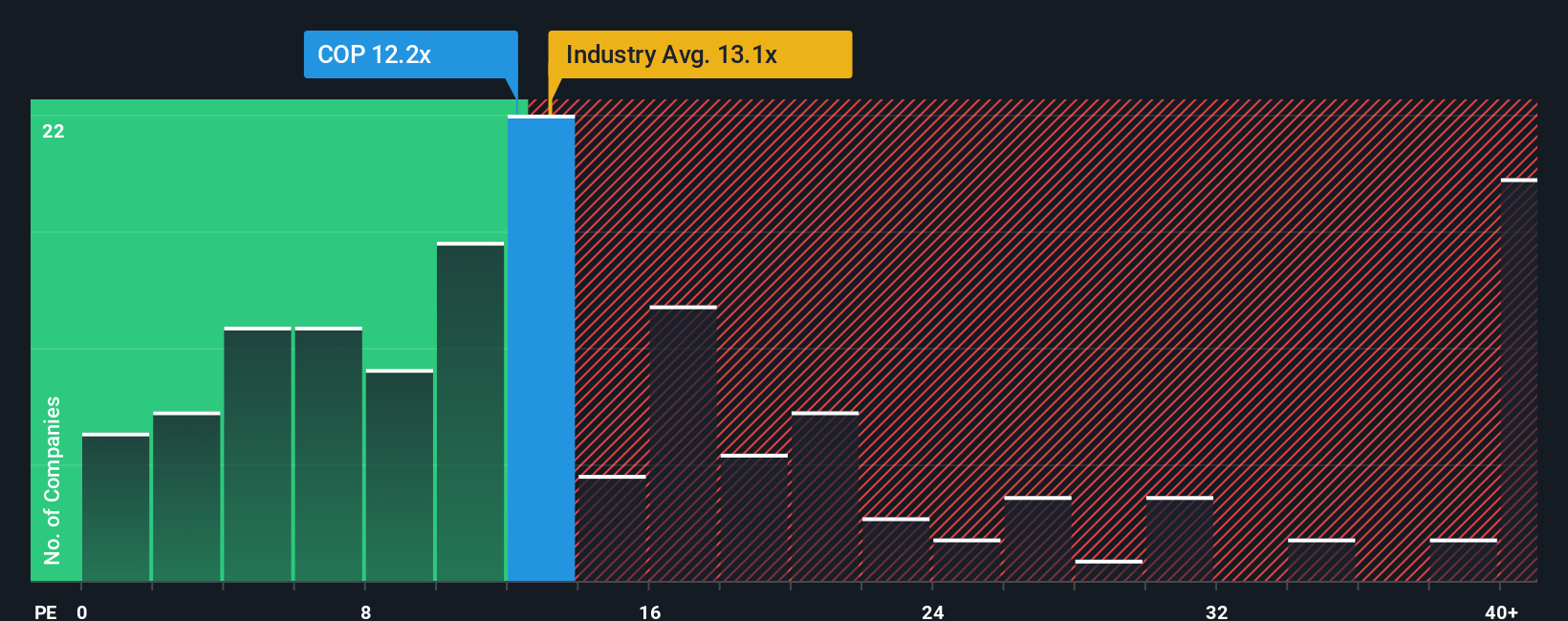

While the narrative fair value and discount suggest upside, the plain P/E picture is more cautious. At 13.5x earnings, ConocoPhillips trades slightly richer than the US Oil and Gas industry at 13.2x and its peer average at 12.1x, yet below a fair ratio of 21x that our model suggests the market could move toward. So is this a margin of safety? Or are you paying up for a story that still has to play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ConocoPhillips Narrative

If this story does not quite fit how you see ConocoPhillips, or you prefer to work from your own data checks, you can build a tailored view in just a few minutes, starting with Do it your way.

A great starting point for your ConocoPhillips research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at a single stock. Use targeted screeners to uncover ideas that truly fit your plan.

- Spot potential bargains early by checking out these 870 undervalued stocks based on cash flows that may be priced below their underlying cash flow strength.

- Ride major tech shifts by focusing on these 25 AI penny stocks that link artificial intelligence with real business traction.

- Tighten your income focus by reviewing these 14 dividend stocks with yields > 3% that may offer yields above 3% with room for further research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal