QuantumScape (QS) Valuation Check After NASDAQ Composite Inclusion And Recent Share Price Moves

QuantumScape added to NASDAQ Composite sparks fresh attention on the stock

QuantumScape (QS) has been added to the NASDAQ Composite Index, a change that may draw more attention from index trackers and benchmarked funds as investors reassess how the solid state battery developer fits into their portfolios.

See our latest analysis for QuantumScape.

QuantumScape’s recent inclusion in the NASDAQ Composite comes after a mixed stretch for the stock, with a 6.14% 1 day share price return, a 27.85% 90 day share price decline and a 68.09% 1 year total shareholder return suggesting momentum has been choppy but still meaningful over the longer term.

If this kind of index driven move has your attention, it could be a good moment to broaden your watchlist with high growth tech and AI stocks as another source of ideas in the space.

With QS trading at US$11.06, sitting on a very large modelled intrinsic discount and a low value score of 2, you have to ask yourself: is this a genuine mispricing, or is the market already baking in ambitious future growth?

Most Popular Narrative Narrative: 55.8% Undervalued

According to the most followed narrative, QuantumScape’s fair value of US$25 sits well above the last close at US$11.06, setting up a wide valuation gap.

QuantumScape's technology directly addresses the five key limitations of current EV batteries: range, charging speed, life, safety, and cost10....

Furthermore, the technology may even simplify battery recycling, as the least recyclable parts (separator and anode material) are either eliminated or made from more recyclable components5051.

Curious what kind of revenue ramp, margins, and future earnings multiple are baked into that US$25 figure? The narrative leans on aggressive growth, improving profitability and a premium valuation usually reserved for established sector leaders. Want to see how those pieces fit together over time and across different scenarios? The full story connects the technical claims to a detailed cash flow path.

Result: Fair Value of $25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks here, including no current revenue and ongoing losses of US$449.607 million that need funding before any commercial payoff.

Find out about the key risks to this QuantumScape narrative.

Another angle on valuation

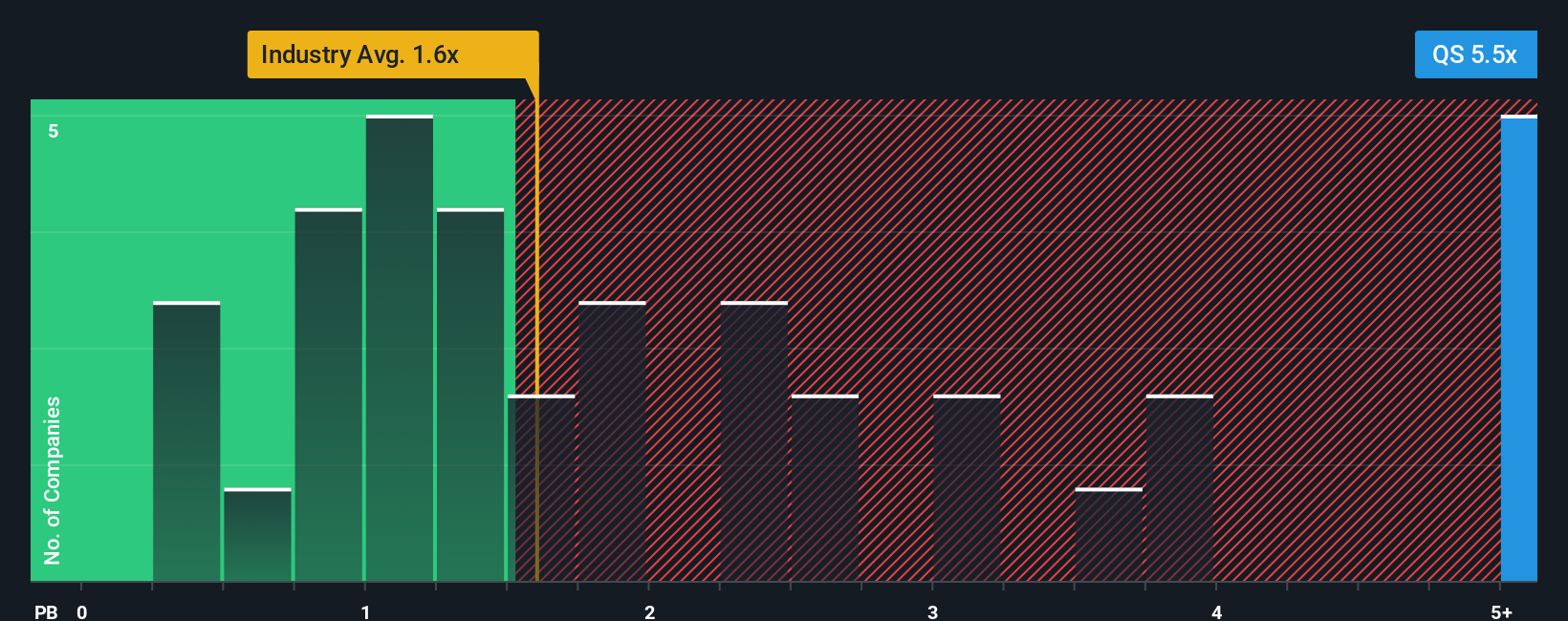

The user narrative leans on a fair value of US$25 and an undervalued label, but the multiples story pulls you in a different direction. On P/B, QS trades at about 5.5x compared with roughly 1.6x to 1.9x for sector peers, which points to a much richer price tag.

That kind of gap can cut both ways, either a premium for a promising technology or extra downside risk if expectations cool. With no meaningful revenue yet and ongoing losses, how comfortable are you paying several times the book value that other auto component names trade on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QuantumScape Narrative

If you interpret the numbers differently, or you prefer to test your own assumptions against the data, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your QuantumScape research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at QS, you could miss other compelling setups, so take a few minutes to scan fresh ideas that might fit your style and goals.

- Spot potential bargains early by checking out these 874 undervalued stocks based on cash flows that line up current prices with underlying cash flow strength.

- Zero in on fast moving themes by scanning these 25 AI penny stocks tied to artificial intelligence across different parts of the market.

- Tap into specialist trends by reviewing these 29 healthcare AI stocks at the intersection of medical data, diagnostics and AI tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal