RLX Technology (NYSE:RLX) Valuation Check After Extending Share Buyback Program Through 2027

RLX Technology (NYSE:RLX) has wrapped up a multi year share buyback, repurchasing 170,000,000 shares for US$330 million, and extended the program through December 31, 2027, keeping capital return on investors’ radar.

See our latest analysis for RLX Technology.

At a share price of US$2.32, RLX Technology’s 1 year total shareholder return of 5.77% contrasts with a 3 year total shareholder return decline of 8.01%. This suggests that longer term momentum has faded, even as buybacks keep investor attention on capital returns.

If this kind of capital return story has your interest, it can be worth widening your search to other fast growing stocks with high insider ownership that investors are watching closely.

With RLX Technology trading at US$2.32, a 41% intrinsic discount estimate and a 34.56% gap to analyst targets raise the key question: is the market overlooking value here or already pricing in any future growth?

Most Popular Narrative: 23.8% Undervalued

With RLX Technology last closing at US$2.32, the most followed narrative points to a higher fair value, built on detailed long term earnings assumptions.

The ongoing global shift from traditional cigarettes to reduced-risk products, such as e-vapor and oral nicotine, is growing the overall nicotine alternatives market; RLX's leadership and early move into multi-category offerings position it to capture expanding consumer demand, supporting strong long-term revenue growth.

Curious what kind of revenue ramp and profit margins sit behind that view? The narrative leans on brisk top line growth, tempered profitability and a rich future earnings multiple. Want to see how those pieces add up to its fair value call?

Result: Fair Value of $3.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh persistent regulatory uncertainty and the dominance of illegal domestic products, which could pressure margins and challenge the long term growth outlook.

Find out about the key risks to this RLX Technology narrative.

Another View: Earnings Multiple Flags Valuation Risk

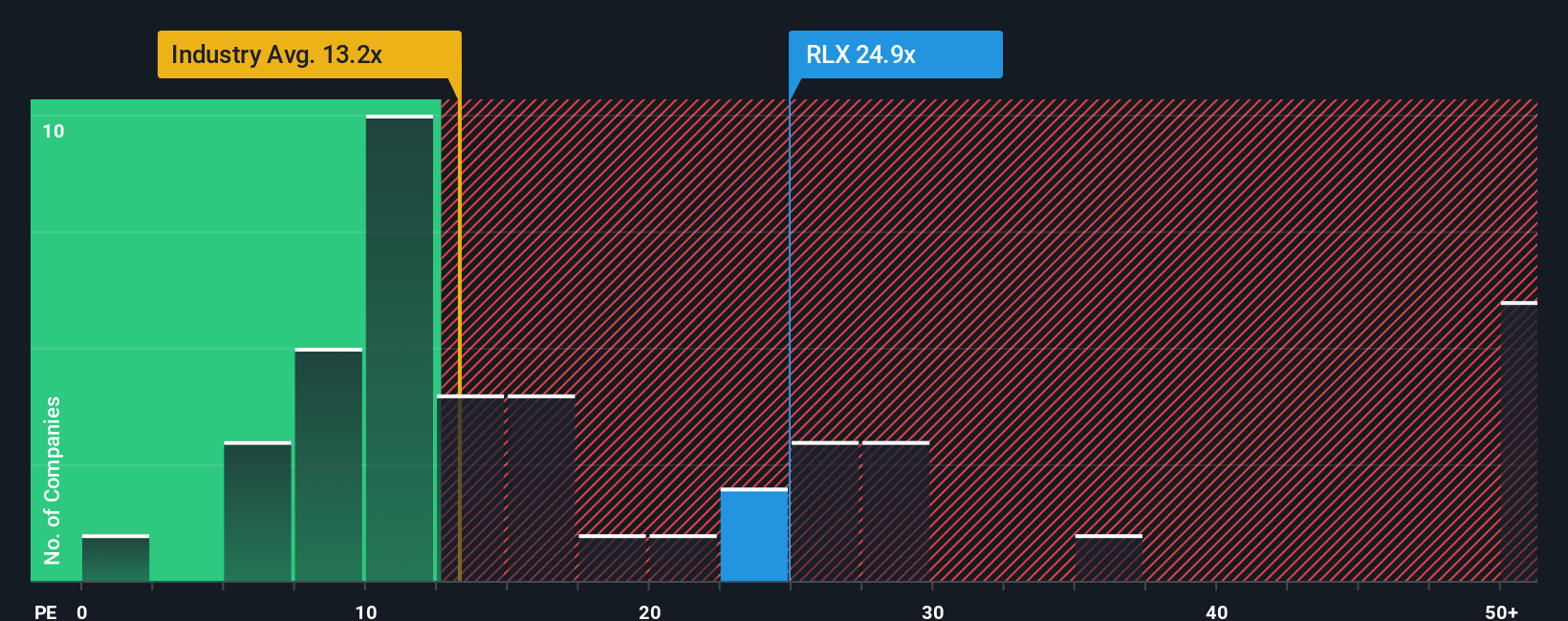

While the narrative points to a fair value of US$3.04 and an undervalued label, RLX Technology currently trades on a P/E of 25.9x. That is higher than the fair ratio of 19.7x, the peer average of 20.9x, and the global tobacco industry at 13x, which suggests investors are already paying up for growth. The question is whether you think future execution and regulatory outcomes justify that premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RLX Technology Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete RLX view in minutes. Do it your way.

A great starting point for your RLX Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If RLX has caught your attention, do not stop here. The right next idea could already be on your radar if you widen your search now.

- Target higher income potential by scanning these 14 dividend stocks with yields > 3% that might suit a returns focused portfolio.

- Catch early growth themes by reviewing these 3572 penny stocks with strong financials that line up with your risk appetite.

- Zero in on value by checking these 869 undervalued stocks based on cash flows that fit your preferred fundamentals and price discipline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal