3 European Stocks Estimated To Be Trading Below Intrinsic Value In January 2026

As the European markets continue to thrive, with the STOXX Europe 600 Index reaching new highs and closing 2025 with impressive gains, investors are increasingly looking for opportunities within this robust economic environment. In such a context, identifying stocks that may be trading below their intrinsic value can provide potential avenues for growth, particularly when these stocks are supported by strong fundamentals and positive market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK18.50 | SEK36.62 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €73.00 | €142.93 | 48.9% |

| Recupero Etico Sostenibile (BIT:RES) | €6.56 | €12.99 | 49.5% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1647.82 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.30 | NOK66.22 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK384.00 | NOK751.23 | 48.9% |

| Gesco (XTRA:GSC1) | €14.30 | €27.86 | 48.7% |

| Fodelia Oyj (HLSE:FODELIA) | €5.44 | €10.72 | 49.3% |

| Benefit Systems (WSE:BFT) | PLN3590.00 | PLN7095.77 | 49.4% |

| Allcore (BIT:CORE) | €1.36 | €2.66 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

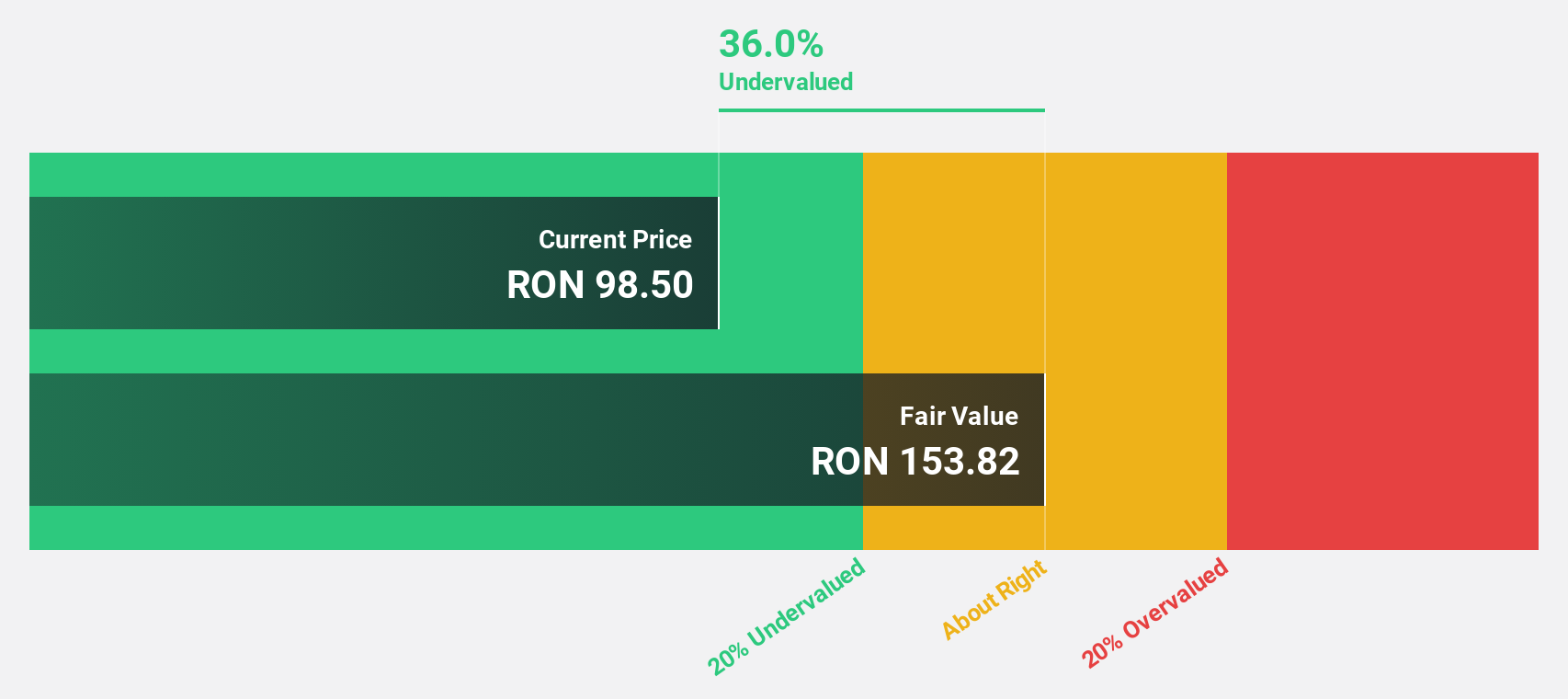

Digi Communications (BVB:DIGI)

Overview: Digi Communications N.V. offers telecommunication services including cable TV, internet, and mobile telephony in Romania, Spain, and Italy with a market cap of RON10.51 billion.

Operations: The company's revenue primarily comes from wireless communications services, totaling €2.21 billion.

Estimated Discount To Fair Value: 31.8%

Digi Communications is trading at RON110.2, significantly below its estimated fair value of RON161.47, indicating potential undervaluation based on cash flows. Despite a low return on equity forecast of 6% in three years and declining profit margins from 18.4% to 2%, earnings are expected to grow substantially by 25% annually, outpacing the regional market's growth rate. Recent earnings reports show increased sales but a sharp drop in net income year-over-year.

- According our earnings growth report, there's an indication that Digi Communications might be ready to expand.

- Unlock comprehensive insights into our analysis of Digi Communications stock in this financial health report.

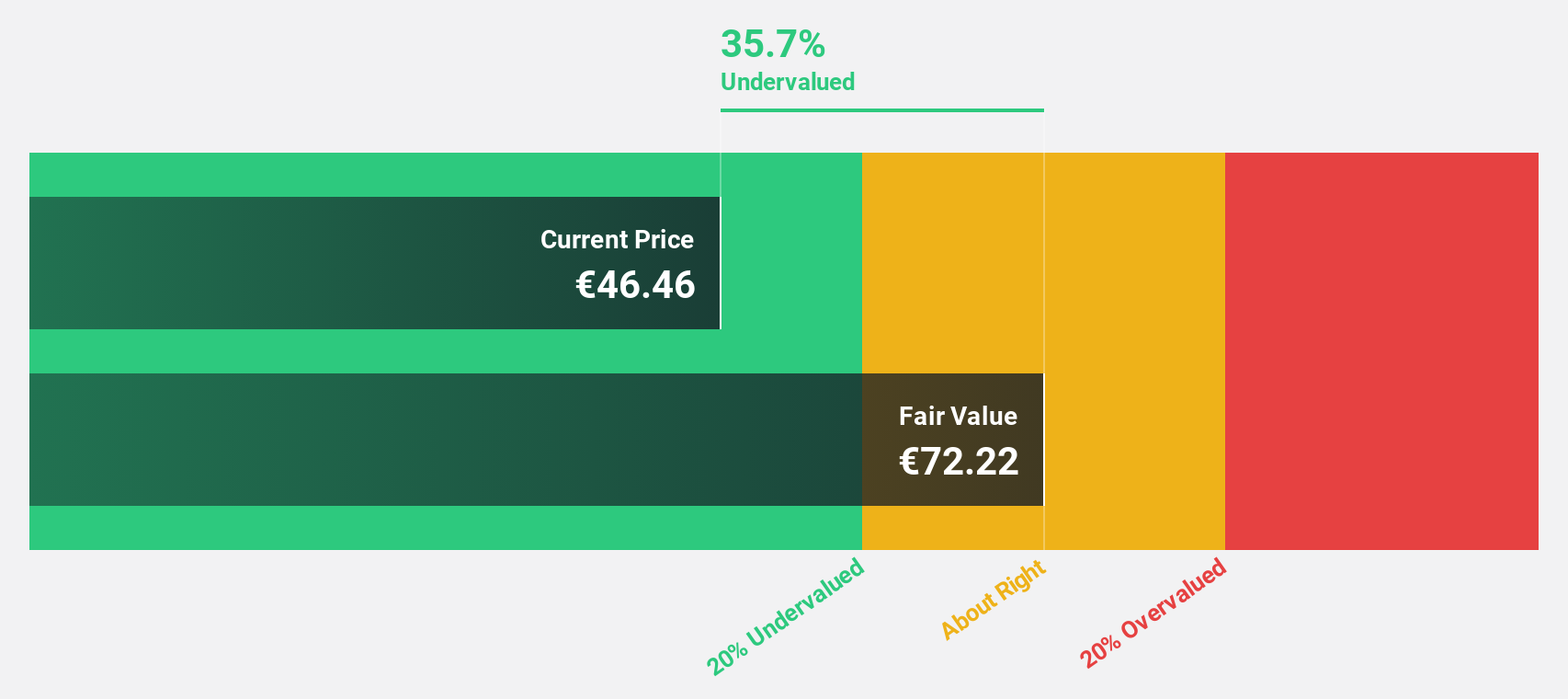

SPIE (ENXTPA:SPIE)

Overview: SPIE SA is a company that offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally with a market cap of €8.27 billion.

Operations: The company generates revenue from various segments, including €3.46 billion from Germany, €775.20 million from Central Europe, €2.09 billion from North-Western Europe, and €483.40 million from Global Services Energy.

Estimated Discount To Fair Value: 41.2%

SPIE, trading at €49.2, is significantly undervalued compared to its estimated fair value of €83.65, highlighting potential based on cash flows. While the company faces high debt levels and slower revenue growth than the French market, earnings are projected to grow at a robust 20.1% annually over the next three years. The recent European framework agreement with Tesla for battery energy storage systems may further enhance SPIE's strategic positioning in energy transition projects across Europe.

- Our expertly prepared growth report on SPIE implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on SPIE's balance sheet by reading our health report here.

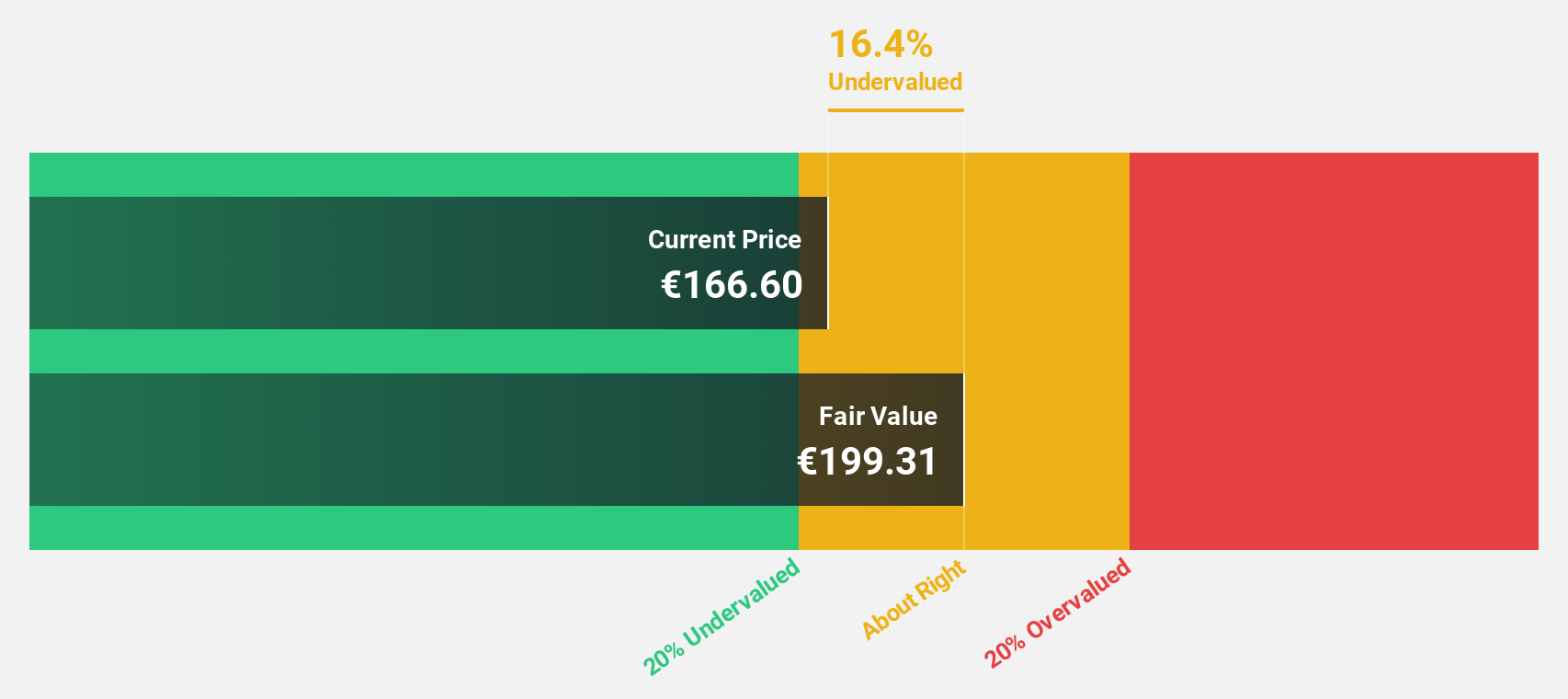

AlzChem Group (XTRA:ACT)

Overview: AlzChem Group AG, with a market cap of €1.59 billion, develops, produces, and markets a variety of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, which accounts for €370.59 million, and its Basics & Intermediates segment, contributing €163.48 million.

Estimated Discount To Fair Value: 32.7%

AlzChem Group, trading at €157.4, is highly undervalued with an estimated fair value of €233.94, suggesting strong potential based on cash flows. The company recently announced a significant investment of €120 million in automated production facilities to bolster its market position in sports and health sectors, aiming for substantial sales growth. Despite high share price volatility, AlzChem's earnings are projected to grow 19.8% annually, outpacing the German market's average growth rate.

- In light of our recent growth report, it seems possible that AlzChem Group's financial performance will exceed current levels.

- Navigate through the intricacies of AlzChem Group with our comprehensive financial health report here.

Make It Happen

- Gain an insight into the universe of 197 Undervalued European Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal