A Look At eXp World Holdings (EXPI) Valuation After Recent Share Price Weakness

eXp World Holdings (EXPI) has drawn investor attention after recent share price moves, with the stock showing a one-month return of about a 17% decline and a past three-month return of about a 16% decline.

See our latest analysis for eXp World Holdings.

At a recent share price of US$9.10, the stock’s 1 year total shareholder return of about 19% decline and 5 year total shareholder return of about 74% decline indicate reduced momentum. The recent share price weakness may also reflect increased caution around its growth prospects and risk profile.

If eXp World Holdings’ swings have you reassessing your watchlist, this could be a moment to broaden your search with fast growing stocks with high insider ownership.

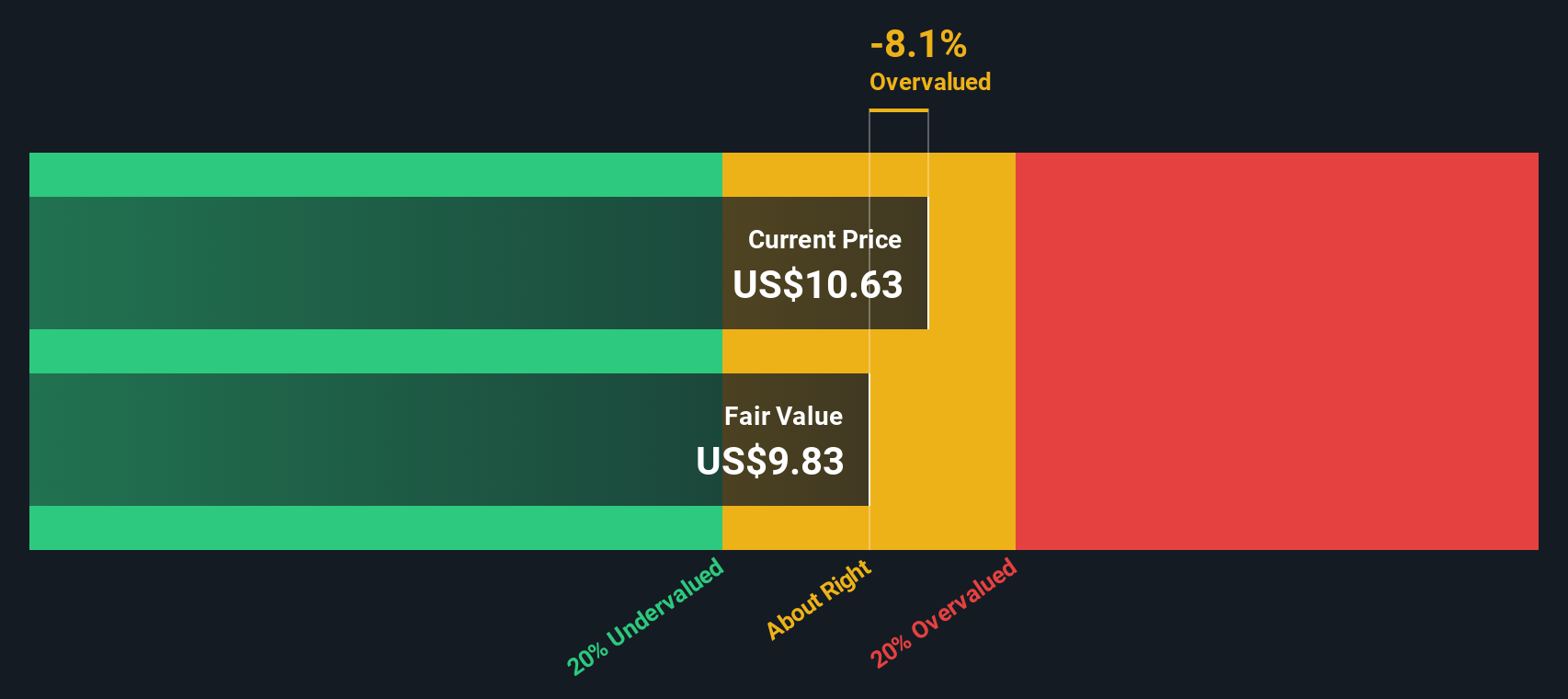

With the share price under pressure and analysts’ price target higher than where the stock trades today, the key question is whether EXPI is now undervalued or if the market is already pricing in any future growth potential.

Most Popular Narrative Narrative: 30% Undervalued

Compared with eXp World Holdings’ last close of US$9.10, the most followed narrative points to a fair value of about US$13.00 per share. This creates a sizeable valuation gap that hinges on its long term growth and margin potential.

Accelerating global expansion supported by a scalable cloud-based platform is allowing eXp to rapidly launch into new markets (Peru, Turkey, Ecuador, Japan, South Korea) and capture productive agents quickly. This increases potential transaction fees and top-line revenue in tandem with the ongoing digitalization of commerce and work.

Curious how modest revenue growth assumptions, a turn to profitability and a rich future earnings multiple combine to justify that price target? The full narrative unpacks the projections, the time frame and the valuation math driving this fair value call.

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on agents staying central to real estate transactions and on commissions holding up in the face of regulatory change and affordability pressures that could squeeze volumes.

Find out about the key risks to this eXp World Holdings narrative.

Another View: DCF Points The Other Way

While the popular narrative sees eXp World Holdings as roughly 30% undervalued at a fair value of about US$13, our DCF model reaches a different conclusion. On this view, EXPI’s fair value is around US$7.44, which would make the current US$9.10 share price look overvalued instead.

This gap between a bullish narrative and a more cautious cash flow model raises a simple question for you: which set of assumptions about future revenue, margins and required return feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view of eXp World Holdings in just a few minutes, starting with Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If eXp World Holdings has sharpened your thinking, do not stop here. The screener can help you quickly spot other opportunities that might suit your style.

- Target reliable income by scanning these 14 dividend stocks with yields > 3% that may suit investors who prioritise regular cash returns alongside business quality.

- Capture potential growth trends in artificial intelligence by reviewing these 25 AI penny stocks that are tied to expanding use cases across multiple sectors.

- Spot potential mispricings by working through these 875 undervalued stocks based on cash flows that currently trade at a discount based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal