Should Trane’s Data Center Cooling Acquisition Reshape Trane Technologies’ (TT) Margin Profile And Growth Mix?

- In early December 2025, Trane Technologies announced a definitive agreement to acquire the Digital business of Stellar Energy International, aiming to expand its presence in data center thermal management ahead of its upcoming fiscal fourth-quarter earnings release.

- This move highlights how Trane is aligning its HVAC expertise with the growing cooling needs of data centers, potentially reshaping its growth mix and margin profile.

- We will now examine how the data center-focused acquisition influences Trane Technologies’ existing investment narrative and longer-term earnings assumptions.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trane Technologies Investment Narrative Recap

To own Trane Technologies, you need to believe its core HVAC and refrigeration business can keep converting strong demand into consistent earnings, while managing tariff, transport cycle and macro risks. The Stellar Energy Digital acquisition adds a targeted data center thermal capability, but it is unlikely to change the most immediate near term catalyst, which remains the upcoming fourth quarter earnings release, or to remove the key risk of potential softness in data center and other commercial HVAC verticals.

Among recent announcements, Trane’s reaffirmed 2025 guidance, including expected full year revenue growth of about 7 percent with organic growth of 6 percent, frames how investors might think about the incremental impact of the Stellar Energy Digital deal. With earnings already supported by dividends, ongoing buybacks and high reported return on equity, the acquisition fits into an existing capital allocation story while still leaving the transport segment downturn and broader macro uncertainty as important variables.

However, investors should not overlook the risk that weaker data center or healthcare HVAC demand could...

Read the full narrative on Trane Technologies (it's free!)

Trane Technologies' narrative projects $25.4 billion revenue and $3.7 billion earnings by 2028. This implies 6.9% yearly revenue growth and about an $0.8 billion earnings increase from $2.9 billion today.

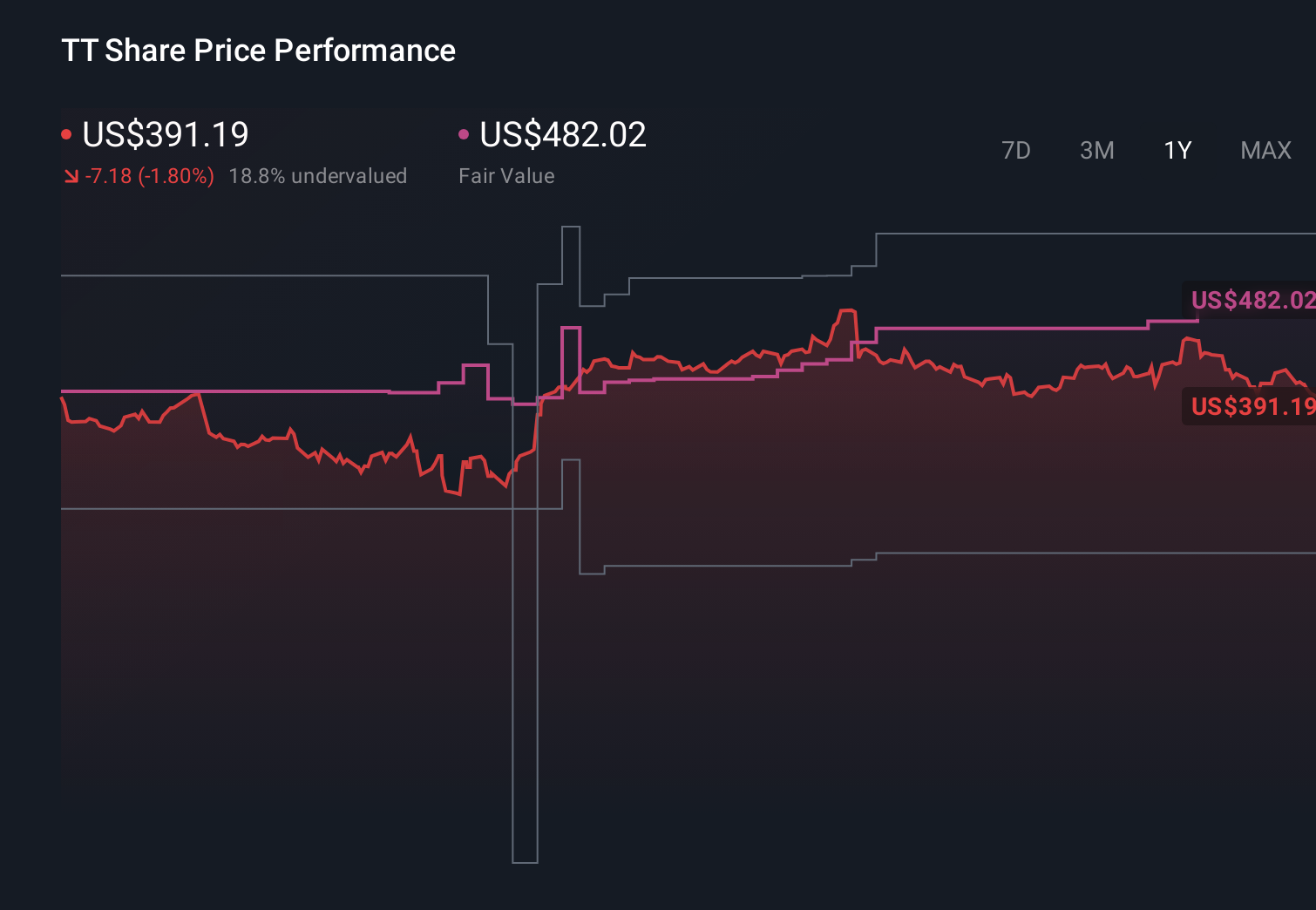

Uncover how Trane Technologies' forecasts yield a $482.28 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$304 to US$482 per share, showing how far apart individual views can be. Against that backdrop, the growing reliance on data center related HVAC demand makes it especially important to weigh how concentrated end market exposure could shape Trane’s future performance before deciding where you stand.

Explore 4 other fair value estimates on Trane Technologies - why the stock might be worth as much as 21% more than the current price!

Build Your Own Trane Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trane Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trane Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trane Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal