Global Growth Companies Insiders Are Betting On

As global markets navigate a landscape marked by fluctuating stock indices and geopolitical tensions, investors are increasingly focused on sectors showing resilience and growth potential. In this context, companies with high insider ownership often attract attention as they suggest confidence from those closest to the business, aligning well with current market conditions where strategic insider bets can indicate promising growth trajectories.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's dive into some prime choices out of the screener.

Espressif Systems (Shanghai) (SHSE:688018)

Simply Wall St Growth Rating: ★★★★★★

Overview: Espressif Systems (Shanghai) Co., Ltd. is a fabless semiconductor company that develops and sells advanced low-power wireless communication chipsets both in China and internationally, with a market cap of CN¥27.88 billion.

Operations: Espressif Systems generates revenue primarily from its semiconductor segment, amounting to CN¥2.46 billion.

Insider Ownership: 37.4%

Earnings Growth Forecast: 29.5% p.a.

Espressif Systems (Shanghai) demonstrates strong growth potential with earnings forecasted to increase significantly by 29.5% annually over the next three years, outpacing the broader Chinese market. The company trades at a relatively attractive Price-To-Earnings ratio of 62.9x compared to its semiconductor peers, suggesting good value. Recent financial performance shows robust revenue growth from CNY 1.46 billion to CNY 1.91 billion year-on-year, reflecting its high-quality earnings and substantial insider ownership stability without significant recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Espressif Systems (Shanghai).

- In light of our recent valuation report, it seems possible that Espressif Systems (Shanghai) is trading behind its estimated value.

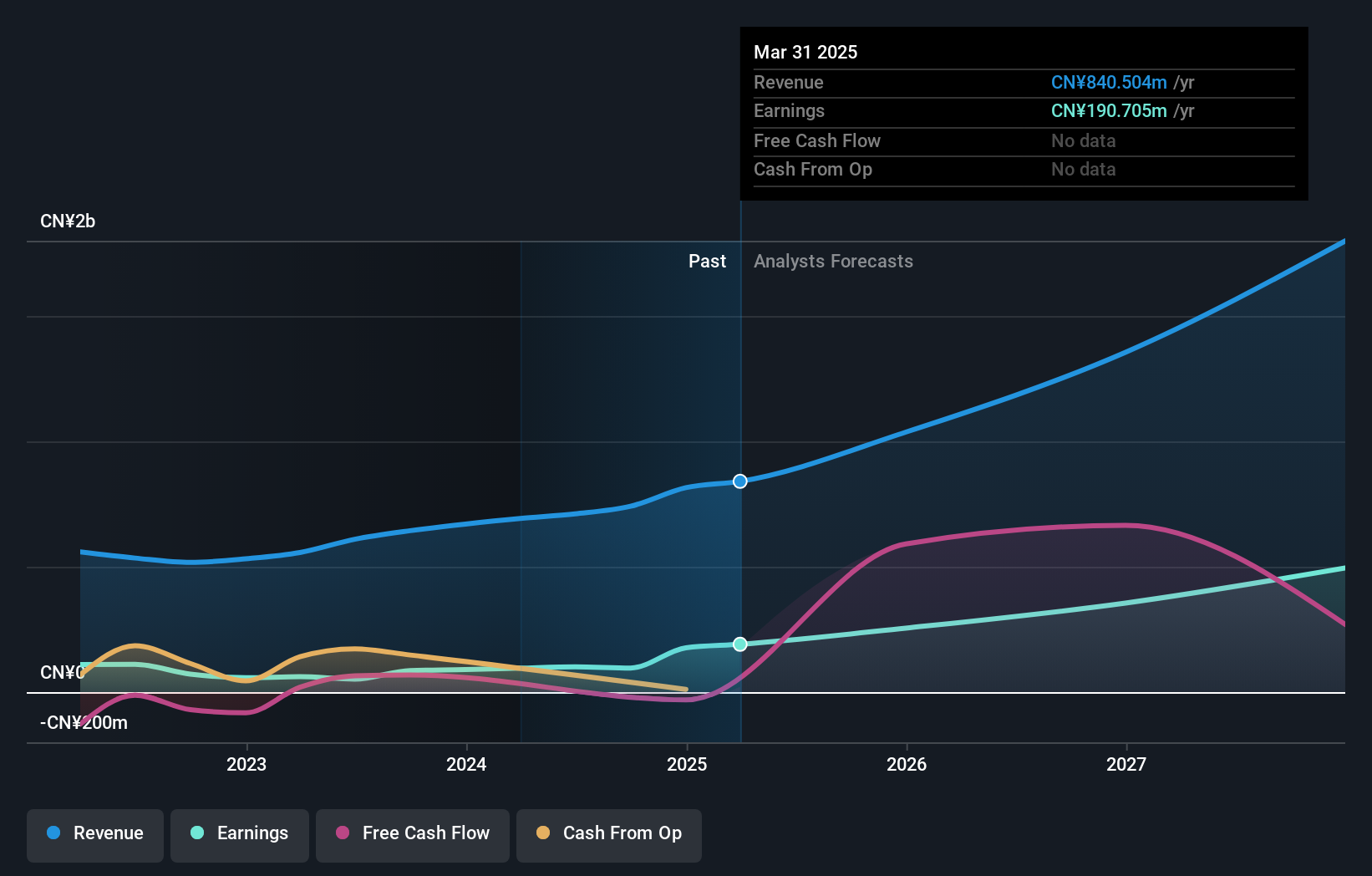

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry, with a market cap of CN¥19.84 billion.

Operations: ArcSoft Corporation Limited generates revenue through its role as a provider of algorithms and software solutions in the computer vision sector globally.

Insider Ownership: 32.5%

Earnings Growth Forecast: 33.8% p.a.

ArcSoft's earnings are forecast to grow significantly at 33.8% annually, surpassing the broader Chinese market's growth rate. Recent financials highlight robust performance with net income rising to CNY 141.72 million from CNY 88.29 million year-on-year, alongside revenue growth from CNY 573.68 million to CNY 627.55 million over the same period. Despite a low forecasted return on equity of 13.8%, ArcSoft's high insider ownership and lack of recent insider trading activity suggest strong internal confidence in its growth trajectory.

- Take a closer look at ArcSoft's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that ArcSoft is priced higher than what may be justified by its financials.

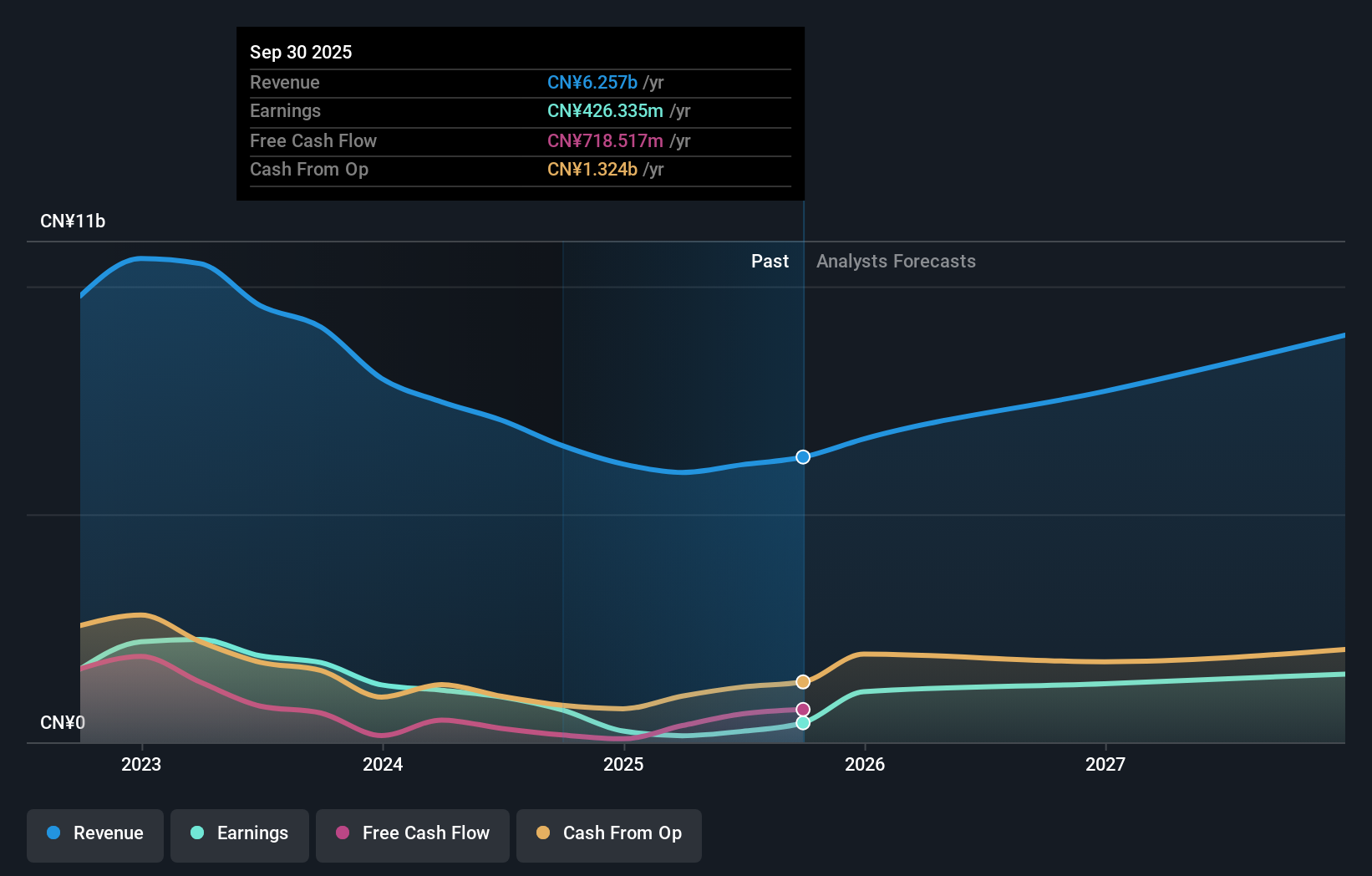

Lepu Medical Technology (Beijing) (SZSE:300003)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. operates in the healthcare sector, focusing on the development and manufacturing of medical devices and pharmaceuticals, with a market cap of CN¥29.14 billion.

Operations: Lepu Medical Technology (Beijing) Co., Ltd. generates revenue through its core activities in the healthcare sector, specifically from the development and manufacturing of medical devices and pharmaceuticals.

Insider Ownership: 13%

Earnings Growth Forecast: 36.9% p.a.

Lepu Medical Technology's earnings are projected to grow significantly at 36.91% annually, outpacing the broader Chinese market. Recent financials show net income rising from CNY 802.66 million to CNY 982.05 million year-on-year, with revenue increasing slightly to CNY 4.94 billion. Despite a low forecasted return on equity of 8.4%, Lepu's high insider ownership and absence of recent insider trading indicate internal confidence in its growth potential amidst ongoing procurement agreements and strategic bylaw amendments.

- Delve into the full analysis future growth report here for a deeper understanding of Lepu Medical Technology (Beijing).

- According our valuation report, there's an indication that Lepu Medical Technology (Beijing)'s share price might be on the expensive side.

Turning Ideas Into Actions

- Click this link to deep-dive into the 861 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal