Assessing U.S. Bancorp (USB) Valuation After Recent Share Price Momentum And Modest Undervaluation Signals

U.S. Bancorp (USB) is back on investors’ radar after recent share price moves. The stock last closed at $53.93 as the bank continues to trade in line with broader sentiment toward large U.S. lenders.

See our latest analysis for U.S. Bancorp.

Recent trading has been mixed, with a 1 day share price return of 1.07% alongside a 7 day share price decline of 1.05%. However, a 90 day share price return of 13.54% and a 1 year total shareholder return of 15.55% suggest that momentum has been building over time rather than fading.

If U.S. Bancorp’s move has you reviewing your watchlist, this can be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With U.S. Bancorp trading at $53.93, a value score of 4 and an estimated intrinsic value implying roughly a 40% discount, is this a genuine mispricing, or is the market already baking in future growth?

Most Popular Narrative Narrative: 6.2% Undervalued

Compared with the last close at $53.93, the most followed narrative sees fair value closer to the high 50s, pointing to a modest valuation gap.

Analysts are assuming U.S. Bancorp's revenue will grow by 8.5% annually over the next 3 years. Analysts assume that profit margins will shrink from 25.5% today to 22.8% in 3 years time.

Curious how steady top line growth, slightly slimmer margins, and a richer future earnings multiple can still support a higher value? The narrative spells out the path.

Result: Fair Value of $57.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that path depends on U.S. Bancorp keeping credit issues and commercial real estate risks in check, while also managing higher regulatory and cybersecurity costs that could squeeze margins.

Find out about the key risks to this U.S. Bancorp narrative.

Another View: Market Multiple Sends A Different Signal

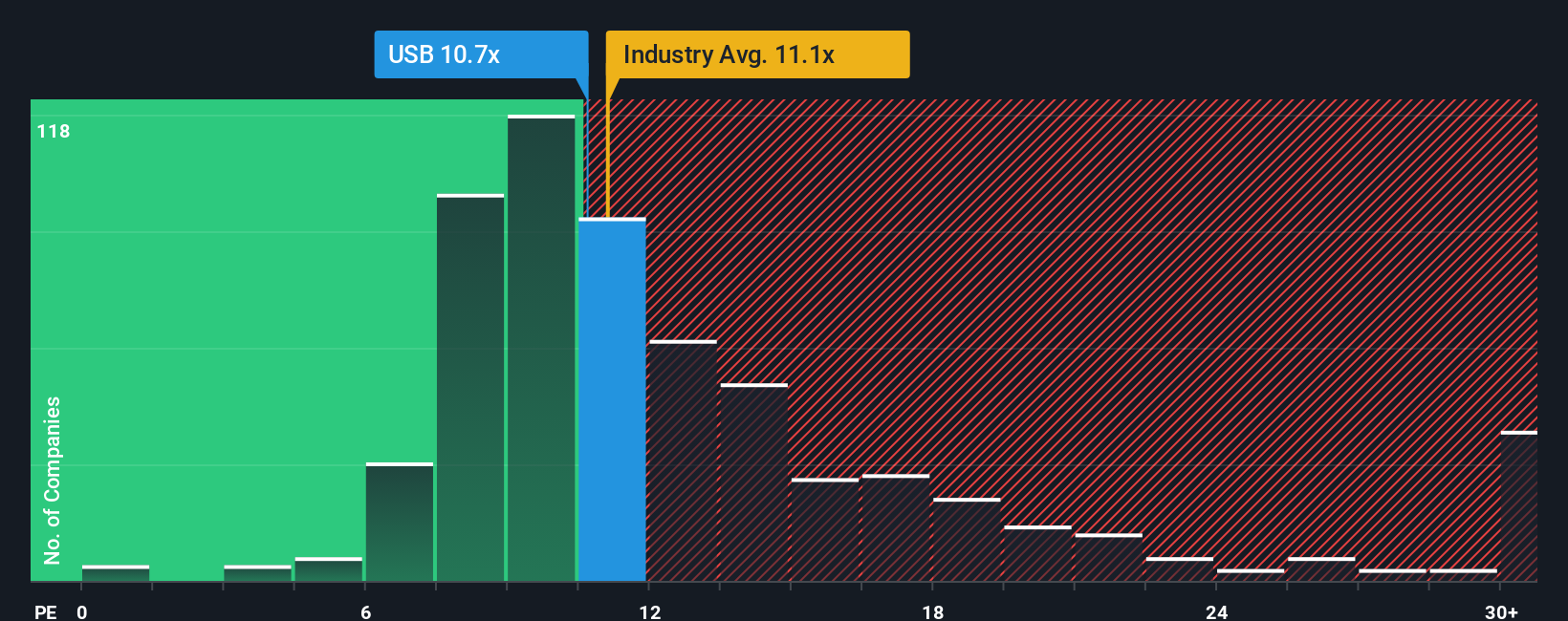

While the narrative and fair value estimate point to U.S. Bancorp being 6.2% undervalued, the current P/E of 12.3x sits slightly above the US Banks industry at 11.8x, yet below the peer average of 19x and a fair ratio of 14.5x. That mix hints at both some valuation risk and a possible opportunity, so which side do you think the market is pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Bancorp Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding U.S. Bancorp.

Looking for more investment ideas?

If U.S. Bancorp has you thinking more broadly about your portfolio, do not stop here. This is your chance to spot other opportunities before everyone else.

- Target dependable income by checking out these 14 dividend stocks with yields > 3% that could help you build a steadier stream of cash returns.

- Hunt for mispriced opportunities using these 868 undervalued stocks based on cash flows that may not be fully appreciated by the wider market yet.

- Position your portfolio for the next wave of tech by reviewing these 25 AI penny stocks riding advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal