UK Stocks Estimated To Be Trading Below Fair Value In January 2026

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China and falling commodity prices impacting major companies. As global economic pressures continue to influence market performance, identifying stocks trading below their fair value could present opportunities for investors seeking potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Serabi Gold (AIM:SRB) | £3.16 | £6.25 | 49.5% |

| PageGroup (LSE:PAGE) | £2.336 | £4.53 | 48.4% |

| Nichols (AIM:NICL) | £9.34 | £18.53 | 49.6% |

| Man Group (LSE:EMG) | £2.31 | £4.38 | 47.2% |

| Ibstock (LSE:IBST) | £1.41 | £2.68 | 47.3% |

| Gym Group (LSE:GYM) | £1.50 | £2.94 | 48.9% |

| Fintel (AIM:FNTL) | £2.125 | £3.81 | 44.3% |

| Fevertree Drinks (AIM:FEVR) | £8.05 | £15.87 | 49.3% |

| Anglo Asian Mining (AIM:AAZ) | £2.625 | £5.15 | 49.1% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.18 | £4.19 | 48% |

Here's a peek at a few of the choices from the screener.

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the UK, Ireland, Italy, the rest of Europe, Australia, New Zealand, and internationally; it has a market cap of approximately £4.93 billion.

Operations: Entain's revenue segments include £500.90 million from CEE, £2.14 billion from the UK & Ireland, and £2.55 billion from International operations.

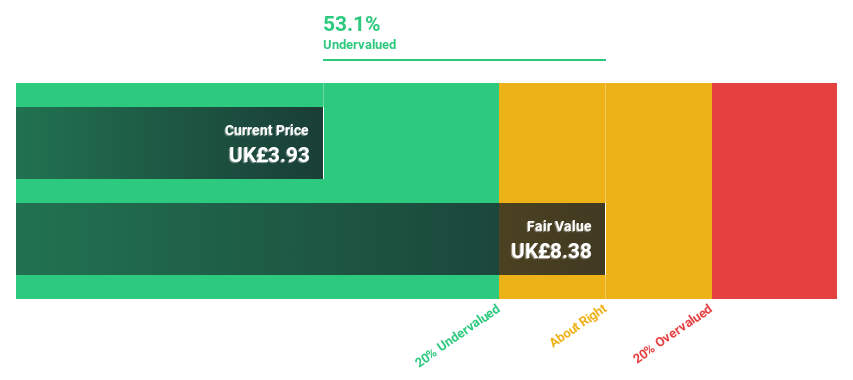

Estimated Discount To Fair Value: 13.9%

Entain is trading at a good value compared to peers, with its stock price 13.9% below fair value estimates of £8.96. The company recently completed a €500 million fixed-income offering aimed at refinancing existing debt, which could enhance cash flow management. While the dividend yield of 2.54% is not well covered by earnings, Entain's forecasted revenue growth outpaces the UK market, and profitability is expected within three years amidst executive transitions.

- According our earnings growth report, there's an indication that Entain might be ready to expand.

- Click here to discover the nuances of Entain with our detailed financial health report.

M&G (LSE:MNG)

Overview: M&G plc operates in the savings and investment sectors both in the United Kingdom and internationally, with a market capitalization of £6.91 billion.

Operations: The company's revenue is primarily derived from its Asset Management segment, generating £1.07 billion, and its Life (Including Wealth) segment, contributing £7.57 billion.

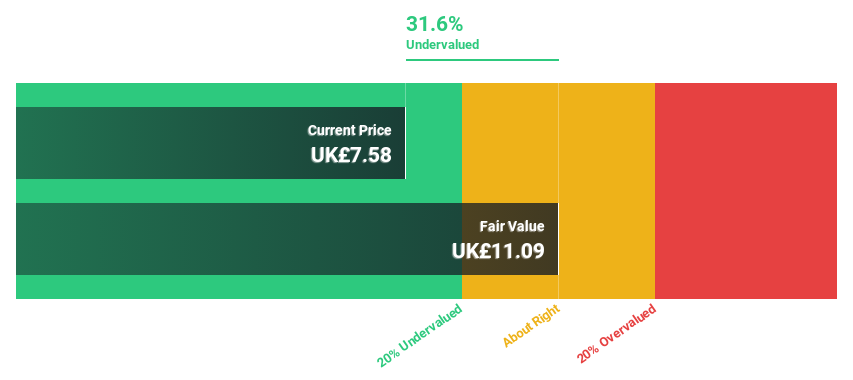

Estimated Discount To Fair Value: 27.9%

M&G is trading at £2.91, significantly below its estimated fair value of £4.04, indicating it is undervalued based on cash flows. Although the dividend yield of 6.93% is not well covered by earnings, M&G's profitability is expected to improve over the next three years with a forecasted high return on equity of 20.3%. Recent executive changes and conference presentations may influence future strategic directions and investor engagement in the UK market.

- The analysis detailed in our M&G growth report hints at robust future financial performance.

- Dive into the specifics of M&G here with our thorough financial health report.

QinetiQ Group (LSE:QQ.)

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and internationally with a market cap of £2.36 billion.

Operations: The company's revenue is derived from two main segments: EMEA Services, contributing £1.47 billion, and Global Solutions, generating £417 million.

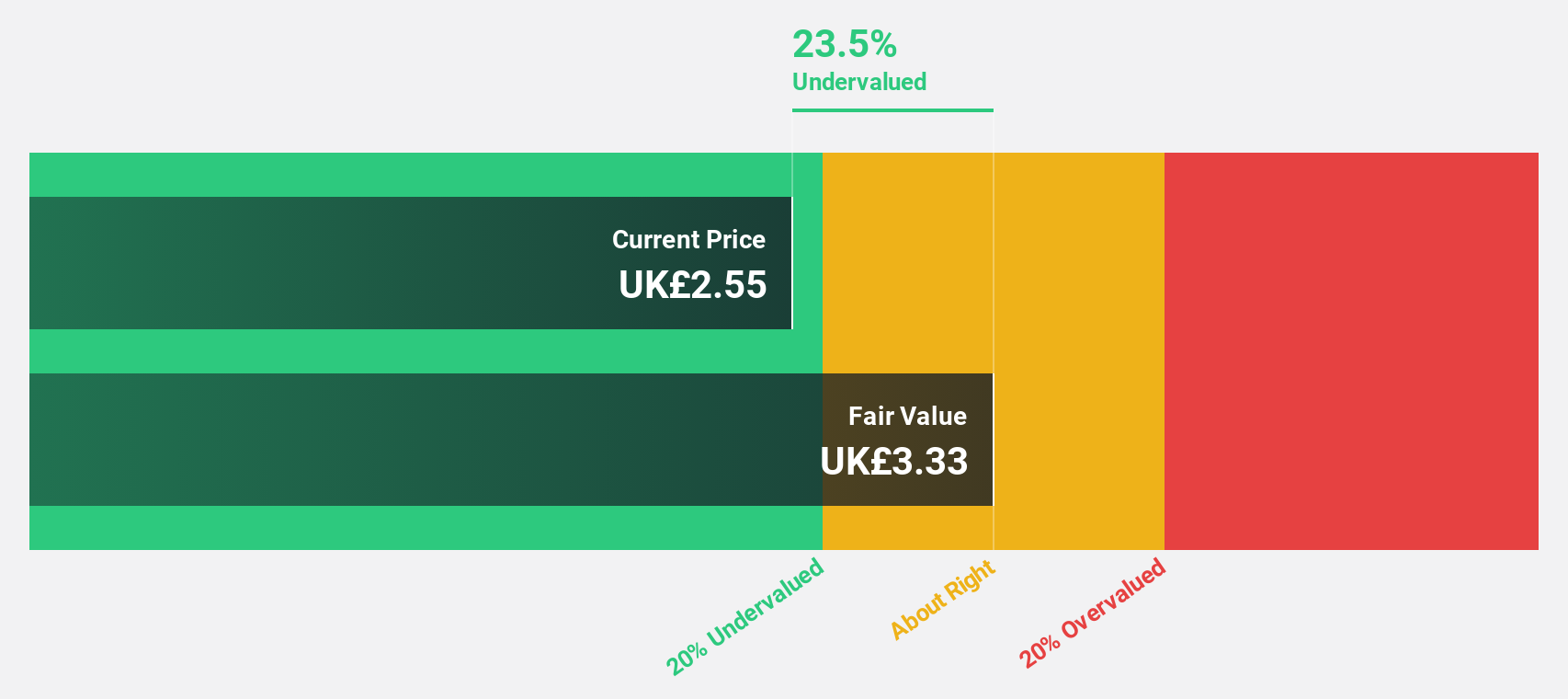

Estimated Discount To Fair Value: 19%

QinetiQ Group is trading at £4.44, below its estimated fair value of £5.48, reflecting an undervaluation based on cash flows. The company's earnings are projected to grow significantly over the next three years, with a high return on equity forecasted at 30.8%. Recent board appointments of experienced leaders Brad Feldmann and John Kavanaugh could strengthen strategic growth initiatives. Despite a recent dip in sales and net income, QinetiQ increased its interim dividend by 7%, supporting its progressive dividend policy.

- Our growth report here indicates QinetiQ Group may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of QinetiQ Group.

Next Steps

- Access the full spectrum of 58 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal