Assessing ING Groep (ENXTAM:INGA) Valuation After Strong Multi‑Year Shareholder Returns

Why ING Groep (ENXTAM:INGA) is on investors’ radar today

ING Groep (ENXTAM:INGA) is back in focus after a stretch of strong share price performance, with recent returns over the past week, month and past 3 months prompting closer attention from income and value oriented investors.

See our latest analysis for ING Groep.

That recent 16.43% 3 month share price return sits alongside a 71.03% 1 year total shareholder return and a 332.75% 5 year total shareholder return, which suggests positive momentum has been building over time.

If ING Groep’s move has you looking around the market, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With ING Groep showing a 51.18% intrinsic discount alongside strong recent total returns, the big question now is whether the shares are still undervalued or if the market is already taking future growth into account.

Most Popular Narrative: 12.3% Undervalued

According to the narrative, ING Groep’s fair value of €27.92 sits above the recent €24.49 close, which puts a spotlight on how that gap is justified.

Additionally, ING is among the sector leaders when it comes to trying to pivot away from NII as the predominant factor of profits. Instead, the industry in general and the Dutch bankers in particular aim to reap an ever higher share of income from fees for various services, be it client wealth management, M&A activities, debt underwriting and other areas. The past quarter demonstrates that ING has made ground in this effort at exactly the right time, while still standing to profit from the aforementioned EU investment initiative.

Want to see what is driving that higher fair value, according to PittTheYounger? The narrative leans on earnings, margins and a punchy profit multiple. Curious how those moving parts fit together into that price tag?

Result: Fair Value of €27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh risks such as weaker European growth affecting loan demand, as well as regulation and higher capital requirements pressuring profitability and valuations.

Find out about the key risks to this ING Groep narrative.

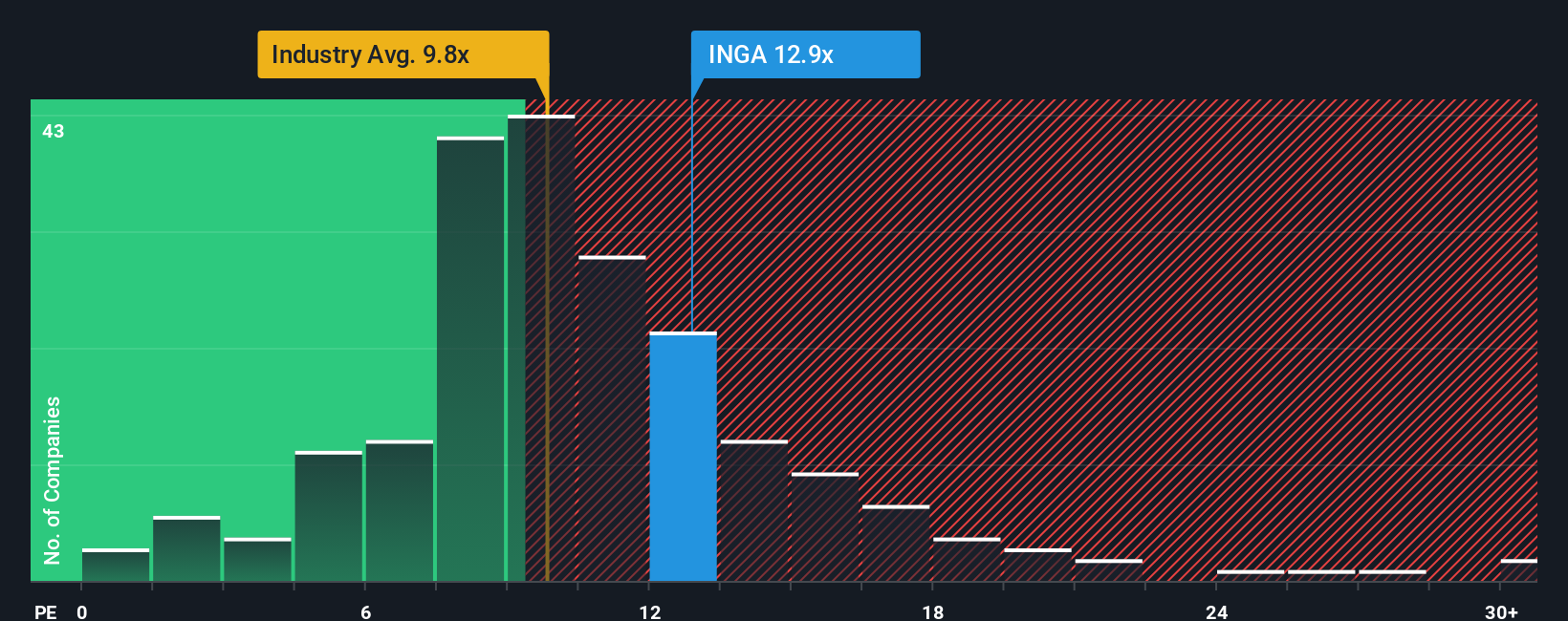

Another View: What Earnings Ratios Are Saying

That 12.3% undervaluation call is only one angle. On earnings, ING Groep trades on a 14.2x P/E, which sits above its 13.5x fair ratio, the 12.6x peer average and the 11.1x European banks average. That richer tag could indicate additional potential or simply a smaller margin for error. How do you interpret it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

If you look at the numbers and come to a different conclusion, or simply want your own view backed by data, you can build a full narrative in just a few minutes, starting with Do it your way.

A great starting point for your ING Groep research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If ING Groep has sharpened your appetite for opportunities, do not stop here. Use the Simply Wall St Screener to uncover more ideas that fit your style.

- Target reliable cash returns by checking out these 14 dividend stocks with yields > 3% that might suit an income focused approach.

- Spot potential mispricings early by scanning these 875 undervalued stocks based on cash flows that could offer a more attractive entry point.

- Ride powerful tech shifts by reviewing these 25 AI penny stocks that are tied directly to real business models and cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal