Sea (NYSE:SE) Valuation Check After Recent Share Price Volatility

Sea (NYSE:SE) is back in focus after recent share price swings. The stock has shown mixed performance over the past week, month, and past 3 months, prompting investors to reassess its current valuation.

See our latest analysis for Sea.

Sea's recent share price return has been choppy, with a 3.07% 1 day move and a 31.16% 3 month share price decline. However, its 1 year total shareholder return of 21.23% suggests longer term momentum has been stronger than the latest swings imply.

If Sea's recent volatility has caught your attention, this can be a good moment to broaden your watchlist and check out high growth tech and AI stocks for other tech focused opportunities.

So with Sea trading around $131.49, an estimated 53% below one intrinsic value estimate and roughly 45% below some analyst targets, you have to ask: is this a genuine opening, or is the market already factoring in future growth?

Most Popular Narrative: 31.4% Undervalued

With Sea last closing at $131.49 against a narrative fair value of $191.62, the gap between price and expectations is already clear to see.

Street research remains broadly constructive on Sea, with a cluster of recent upgrades and price target increases reflecting confidence in the companys multi segment growth trajectory and ability to reinvest behind its leading positions while still compounding value.

Want to see what is sitting behind that confidence? The narrative leans on faster growth, higher margins, and a future earnings multiple that needs to reset meaningfully. Curious how those moving parts fit together to reach that fair value number? The full breakdown spells it out in black and white.

Result: Fair Value of $191.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story could be challenged if competition in Brazil and Southeast Asia intensifies, or if Garena’s reliance on Free Fire leads to weaker gaming revenue.

Find out about the key risks to this Sea narrative.

Another View: What The Market Is Paying Today

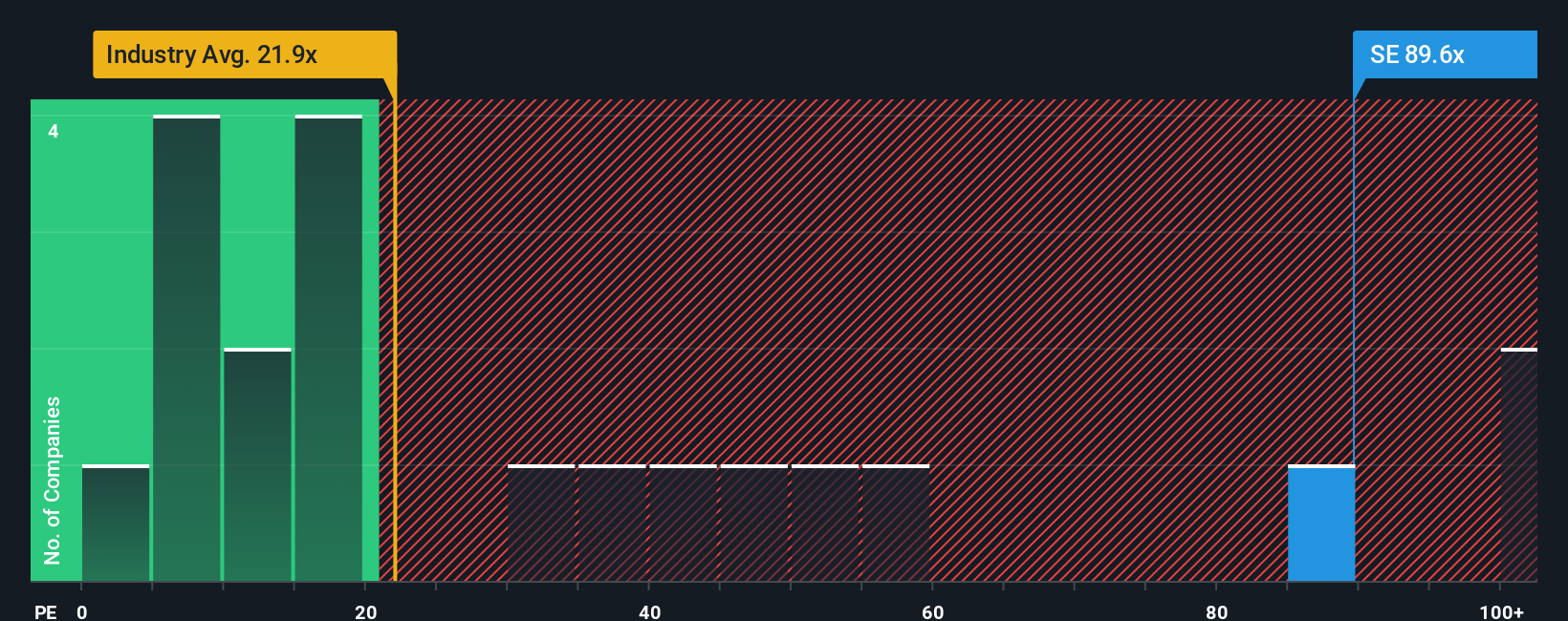

The narrative fair value of $191.62 suggests upside from the current $131.49 share price, but the current P/E of 54.9x tells a tighter story. That multiple is higher than peers at 46.3x and the industry at 19.4x, and also above the fair ratio of 34.8x, which is a level the market could move towards over time.

If earnings growth does not keep pace with that higher multiple, the gap to the 34.8x fair ratio points to valuation risk rather than a clear margin of safety. How comfortable are you paying this price today for Sea’s future earnings profile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If you are not convinced by this view or you prefer to test the numbers yourself, you can build a fresh story in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Looking for more investment ideas?

If Sea has you thinking harder about price and potential, do not stop here. Broaden your opportunity set and stress test your next moves with fresh data.

- Target income focused opportunities by checking out these 14 dividend stocks with yields > 3% that may suit a yield orientated portfolio.

- Spot potential growth stories early by scanning these 3572 penny stocks with strong financials where fundamentals help you sift signal from noise.

- Position yourself in emerging themes by reviewing these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal