A Look At Micron Technology (MU) Valuation After Strong Recent Share Price Momentum

Micron Technology (MU) has drawn investor interest after recent trading, with the stock last closing at $315.42. That price now sits alongside a 1 day return of 10.5% and a past month gain of 33.0%.

See our latest analysis for Micron Technology.

The latest move comes on top of strong recent momentum, with a 90 day share price return of 65.2% and a very large 1 year total shareholder return. Taken together, these figures signal that sentiment around Micron’s growth prospects and risk profile has shifted meaningfully.

If Micron’s run has you thinking about where else capital might work hard in semiconductors and AI, it could be worth scanning high growth tech and AI stocks as a next step.

With Micron now at $315.42 and trading slightly above the average analyst price target, the key question is whether strong recent returns still leave room for upside or if the market is already pricing in future growth.

Most Popular Narrative: 54.7% Overvalued

According to BlackGoat’s narrative, Micron’s fair value of about $203.92 sits well below the last close at $315.42, setting up a sharp valuation gap.

The AI Supercycle: This is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products, becoming a key supplier for the next-generation "Blackwell" AI accelerator. The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms. With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

Want to see how one investor gets to that higher fair value? It leans heavily on faster revenue, fatter margins and a rich profit multiple. Curious which assumptions really move the needle and how sensitive the outcome is to them? The full narrative lays out the entire blueprint.

Result: Fair Value of $203.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including intense competition in high bandwidth memory and the risk that industry cyclicality or geopolitics could hit pricing and demand.

Find out about the key risks to this Micron Technology narrative.

Another View: Market Ratio Check

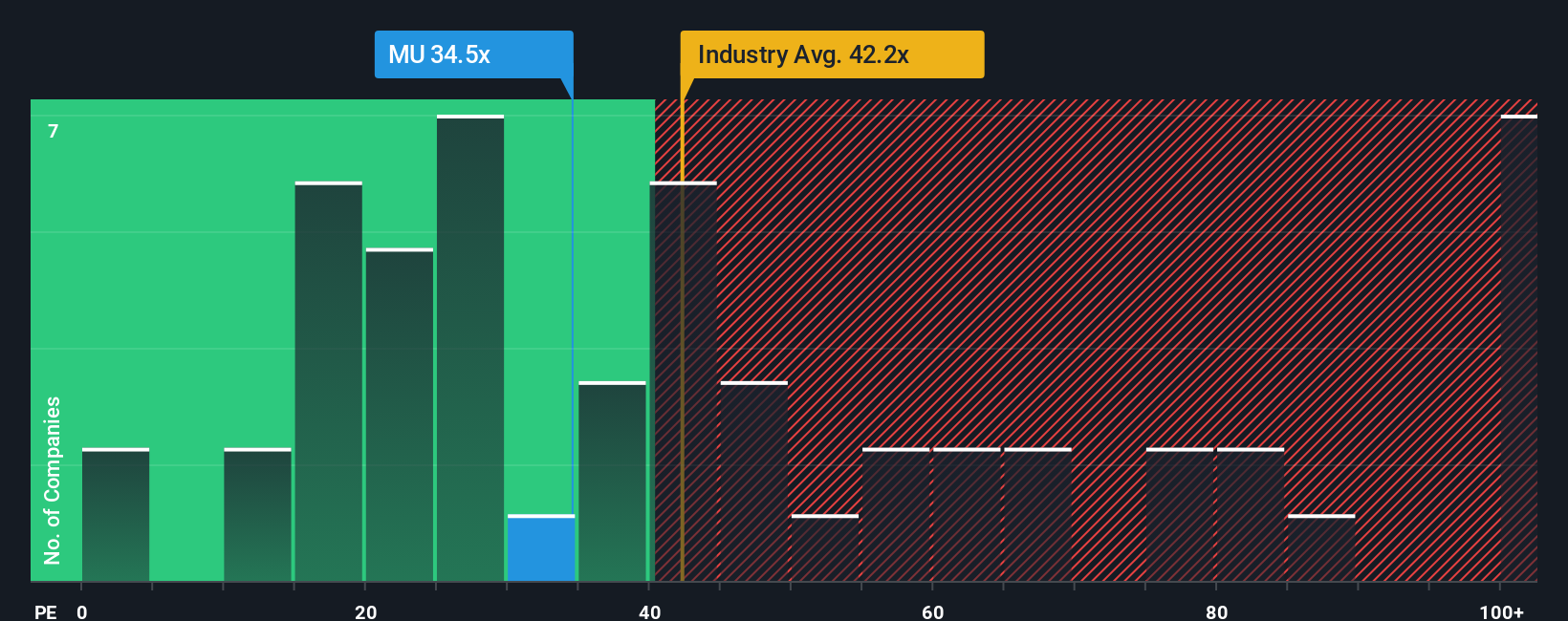

BlackGoat’s fair value points to Micron looking overvalued, but our P/E work tells a different story. At 29.8x earnings, Micron trades well below peers at 63.2x and below the US Semiconductor average of 37.3x. Our fair ratio sits even higher at 49.6x.

That gap cuts both ways. It can hint at a safety buffer if sentiment cools or signal that expectations are already demanding. The real question for you is whether Micron’s current fundamentals and risks justify the market ever moving closer to that fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full Micron view yourself in minutes by starting with Do it your way.

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Micron has sharpened your thinking, do not stop here, use the Simply Wall St Screener to spot other opportunities that might fit your goals even better.

- Target long term compounding potential by checking out these 875 undervalued stocks based on cash flows that screen for prices below estimated cash flow value.

- Ride structural growth themes by scanning these 25 AI penny stocks focused on companies building or benefiting from artificial intelligence trends.

- Strengthen your income stream by reviewing these 14 dividend stocks with yields > 3% that highlight companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal