European stock outlook for 2026: institutions say there is room for growth and are optimistic about stocks benefiting from banks, renewable energy, and German stimulus

The Zhitong Finance App learned that after experiencing the best performance year since 2021, analysts and strategists predict that the European stock market will still have room for further growth in 2026.

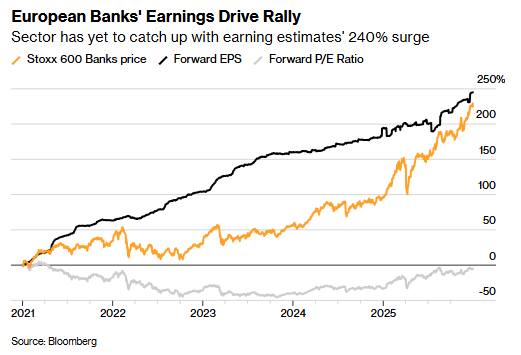

Specifically, sectors that performed well last year are generally believed to continue to strengthen. As the best-performing sector so far in 2025, the banking industry is expected to hand over another impressive report card, and both Morgan Stanley and Barclays Bank have included it in the top recommendations. The bullish themes surrounding increased defense spending, renewable energy, and electrification are expected to continue.

Many brokerage firms also specifically pointed out in their New Year's stock selection strategies that companies benefiting from Germany's economic stimulus policies will be another major investment highlight, while companies with clear self-improvement strategies have also attracted attention.

Here is a selection of popular European targets recommended by analysts in the new year:

Morgan Stanley

The strategist led by Marina Zavolock believes that in 2026, the European stock market is expected to continue to rise, taking advantage of the “expansion of the scope of US economic recovery.” The US market contributes about 23% of the weighted revenue of European companies. As the profit growth of US companies exceeds market expectations, combined with good tax and regulatory policies, European companies will benefit significantly from this.

Among Morgan Stanley's most promising European sectors in 2025, the banking sector topped the list, followed by the tobacco and defense sector. Core recommendation targets at the individual stock level include Santander Bank, Lloyd's, Siemens Energy, Centrick Group, Fresenius Group, Dutch International Group, Prosus NV, Rheinmetall, ENGIE SA, Société Générale, and Airbus.

UBS

For the first time in three years, UBS predicts that European corporate profits will resume growth in 2026. Strategist Gerry Fowler said, “The most attractive investment opportunities are stemming from Europe's economic transformation and the wave of structured investment.” He pointed out that with over 2 trillion euros (about 2.2 trillion US dollars) of investment in power grids and clean energy, the advantages of the renewable energy sector are particularly prominent. Electrification-related companies will also benefit from favorable regulatory policies and continued investment in infrastructure. Core targets include EDP SA and Solaria Energia y Medio Ambiente.

Fowler also said, “Domestic policy dividends are driving Europe to spawn a number of new global leaders in renewable energy, electrification, defense and infrastructure.” In particular, he emphasized that companies such as Acciona SA, Rexel FP, and Prysmian SPA are leveraging local advantages to achieve international expansion.

At the same time, the bank said that the banking sector has strong capital strength, accelerated loan growth, attractive valuations, and positive development prospects.

Barclays

The strategist led by Emmanuel Cau said that the artificial intelligence (AI) theme will probably still “hold the lifeblood of the holding market” in 2026. However, the European stock market will also benefit from German policy stimulus, and earnings per share are expected to grow by 8%, driven by operating leverage effects, low base effects, and relief from foreign exchange pressure.

Barclays overtakes the banking industry and cyclical sectors highly related to the economic cycle. Core recommendation targets include Capita Plc, JCDecaux SE, TUI Group, Flutter Entertainment Plc, ICG Plc, and London Stock Exchange Group.

The bank is also underrated in the UK market. The FTSE 100 index is expected to outperform the market. The reason is that the index's defensive appeal has declined in the context of the cyclical recovery of the European economy. Barclays also pointed out that Britain's political and financial situation is still weak.

Jefferies

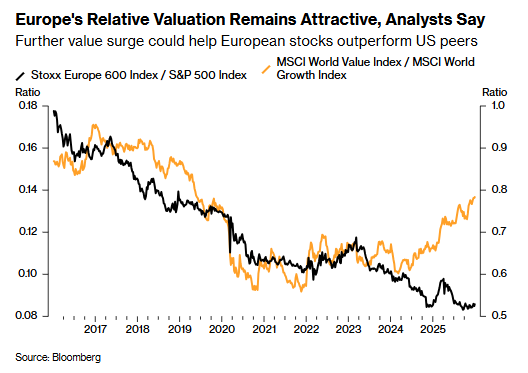

Jefferies analysts pointed out that the current valuation of the European stock market is still heavily discounted compared to its US stock peers. If the market investment logic shifts to favor stocks benefiting from “AI commercialization,” which in turn pushes the stock market to rise and spread, the relative valuation advantage of the European stock market will become more and more prominent.

The Jefferies team said that loose global fiscal and monetary policies will still provide support for risky assets, and now is the best time to increase European asset holdings.

The cyclical sector is expected to continue to outperform the market. Individual stocks recommended by Jefferies include Geberit Group, Heidelberg Materials AG, Skanska AB, Société Générale, Volvo Group and Wickes Group Plc.

Furthermore, some companies continue to promote business streamlining through cost reduction and asset divestment, and their investment attractiveness has also increased. Core recommended targets in this field include Admiral Group Plc, Elementis Plc, Glencore Group, Heineken, Nestle Group, and Stellantis.

Deutsche Bank

Deutsche Bank analysts have a “constructive attitude” to the European and American stock markets, and they prefer the European market from a tactical point of view. The team said the level of optimism about the German market is slightly higher than the overall level of Europe. In terms of individual stock selection, the bank is clearly optimistic about the targets that will best benefit from the German government's stimulus policy.

Analysts led by Tim Rokossa expect that the “Top 10 German Gold Stocks” portfolio they have built is expected to achieve double-digit gains. The portfolio covers TUI Group, Voestalpine, Heidelberg Materials, Palfinger AG, Vossloh, Kaioh Group, Volkswagen, Siemens Energy, Bechtle AG, and Commerzbank.

Panmure Liberum

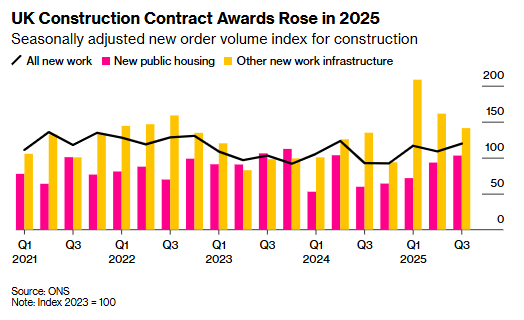

According to the agency, high-certainty investment targets in the UK market in 2026 include construction companies involved in the UK infrastructure and affordable housing sector. Analysts led by Joe Brent pointed out that the latest market data sent positive signals. The number of contracts signed continued to increase, and the construction purchasing managers' index remained in the expansion range. Core recommendations include Costain Group Plc, Keller Group Plc, and Kier Group Plc.

Panmure is also optimistic about the UK real estate sector. Analysts led by Tim Leckie wrote: “Entering 2026, the development trend of listed UK housing companies is at its best level since 2021.” Currently, interest rates have stabilized, and actual yields may decline. The increase in rental income in the market last year is gradually being transformed into a predictable profit growth momentum. The sector's preferred targets include NewRiver REIT Plc, Land Securities Group Plc, and British Land Co.

Hargreaves Lansdown

Hal Cook, a senior investment analyst at Hargreaves Lansdown, believes that in 2026, there are three UK investment trusts that can effectively enrich the diversity of investment portfolios, namely Alliance Witan Plc, J.P. Morgan Emerging Markets Growth and Income Trust, and Personal Assets Trust Plc. “In an uncertain market environment, investors should diversify asset classes, regions, sectors and investment styles to reduce the risk of a single event causing major damage to the overall investment portfolio,” he said.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal