A Look At Microchip Technology (MCHP) Valuation As Interest Builds Around Automotive And Industrial Chip Exposure

Microchip Technology (MCHP) is back in focus as investors reassess its role in core automotive and industrial markets, where microcontrollers and analog chips underpin long product cycles and embedded systems used across critical equipment.

See our latest analysis for Microchip Technology.

The recent 1 day share price return of 2.06% to US$65.03 comes after a softer 30 day share price return of 1.19%, while the 1 year total shareholder return of 15.08% contrasts with weaker 3 and 5 year total shareholder returns. This suggests momentum has picked up only recently as investors reassess growth and risk around its automotive and industrial exposure.

If Microchip’s recent moves have caught your eye, it could be a good moment to see how it compares with other chip names by screening high growth tech and AI stocks.

With Microchip posting revenue of US$4.21b alongside a net loss of US$242.9m, and trading at US$65.03 with mixed multi year returns, are you looking at an undervalued compounder or a stock already pricing in future growth?

Most Popular Narrative: 13.4% Undervalued

With Microchip Technology last closing at US$65.03 against a narrative fair value of US$75.12, the current pricing sits below that narrative anchor, framing a potential gap between market expectations and the longer term earnings and margin story behind the model.

Operational leverage is set to improve as inventory write-offs and factory underutilization charges decline, with management targeting a return to 65% non-GAAP gross margins. As factory utilization ramps beginning in the December quarter and charges subside, incremental profits are expected to flow disproportionately to operating income and earnings.

Want to see what kind of revenue path and margin reset have to line up to support that higher fair value, and how rich the implied future earnings multiple really is compared with the sector? The narrative lays out a clear earnings climb, share count path, and discount rate that all have to work together for this pricing gap to close.

Result: Fair Value of $75.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still watchpoints, including elevated inventory with ongoing write offs, and a net debt load that could restrict flexibility if demand does not rebound as expected.

Find out about the key risks to this Microchip Technology narrative.

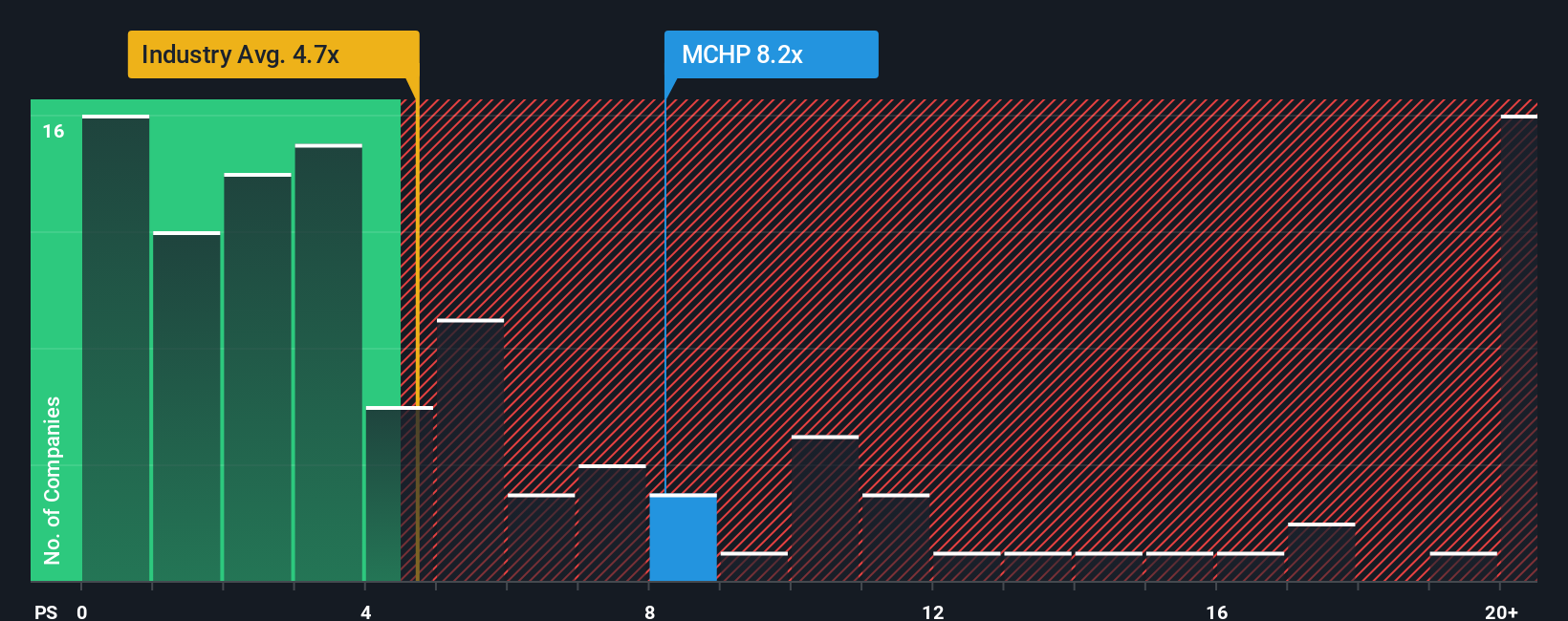

Another Angle: Price To Sales Sends A Different Signal

While the narrative model points to Microchip Technology as 13.4% undervalued, the current P/S ratio of 8.3x looks expensive next to both the US Semiconductor industry at 5.6x and peers at 7.0x, and is only roughly in line with a fair ratio of 8.4x. That leaves you weighing a richer sales multiple against a story that still argues for upside. Which signal feels more convincing to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microchip Technology Narrative

If you interpret the numbers differently and prefer to test your own assumptions, you can build a complete Microchip view in just a few minutes by starting with Do it your way.

A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about putting your capital to work, do not stop at a single stock. Broaden your watchlist with focused, data driven ideas right now.

- Hunt for potential bargains by scanning these 868 undervalued stocks based on cash flows that trade below what their cash flows might justify.

- Zero in on future facing themes by checking out these 25 AI penny stocks shaping how artificial intelligence reaches everyday products and services.

- Strengthen your income game by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal