Top European Dividend Stocks To Consider In January 2026

As the pan-European STOXX Europe 600 Index reaches new highs, buoyed by an improving economic backdrop and a strong annual performance in 2025, investors are increasingly looking towards dividend stocks as a reliable source of income amidst this positive momentum. In such a dynamic market environment, selecting stocks with consistent dividend payouts and robust financial health can provide stability and potential growth opportunities for portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.38% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.79% | ★★★★★★ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.24% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.71% | ★★★★★☆ |

Click here to see the full list of 192 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

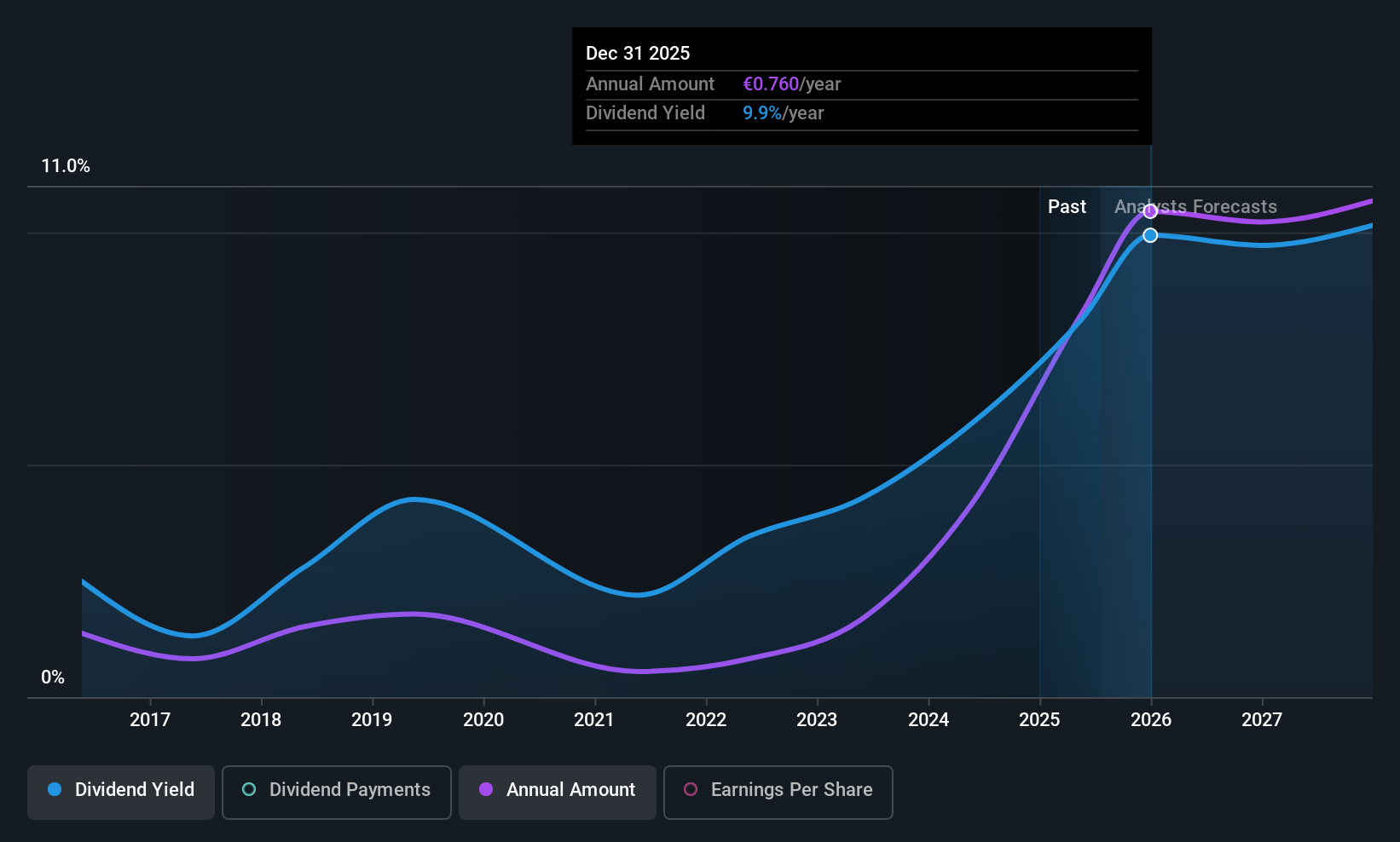

BPER Banca (BIT:BPE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BPER Banca SpA is an Italian bank offering a range of banking products and services to individuals, businesses, and professionals both domestically and internationally, with a market cap of €23.10 billion.

Operations: BPER Banca SpA generates its revenue through various banking products and services tailored for individuals, businesses, and professionals across Italy and international markets.

Dividend Yield: 5.1%

BPER Banca's dividend yield of 5.1% ranks it in the top 25% among Italian dividend payers, though its track record is volatile. The payout ratio of 60.6% suggests dividends are currently covered by earnings, with forecasts indicating continued coverage at 82.6% in three years. Recent earnings growth and inclusion in the Euronext 100 Index highlight positive momentum, while a share buyback program supports shareholder value despite past dilution concerns.

- Delve into the full analysis dividend report here for a deeper understanding of BPER Banca.

- In light of our recent valuation report, it seems possible that BPER Banca is trading beyond its estimated value.

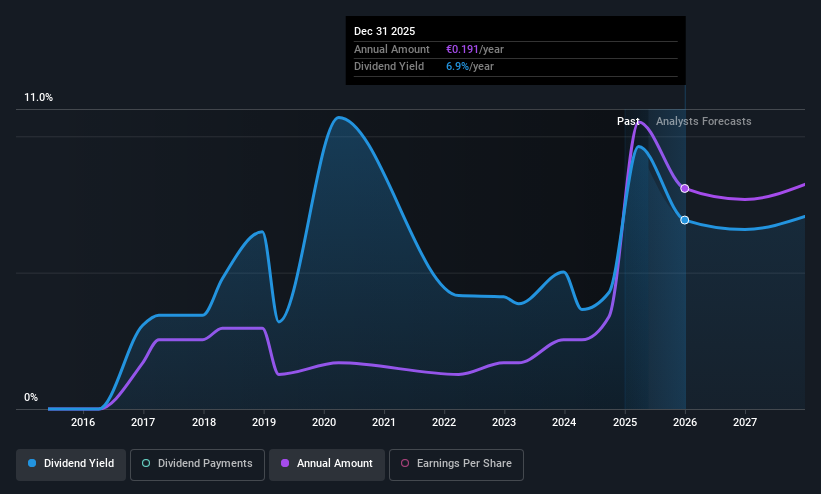

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private clients both in Spain and internationally, with a market cap of €17.22 billion.

Operations: Banco de Sabadell generates its revenue primarily through its banking operations in Spain (€4.28 billion), the United Kingdom (€1.30 billion), and Mexico (€184 million).

Dividend Yield: 7.7%

Banco de Sabadell's dividend yield of 7.67% places it among the top 25% in Spain, yet its history of volatile and unreliable payments raises concerns. The current payout ratio of 50.5% indicates dividends are covered by earnings, with future forecasts suggesting continued coverage at 65.3%. Despite past earnings growth, a high level of bad loans at 2.3% and low allowance for these loans present risks to financial stability and dividend sustainability.

- Take a closer look at Banco de Sabadell's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Banco de Sabadell is priced lower than what may be justified by its financials.

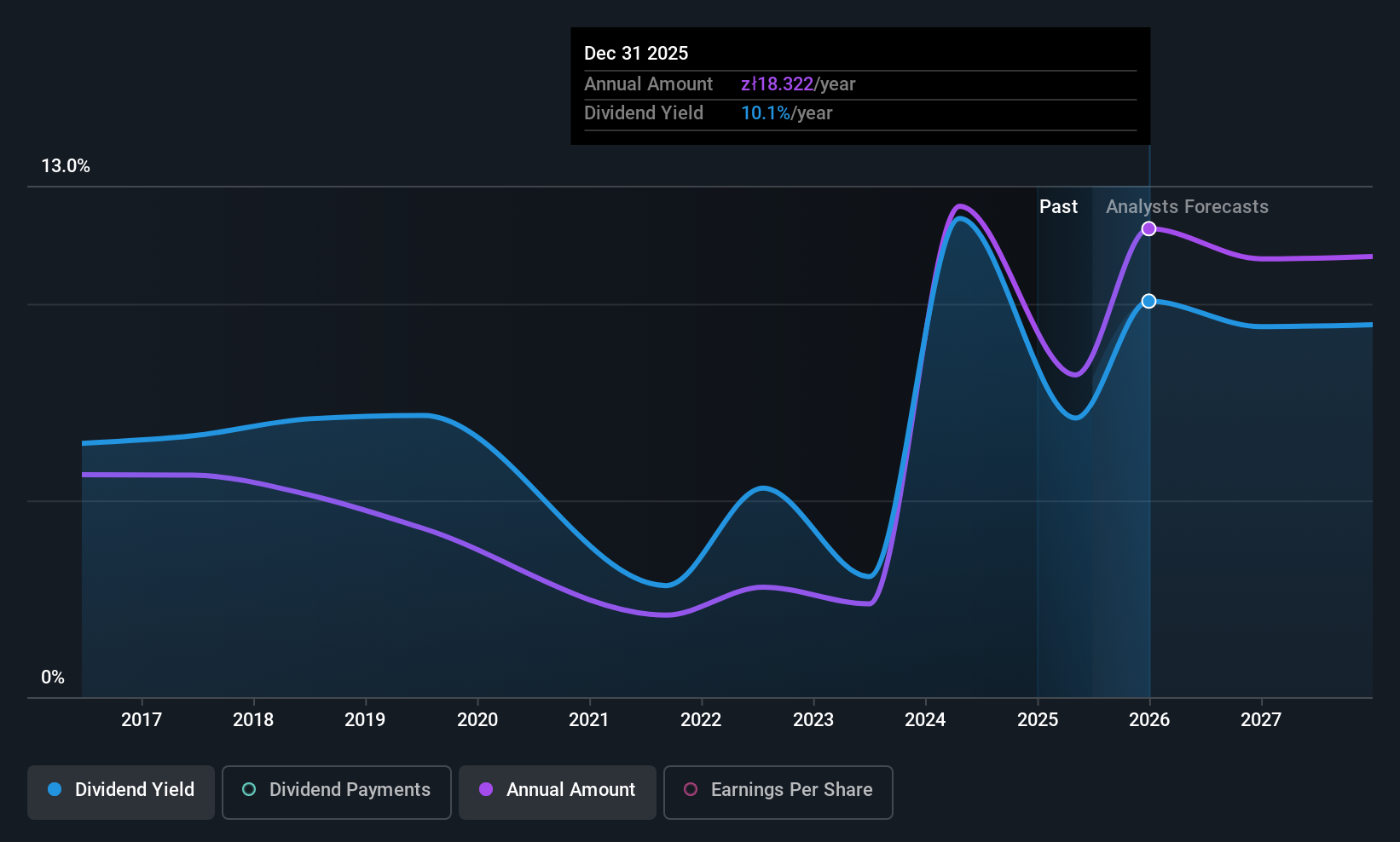

Bank Polska Kasa Opieki (WSE:PEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Polska Kasa Opieki S.A. is a commercial bank offering banking products and services to retail and corporate clients in Poland, with a market cap of PLN55.43 billion.

Operations: Bank Polska Kasa Opieki S.A. generates revenue from Enterprise Banking (PLN2.29 billion) and Corporate and Investment Banking (PLN2.98 billion).

Dividend Yield: 6%

Bank Polska Kasa Opieki's dividend yield of 5.97% is below the top 25% in Poland, and its history of volatile dividends over the past decade highlights reliability concerns. Despite a low payout ratio of 48.6%, ensuring current dividend coverage by earnings, future earnings forecasts suggest potential challenges with a projected decline of 5.3% annually over three years. Recent executive changes may also impact strategic direction, adding uncertainty to its dividend sustainability outlook.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank Polska Kasa Opieki.

- Our valuation report here indicates Bank Polska Kasa Opieki may be undervalued.

Key Takeaways

- Embark on your investment journey to our 192 Top European Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal