Top Three Dividend Stocks To Consider

As the United States stock market kicks off the new year with major indexes like the Dow and S&P 500 snapping recent losing streaks, investors are keenly observing opportunities that can offer stability amid fluctuating trends. In this context, dividend stocks stand out as they provide not only potential capital appreciation but also a steady income stream, making them an attractive consideration for those looking to balance growth and income in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.86% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.44% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.82% | ★★★★★★ |

| OceanFirst Financial (OCFC) | 4.48% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.33% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.12% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Dillard's (DDS) | 4.90% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.25% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.61% | ★★★★★★ |

Click here to see the full list of 120 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bank OZK (OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK is a full-service Arkansas state-chartered bank offering retail and commercial banking services across the United States, with a market cap of $5.30 billion.

Operations: Bank OZK generates its revenue primarily from its Community Banking segment, which accounts for $1.54 billion.

Dividend Yield: 3.7%

Bank OZK recently announced a quarterly cash dividend increase to $0.46 per share, marking its 62nd consecutive quarter of growth. With a low payout ratio of 27.3%, the dividends are well covered by earnings and expected to remain sustainable with a forecasted payout ratio of 30.8% in three years. Despite trading at significant value below its estimated fair value, the current dividend yield of 3.74% is modest compared to top-tier US dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of Bank OZK.

- Our expertly prepared valuation report Bank OZK implies its share price may be lower than expected.

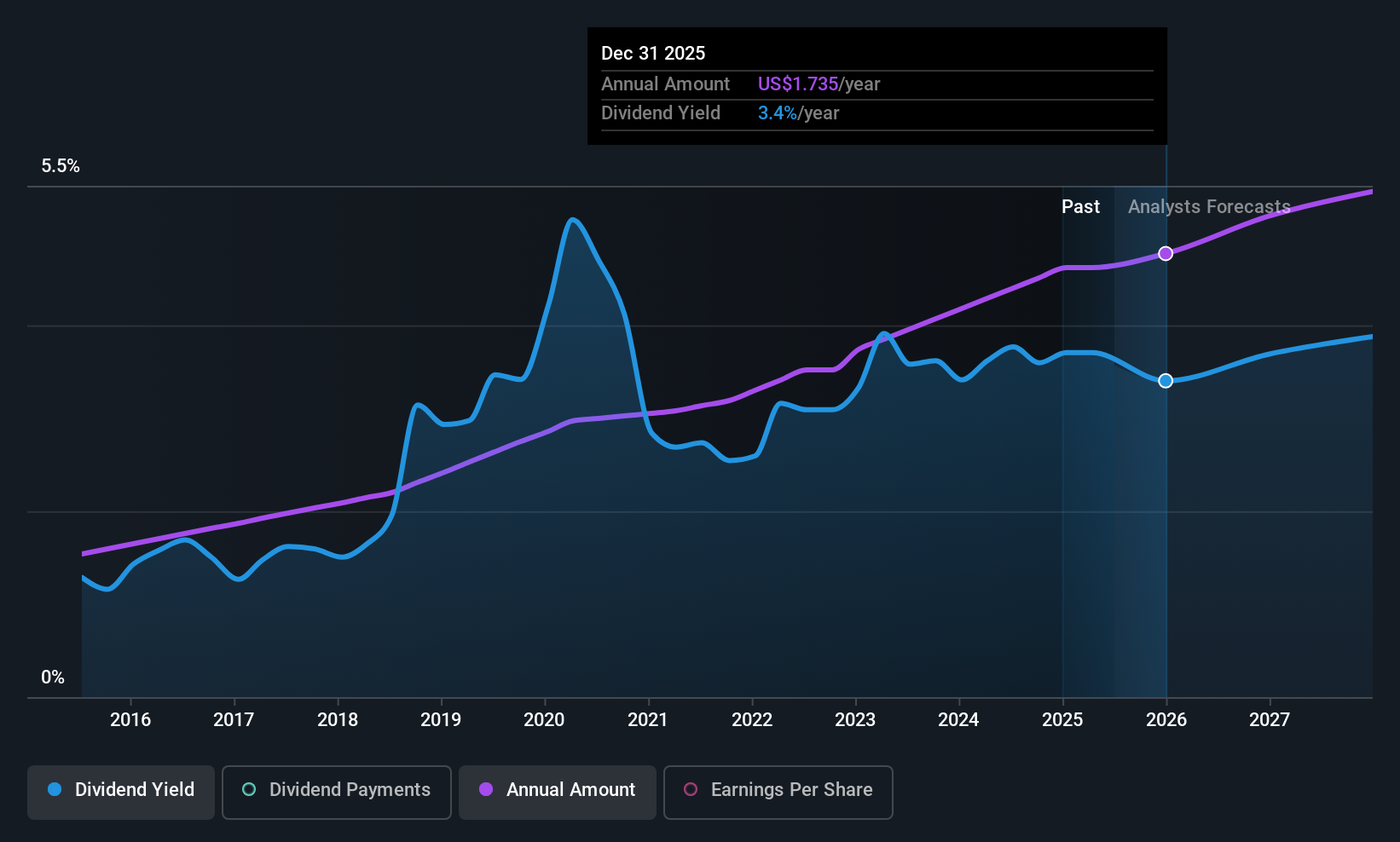

Community Financial System (CBU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Financial System, Inc. is the bank holding company for Community Bank, N.A., with a market cap of $3.06 billion.

Operations: Community Financial System, Inc. generates revenue through several segments: Banking and Corporate ($547.45 million), Employee Benefit Services ($139.56 million), Insurance ($54.20 million), and Wealth Management ($39.61 million).

Dividend Yield: 3.2%

Community Financial System's recent acquisition of Santander Bank branches enhances its presence in Greater Lehigh Valley, potentially boosting future earnings. The company declared a quarterly dividend of $0.47 per share, yielding 3.21%, which is below top-tier US dividend payers but supported by a low payout ratio of 47.6%. With stable and growing dividends over the past decade and earnings growth at 23.7% last year, the dividend appears well-covered and sustainable long-term.

- Get an in-depth perspective on Community Financial System's performance by reading our dividend report here.

- According our valuation report, there's an indication that Community Financial System's share price might be on the cheaper side.

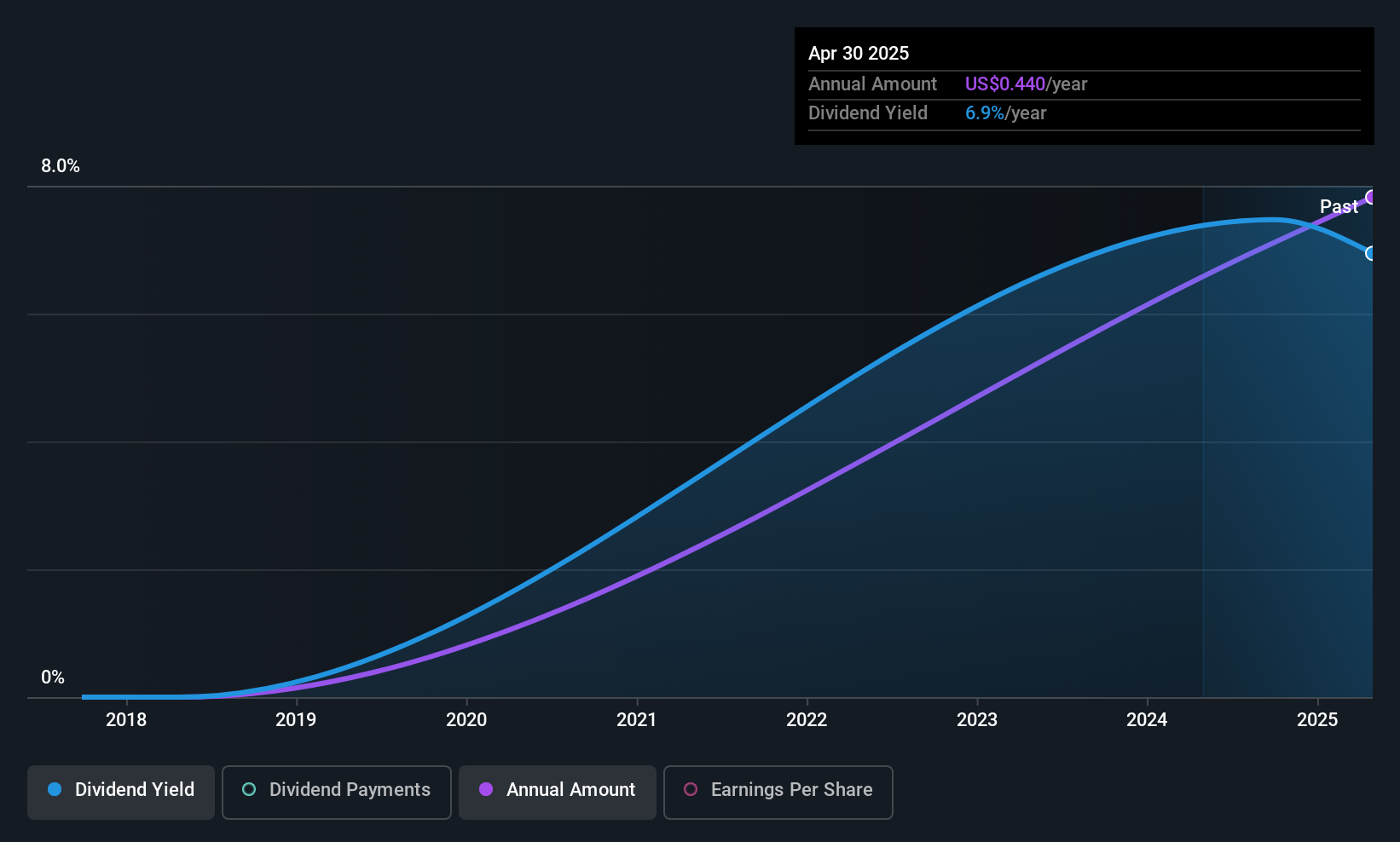

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $330.94 million.

Operations: Yiren Digital Ltd.'s revenue is primarily derived from its Financial Services Business, which generated CN¥5.26 billion, and its Insurance Brokerage Business, contributing CN¥320.21 million.

Dividend Yield: 11.5%

Yiren Digital's recent earnings report shows a decline in net income despite revenue growth, impacting profit margins. The company has initiated dividend payments with a low payout ratio of 22.3%, indicating dividends are well-covered by earnings and cash flows. Although too early to assess stability or growth, the dividend yield is among the top 25% in the US market at 11.49%. Strategic alliances and AI advancements suggest potential for long-term value creation amid evolving fintech landscapes.

- Take a closer look at Yiren Digital's potential here in our dividend report.

- The valuation report we've compiled suggests that Yiren Digital's current price could be quite moderate.

Next Steps

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 117 more companies for you to explore.Click here to unveil our expertly curated list of 120 Top US Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal