A Look At Corporación América Airports (NYSE:CAAP) Valuation After Reports Of Strong Latin American Air Traffic Growth

Recent reports on Corporación América Airports (NYSE:CAAP) highlight air traffic growth across Latin American hubs, including Buenos Aires, with inflation indexed tariffs and disciplined growth capital expenditure drawing fresh attention to the stock.

See our latest analysis for Corporación América Airports.

Against this backdrop of higher passenger volumes and inflation indexed tariffs, Corporación América Airports’ share price of $26.57 comes after a 90 day share price return of 51.92%. The 1 year total shareholder return of 34.33% and very large 5 year total shareholder return suggest momentum has been building over both shorter and longer horizons.

If you are looking beyond airports for other transportation ideas, this could be a useful moment to widen your search with auto manufacturers as a starting point.

With shares near US$26.57 and a value score of 2 despite an intrinsic value gap, investors are left with a key question: is Corporación América Airports still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 1% Overvalued

With Corporación América Airports last closing at US$26.57 against a narrative fair value of about US$26.38, the valuation gap is now very narrow, putting the focus on what is driving that estimate rather than a clear discount or premium.

Robust and accelerating passenger growth across key markets, particularly Argentina, Brazil, Italy, and Armenia, reflects the long-term global trend of increased air travel demand, especially in emerging markets. This is expected to drive sustained revenue and EBITDA growth going forward.

Want to see what is built into that fair value? The narrative leans heavily on steady traffic gains, richer margins, and a profit multiple that assumes consistent execution. The exact mix of revenue growth, margin expansion, and earnings power is all laid out there, but you only see how it fits together when you read it in full.

Result: Fair Value of $26.38 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative still leans on Argentina’s economic stability and ongoing concession negotiations, where currency swings and political decisions could unsettle earnings and cash flows.

Find out about the key risks to this Corporación América Airports narrative.

Another Angle: Big Gap In The DCF

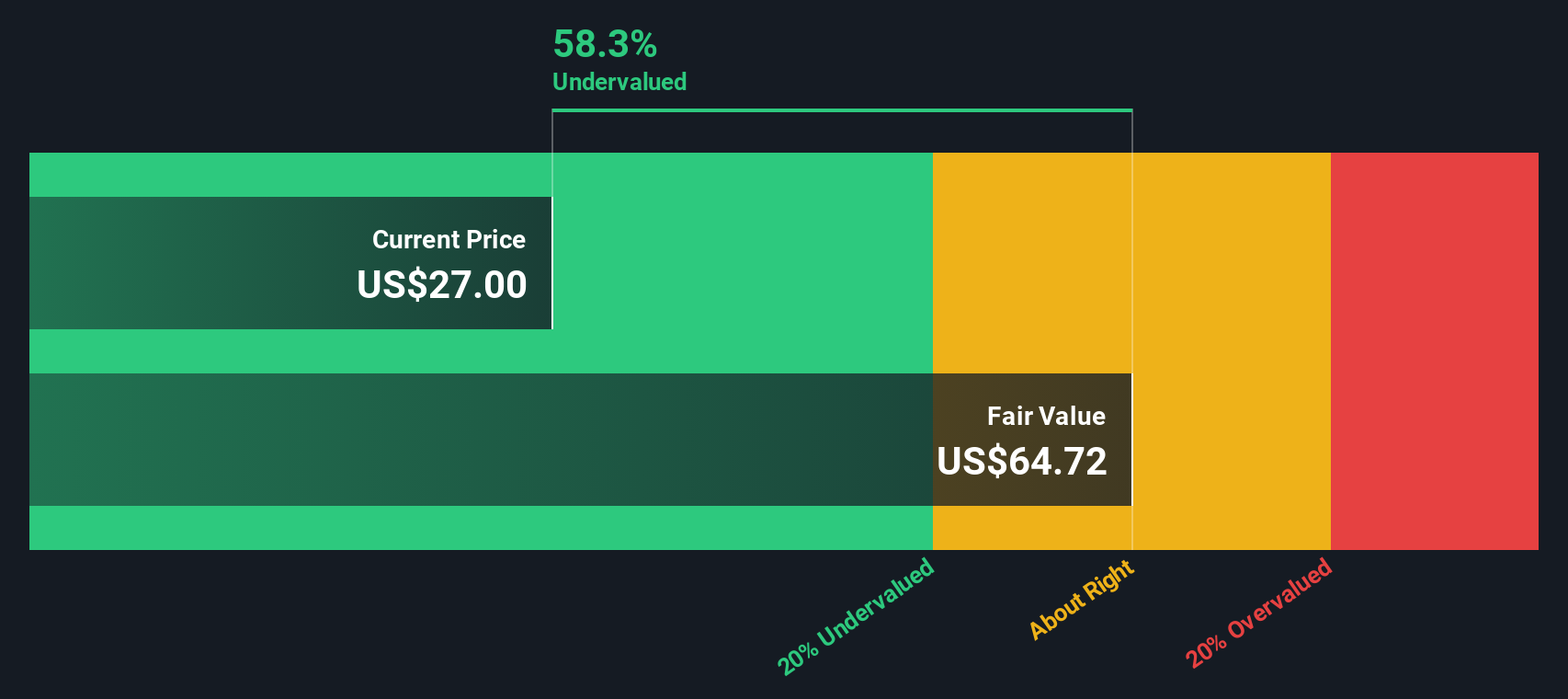

While the consensus fair value of about US$26.38 implies Corporación América Airports is roughly in line with its current price, our DCF model presents a different view, with a fair value estimate of US$63.33. That 58% gap raises a simple question: which story do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Corporación América Airports for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Corporación América Airports Narrative

If you look at the numbers and reach a different conclusion, or prefer to build your own view from the ground up, you can put together a complete narrative in just a few minutes with Do it your way.

A great starting point for your Corporación América Airports research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If you stop with just one company, you risk missing other opportunities that fit your style, so let the Simply Wall St Screener do some of the heavy lifting.

- Spot potential growth stories early by scanning these 3571 penny stocks with strong financials with solid fundamentals before they appear on everyone else’s radar.

- Tap into the artificial intelligence trend by reviewing these 25 AI penny stocks that already align with strong business metrics and real-world use cases.

- Prioritise price discipline by filtering for these 875 undervalued stocks based on cash flows that trade below their estimated cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal