Assessing Capital One Financial (COF) Valuation As Momentum Builds And Discover Deal Shapes Expectations

Capital One Financial (COF) has been drawing fresh attention after recent share price moves, with the stock’s past month and past 3 months returns outpacing its 1 day and 7 day gains, prompting closer portfolio reviews.

See our latest analysis for Capital One Financial.

At a share price of US$247.93, Capital One Financial’s recent 30 day share price return of 7.48% and 90 day share price return of 16.02%, alongside a 1 year total shareholder return of 36.82%, point to momentum that has built over time rather than appearing suddenly.

If strong banking names are on your radar, this is also a good moment to broaden your search with fast growing stocks with high insider ownership and see what else is catching investors’ attention.

With a value score of 1, an intrinsic discount of 17.33% and the share price still below the average analyst target, the key question is whether Capital One is genuinely undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 5.9% Undervalued

With Capital One Financial last closing at US$247.93 against a most-followed fair value estimate of about US$263.52, the narrative frames the current price as leaving some room before reaching that implied level.

The Discover acquisition enables expanded payments infrastructure, customer base, and cross-selling opportunities, supporting long-term revenue growth and higher fee income. Ongoing investments in technology, analytics, and premium offerings are expected to enhance efficiency, credit management, and market share while supporting future international expansion.

Want to see what is behind that uplift in fair value? The narrative leans on aggressive revenue compounding, wider margins, and a very specific future earnings multiple. Curious which numbers underpin it all?

Result: Fair Value of $263.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this uplifted fair value still depends on a smooth Discover integration and disciplined tech spending. Setbacks on either front could quickly challenge the current narrative.

Find out about the key risks to this Capital One Financial narrative.

Another Angle On Valuation

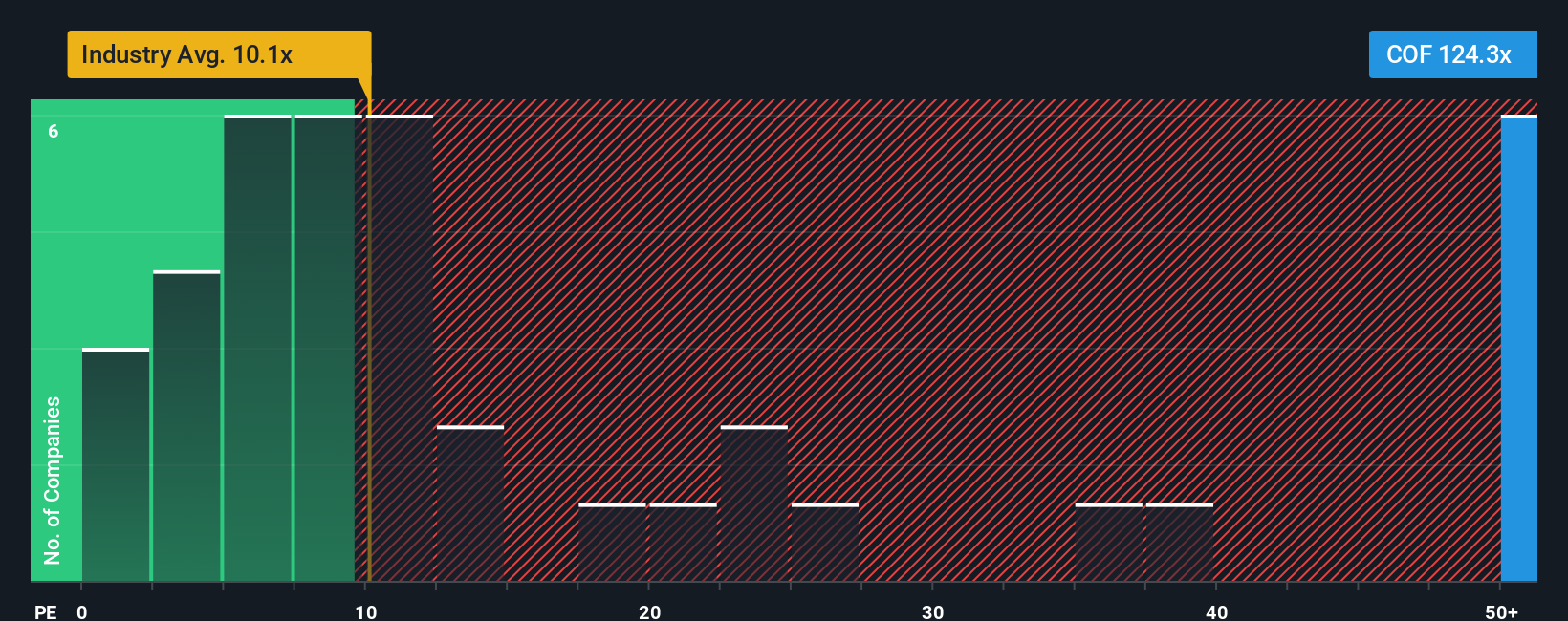

The 5.9% gap to the US$263.52 fair value looks appealing, but the P/E ratio tells a very different story. At 136.9x, Capital One trades well above the US Consumer Finance industry at 9.5x and peers at 28.6x, and far above its own fair ratio of 30.2x. That kind of premium can quickly shrink if sentiment cools. How comfortable are you paying up here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you look at these numbers and reach a different conclusion, you can put the data to work for your own view in just a few minutes, Do it your way.

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that fit your style. Use the Simply Wall St Screener to widen your shortlist.

- Spot potential value setups by checking out these 874 undervalued stocks based on cash flows that align with your expectations on price and cash flows.

- Identify companies exposed to technological change by scanning these 25 AI penny stocks where artificial intelligence is a central part of the business model.

- Support an income-focused approach by reviewing these 14 dividend stocks with yields > 3% that may help balance growth ideas with regular cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal