Exploring 3 Undiscovered Gems in the US Market

As the new year begins, major U.S. stock indexes like the Dow Jones Industrial Average and S&P 500 have rebounded from recent losses, signaling a positive start to 2026 despite ongoing challenges in the tech-heavy Nasdaq. In this dynamic market environment, identifying undiscovered gems—stocks with strong fundamentals and growth potential—can offer unique opportunities for investors seeking to navigate these fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

NVE (NVEC)

Simply Wall St Value Rating: ★★★★★★

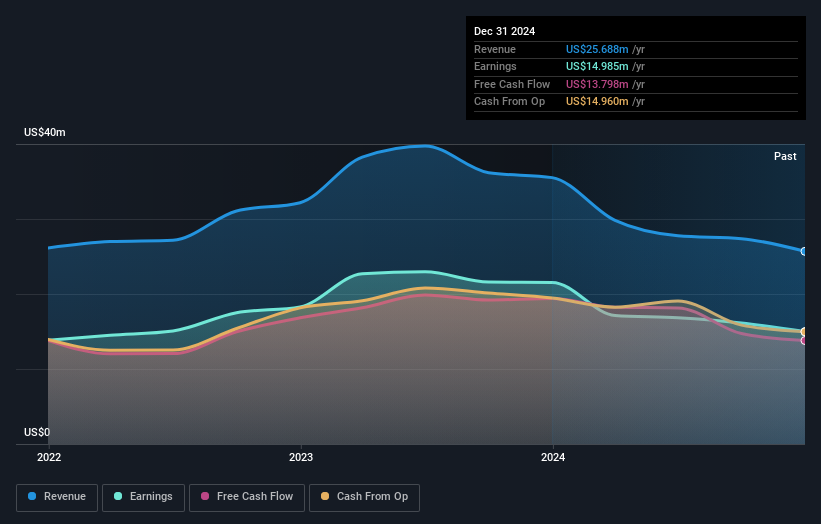

Overview: NVE Corporation develops and sells spintronic devices, utilizing nanotechnology for information acquisition, storage, and transmission, with a market cap of $297.24 million.

Operations: NVE Corporation generates revenue primarily from its electronic components and parts segment, which reported $24.78 million in sales. The company's financial performance is characterized by a notable net profit margin of 56.34%.

NVE Corporation, a small player in the semiconductor industry, has faced challenges with a negative earnings growth of 14.2% over the past year, contrasting with the industry's average growth of 4.7%. Despite this, NVE boasts high-quality earnings and remains debt-free for five years. Its price-to-earnings ratio at 21.5x is attractive compared to the industry average of 37.3x. The company reported revenue of US$6.35 million for Q2 2025, down from US$6.76 million a year ago, while net income was US$3.31 million versus US$4.03 million previously; dividends remain steady at $1 per share.

Preformed Line Products (PLPC)

Simply Wall St Value Rating: ★★★★★★

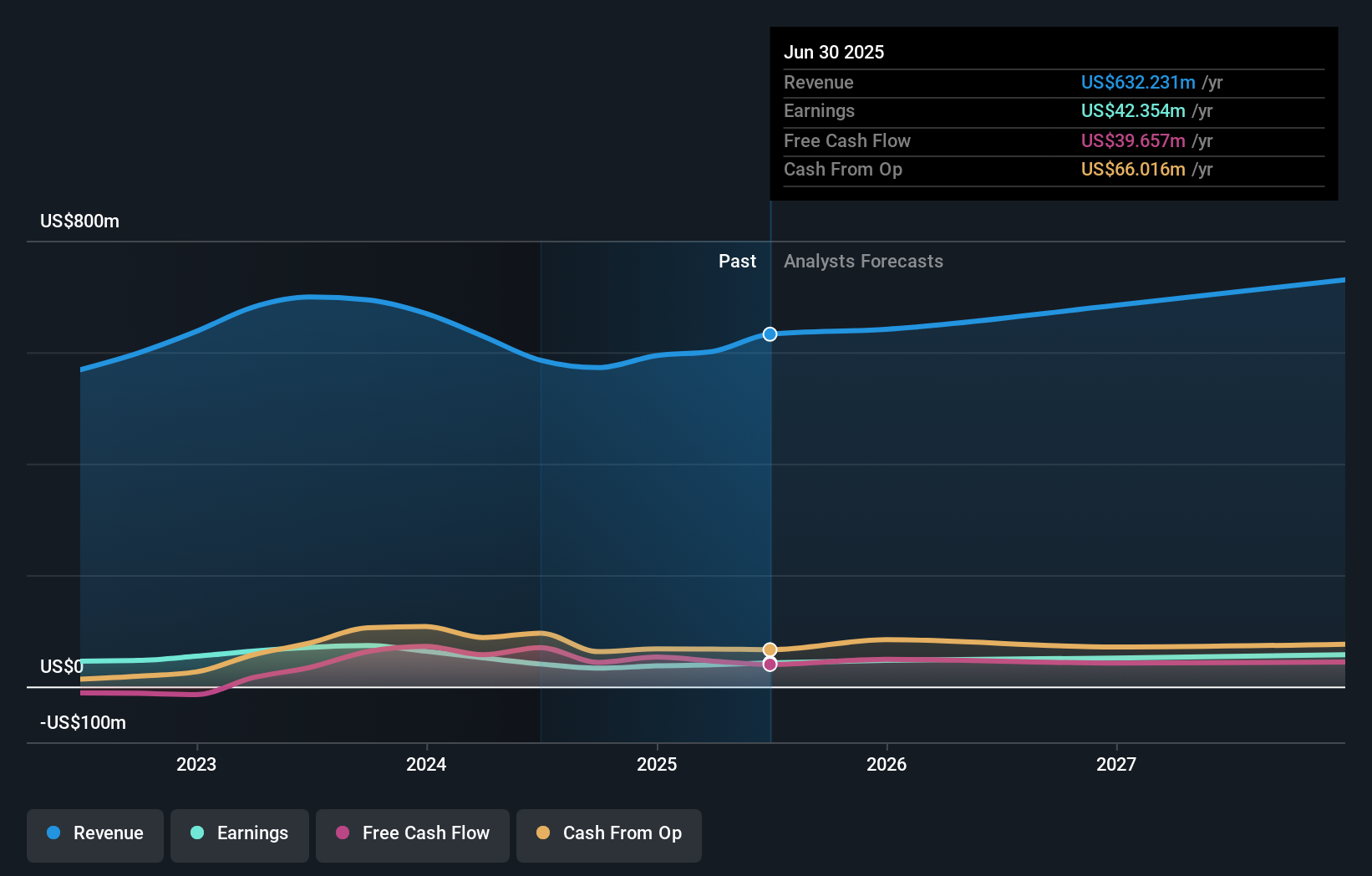

Overview: Preformed Line Products Company specializes in designing and manufacturing products and systems for constructing and maintaining networks across various industries, including energy and telecommunications, with a market cap of $1.04 billion.

Operations: The primary revenue stream for Preformed Line Products comes from its Wire & Cable Products segment, generating $663.35 million.

Preformed Line Products, a smaller player in the electrical industry, has shown resilience with its debt to equity ratio dropping from 24.3% to 8.3% over five years. Despite a recent dip in quarterly net income to US$2.63 million from US$7.68 million last year, the firm maintains high-quality earnings and forecasts robust growth at 21% annually. The company’s price-to-earnings ratio of 27.9x indicates good value compared to the industry average of 30.5x, and it recently increased its dividend by 5%, signaling confidence in future prospects despite mixed recent performance figures.

- Navigate through the intricacies of Preformed Line Products with our comprehensive health report here.

Gain insights into Preformed Line Products' past trends and performance with our Past report.

China Yuchai International (CYD)

Simply Wall St Value Rating: ★★★★★☆

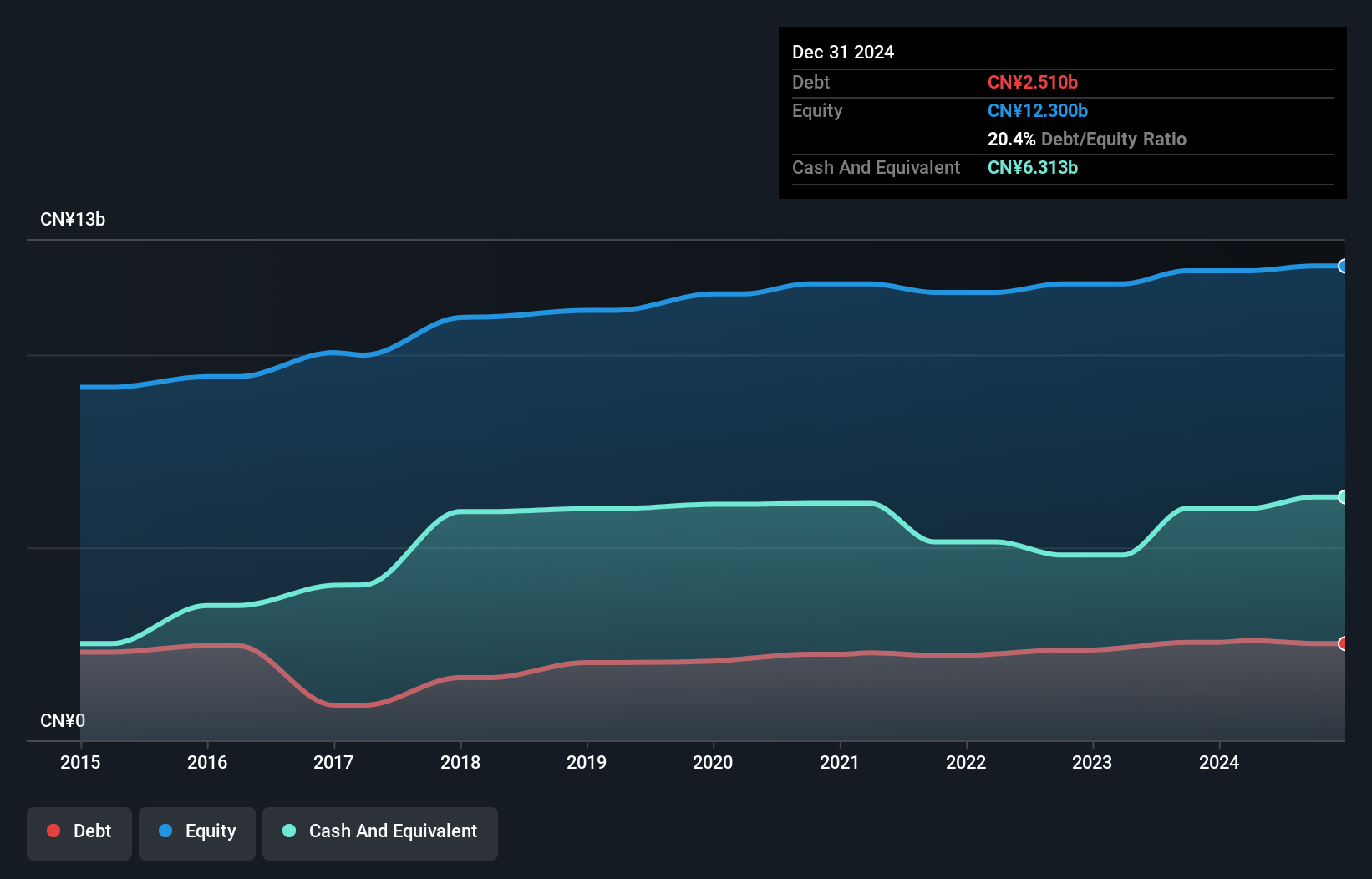

Overview: China Yuchai International Limited focuses on manufacturing, assembling, and selling diesel and natural gas engines for various applications including trucks, buses, and marine equipment, with a market cap of approximately $1.39 billion.

Operations: The company generates revenue primarily from the sale of diesel and natural gas engines for diverse applications such as trucks, buses, and power generation. Its financial performance is influenced by factors like production costs and sales volumes. The net profit margin provides insight into the company's profitability after accounting for all expenses.

China Yuchai International, a notable player in the machinery sector, has shown impressive earnings growth of 29% over the past year, outpacing the industry average. Trading at nearly 79% below its estimated fair value suggests potential undervaluation. The company's debt to equity ratio has slightly increased from 18.3% to 20.9% over five years, yet it holds more cash than total debt, indicating financial stability. Recent board changes include Jiang Fei's appointment as a director, bringing extensive experience and leadership skills that could influence future strategic directions positively for this small-cap entity.

Where To Now?

- Explore the 302 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal