Top UK Dividend Stocks To Consider

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has impacted companies with strong ties to the Chinese economy. Amidst these global uncertainties and market fluctuations, dividend stocks can offer investors a measure of stability and income through regular payouts, making them an attractive option during volatile times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Seplat Energy (LSE:SEPL) | 6.47% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.61% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.91% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.12% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.84% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.61% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.72% | ★★★★★☆ |

| Bytes Technology Group (LSE:BYIT) | 5.72% | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | 3.79% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.67% | ★★★★★☆ |

Click here to see the full list of 52 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

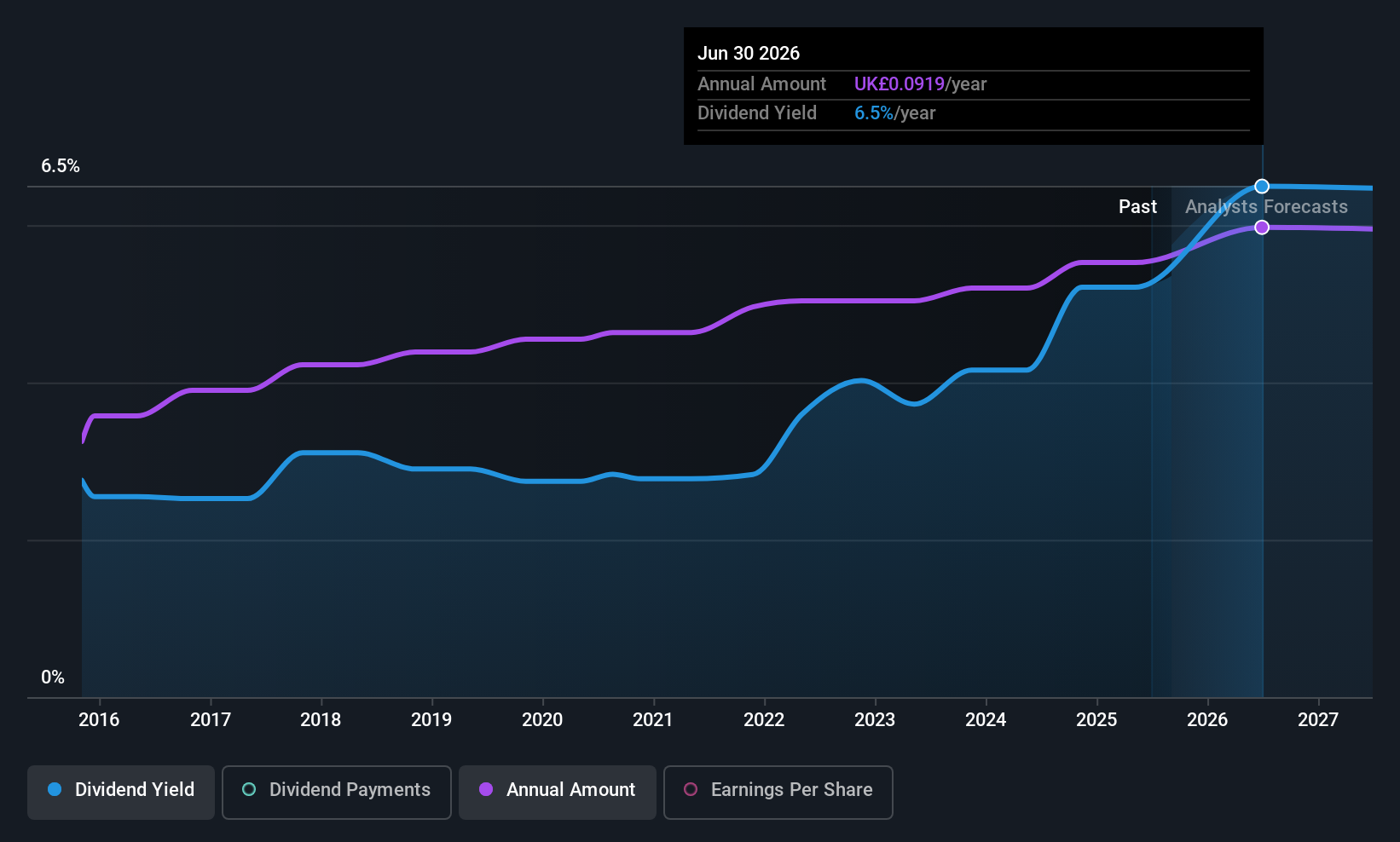

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: James Halstead plc is a manufacturer and supplier of flooring products for commercial and domestic markets across the UK, Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £570.99 million.

Operations: The company's revenue is primarily derived from its manufacture and distribution of flooring products, amounting to £261.97 million.

Dividend Yield: 6.4%

James Halstead offers a dividend yield of 6.42%, placing it in the top 25% of UK dividend payers, with stable and growing dividends over the past decade. However, its high payout ratio (90.3%) indicates dividends are not well covered by earnings or cash flows, raising sustainability concerns despite reliable payments historically. The stock trades at a slight discount to estimated fair value, but investors should monitor financials closely for future coverage improvements.

- Dive into the specifics of James Halstead here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of James Halstead shares in the market.

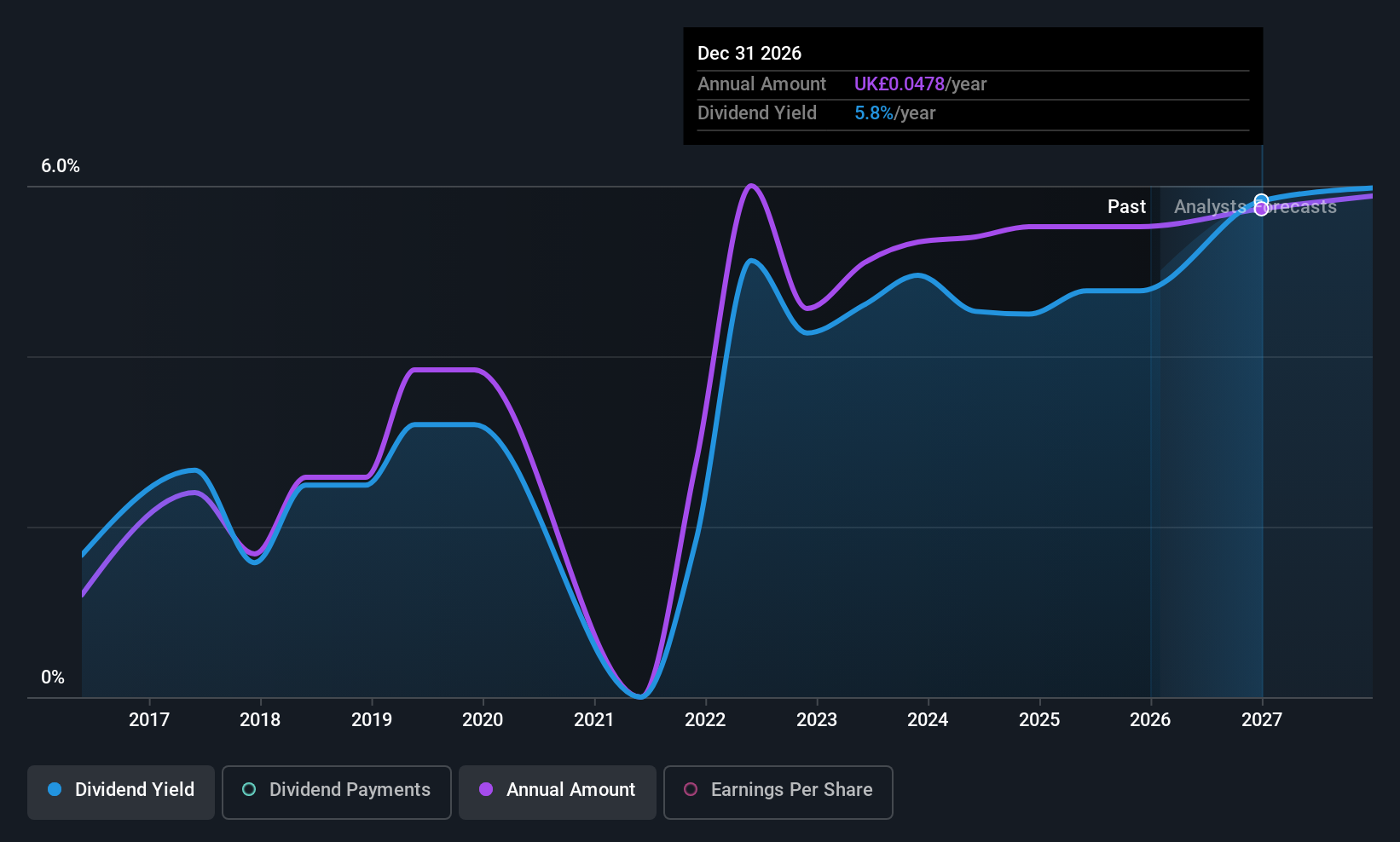

Michelmersh Brick Holdings (AIM:MBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Michelmersh Brick Holdings plc, along with its subsidiaries, manufactures and sells bricks and brick prefabricated products in the United Kingdom and Europe, with a market capitalization of £78.43 million.

Operations: Michelmersh Brick Holdings plc generates revenue of £70.49 million from its Building Products segment.

Dividend Yield: 5.3%

Michelmersh Brick Holdings' dividend yield of 5.32% falls short of the top UK payers, with a high payout ratio (80.7%) suggesting dividends are covered by earnings but less so by cash flows (89.9%). Despite past volatility and unreliability, dividends have grown over ten years. Recent board changes include Darren Waters as an Independent Non-Executive Director, bringing strategic industry expertise to support the company's ongoing focus on sustainable operations amidst changing market conditions.

- Delve into the full analysis dividend report here for a deeper understanding of Michelmersh Brick Holdings.

- Our valuation report here indicates Michelmersh Brick Holdings may be undervalued.

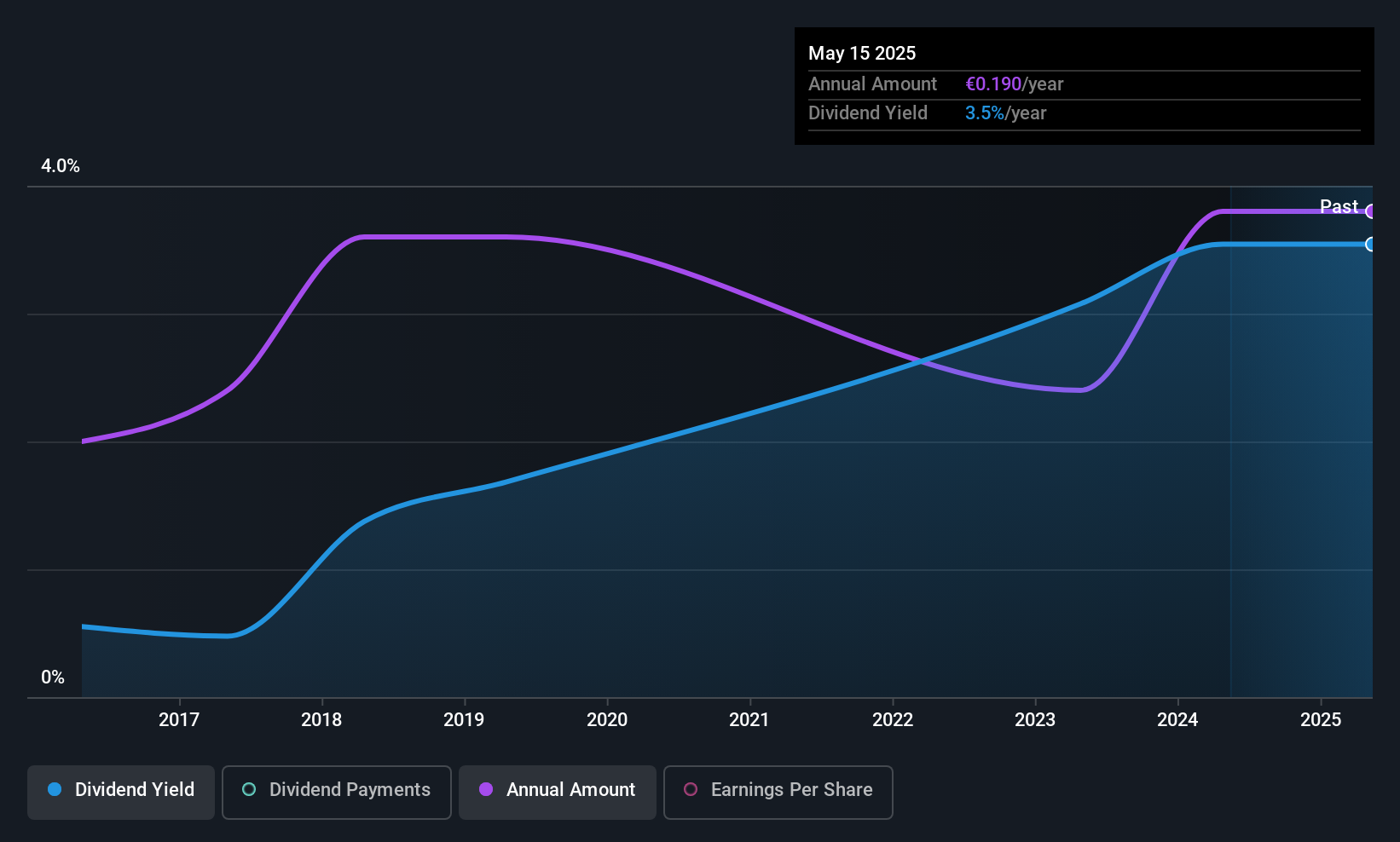

Multitude (LSE:0R4W)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multitude AG, along with its subsidiaries, offers digital lending and online banking services in Finland and has a market cap of €131.26 million.

Operations: Multitude AG generates revenue through its digital lending and online banking services in Finland.

Dividend Yield: 3.9%

Multitude AG's dividend yield is modest compared to top UK payers, yet dividends are well-covered with a low payout ratio of 22.1% and cash payout ratio of 8.1%. Despite volatility over the past decade, dividends have increased. Recent leadership changes include Antti Kumpulainen as CEO and strategic restructuring efforts to streamline operations under Multitude Bank p.l.c., potentially impacting future dividend stability and growth. Earnings guidance projects net profit growth through 2026, supporting dividend sustainability.

- Click here to discover the nuances of Multitude with our detailed analytical dividend report.

- The analysis detailed in our Multitude valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click this link to deep-dive into the 52 companies within our Top UK Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal