China IoT: In December 2025, China's commodity price index was 117.9 points, up 3.2% month-on-month

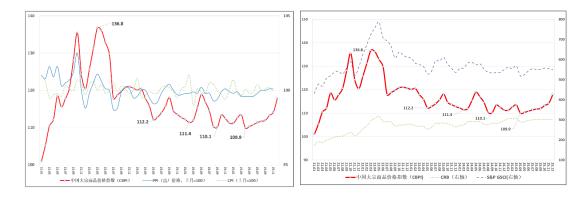

The Zhitong Finance App learned that the China Commodity Price Index (CBPI) for December 2025 released by the China Federation of Logistics and Purchasing was 117.9 points, up 3.2% month-on-month and 6% year-on-year, according to a joint survey by the China IoT Commodity Distribution Branch and Shanghai Steel Federation. Judging from the operation of the index, the index rebounded for eight consecutive months and hit a new high since June 2024, indicating that as market supply and demand continued to improve, companies' confidence in future market development increased, expectations were improving, commodity market sentiment levels continued to rise, and the economy's endogenous growth momentum was further consolidated.

Looking ahead to 2026, although global economic recovery still faces multiple challenges such as international financial market turmoil, international trade frictions, and geopolitical tension, active macroeconomic policies will guarantee the continued recovery of the domestic economy and the bulk market. At the same time, the pace of structural transformation and upgrading of China's economy will accelerate, and will also create new commodity demand. The commodity market is expected to achieve higher quality development in Guben Peiyuan.

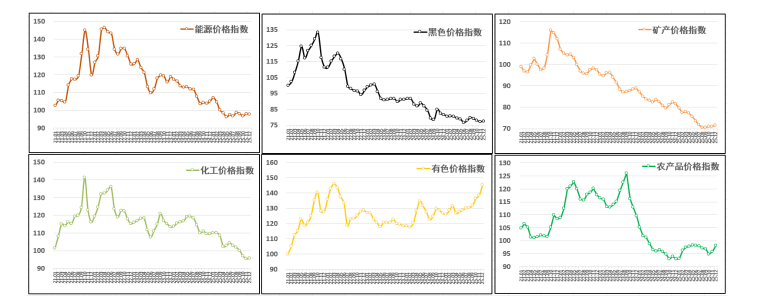

By industry: The non-ferrous price index rose sharply, at 145.2 points, 4.9% month-on-month, and 14.8% year-on-year; the agricultural product price index increased to 98.1 points, 2.5% month-on-month and 5.5% year-on-year; the mineral price index continued to recover, at 71.6 points, up 0.8% month-on-month and 12.2% year-on-year; the black price index stopped falling and rebounded at 77.5 points, up 0.4% month-on-month and 5% year-on-year; the chemical price index rose slightly to 95.6 points It rose 0.3% month-on-month and fell 12.6% year-on-year; the energy price index fell slightly to 97.8 points, down 0.2% month-on-month and 6.9% year-on-year.

By commodity: Among the 50 commodities monitored by the China Federation of Logistics and Purchasing, compared with the previous month, the prices of 31 commodities (62%) rose and the prices of 19 commodities (38%) fell. The top three commodities that rose this month were lithium carbonate, refined tin, and apples, which rose 15.5%, 11.7%, and 8.5% month-on-month respectively; the top three declines were caustic soda, ethylene glycol, and coking coal, which fell 7.2%, 6.8%, and 6.5%, respectively.

Comparing domestic and foreign indices: CBPI is consistent with last month's PPI trend and is somewhat different from CPI. PPI rose 0.1% month-on-month in November; among them, the price of means of production rose 0.1% month-on-month, and the price of means of living remained flat month-on-month. In November, CPI fell 0.1% month-on-month; among them, food prices rose 0.5% month-on-month and non-food prices fell 0.2% month-on-month. The CBPI and CRB indices rose, while the S&P GSCI index declined slightly. Affected by the weakening of the US dollar index and rising expectations of interest rate cuts from the Federal Reserve, international copper prices have repeatedly reached record highs, with a cumulative increase of more than 40% throughout the year. Meanwhile, the strained relationship between the US and the US, the twists and turns in the Russian-Ukrainian peace negotiations process, and geopolitical events such as the cease-fire agreement between Thailand and Cambodia have also disrupted international prices of crude oil, metals, and some agricultural products.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal