Top European Dividend Stocks To Watch In January 2026

As the pan-European STOXX Europe 600 Index reaches a new high, buoyed by an improving economic backdrop and closing 2025 with its strongest annual performance since 2021, investors are increasingly turning their attention to dividend stocks as a potential source of stable income. In this environment of growth and optimism, identifying robust dividend stocks can provide a reliable stream of income while benefiting from Europe's positive market momentum.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.38% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.79% | ★★★★★★ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.38% | ★★★★★☆ |

Click here to see the full list of 192 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

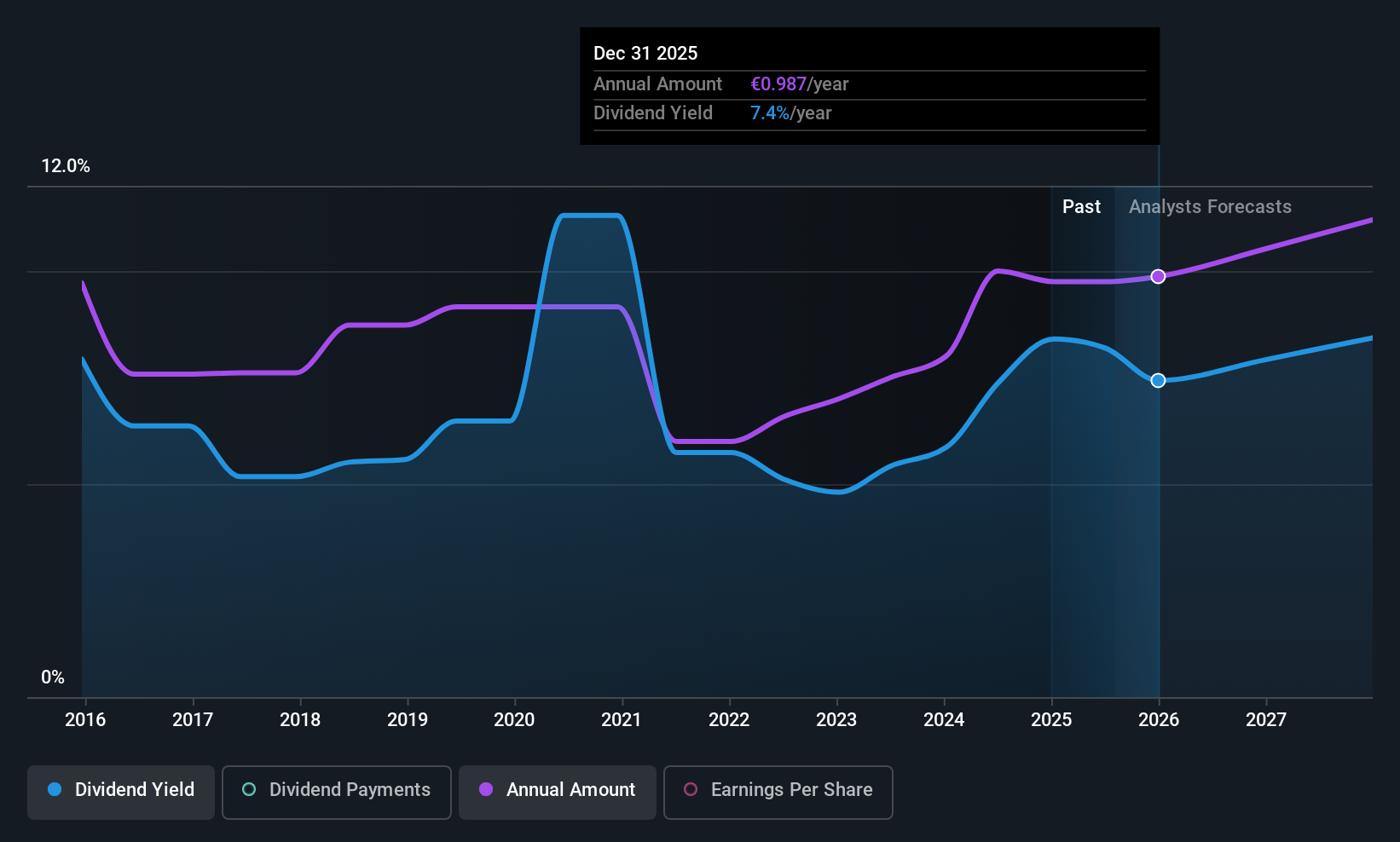

Repsol (BME:REP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Repsol, S.A. is a multi-energy company operating in Spain, Peru, the United States, Portugal, and internationally with a market cap of €18.52 billion.

Operations: Repsol, S.A. generates revenue through its key segments: Customer (€26.49 billion), Upstream (€4.78 billion), Industrial (€41.29 billion), and Low Carbon Generation (€904 million).

Dividend Yield: 6.1%

Repsol's dividend yield of 6.09% places it in the top quartile among Spanish dividend payers, yet its sustainability is questionable due to a high payout ratio of 107.3%, indicating dividends are not fully covered by earnings. However, cash flows do support the dividends with a reasonable cash payout ratio of 62.1%. Despite recent volatility and unreliability in dividend payments, Repsol's focus on renewable fuels could enhance long-term prospects for income investors interested in energy transitions.

- Unlock comprehensive insights into our analysis of Repsol stock in this dividend report.

- Upon reviewing our latest valuation report, Repsol's share price might be too pessimistic.

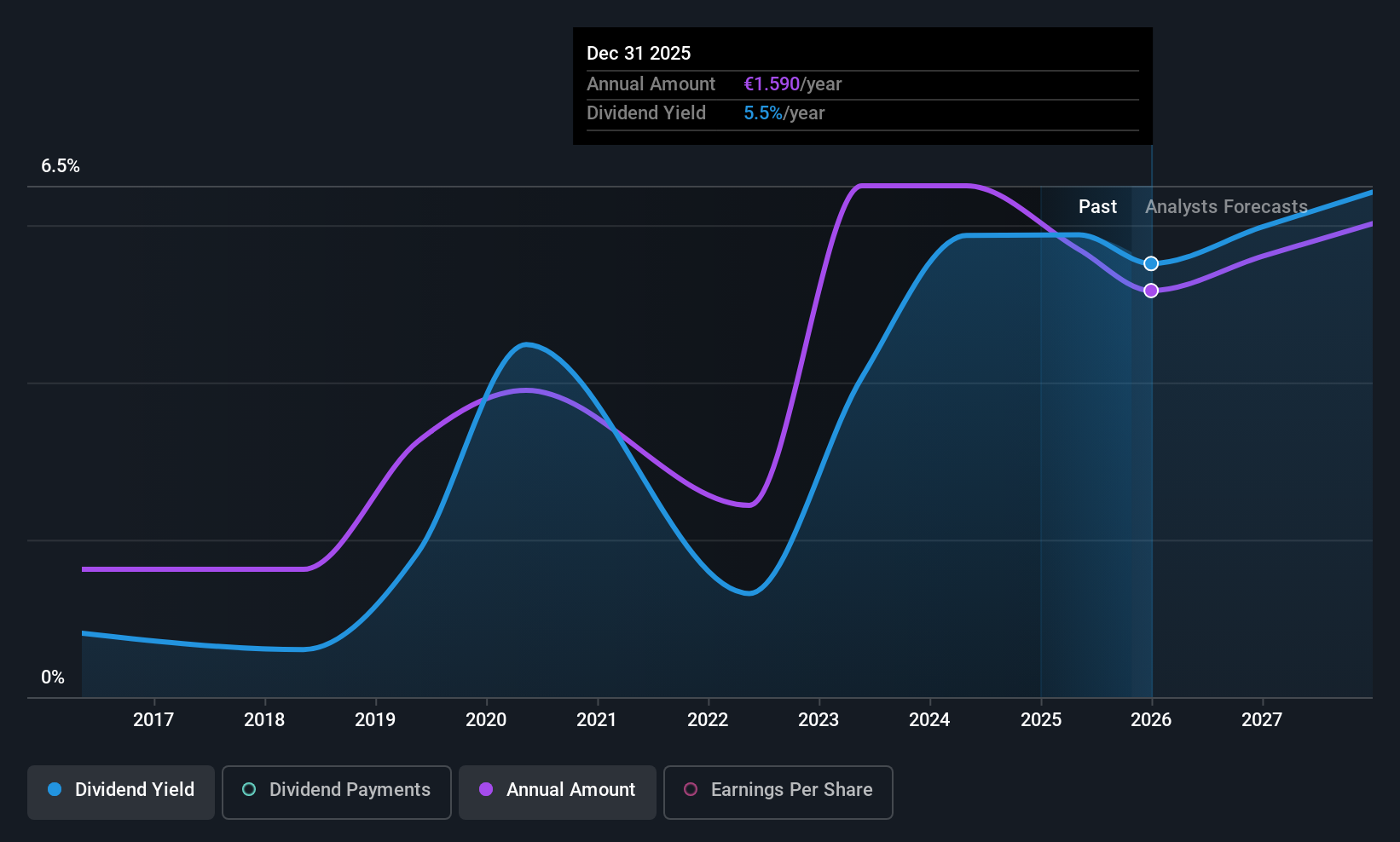

SBO (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBO AG is a global manufacturer and seller of steel products with a market cap of €447.57 million.

Operations: SBO AG generates its revenue through two main segments: Energy Equipment, which accounts for €309.79 million, and Precision Technology, contributing €282.44 million.

Dividend Yield: 6.2%

SBO's dividend yield of 6.16% ranks it in the top quartile of Austrian dividend payers, yet its history shows volatility and unreliability over the past decade. Despite a high payout ratio of 84.8%, dividends are supported by cash flows with a reasonable cash payout ratio of 52.4%. Recent earnings reports indicate declining sales and net income, which may impact future payouts, although analysts anticipate significant stock price growth potential at current valuations.

- Delve into the full analysis dividend report here for a deeper understanding of SBO.

- Our expertly prepared valuation report SBO implies its share price may be lower than expected.

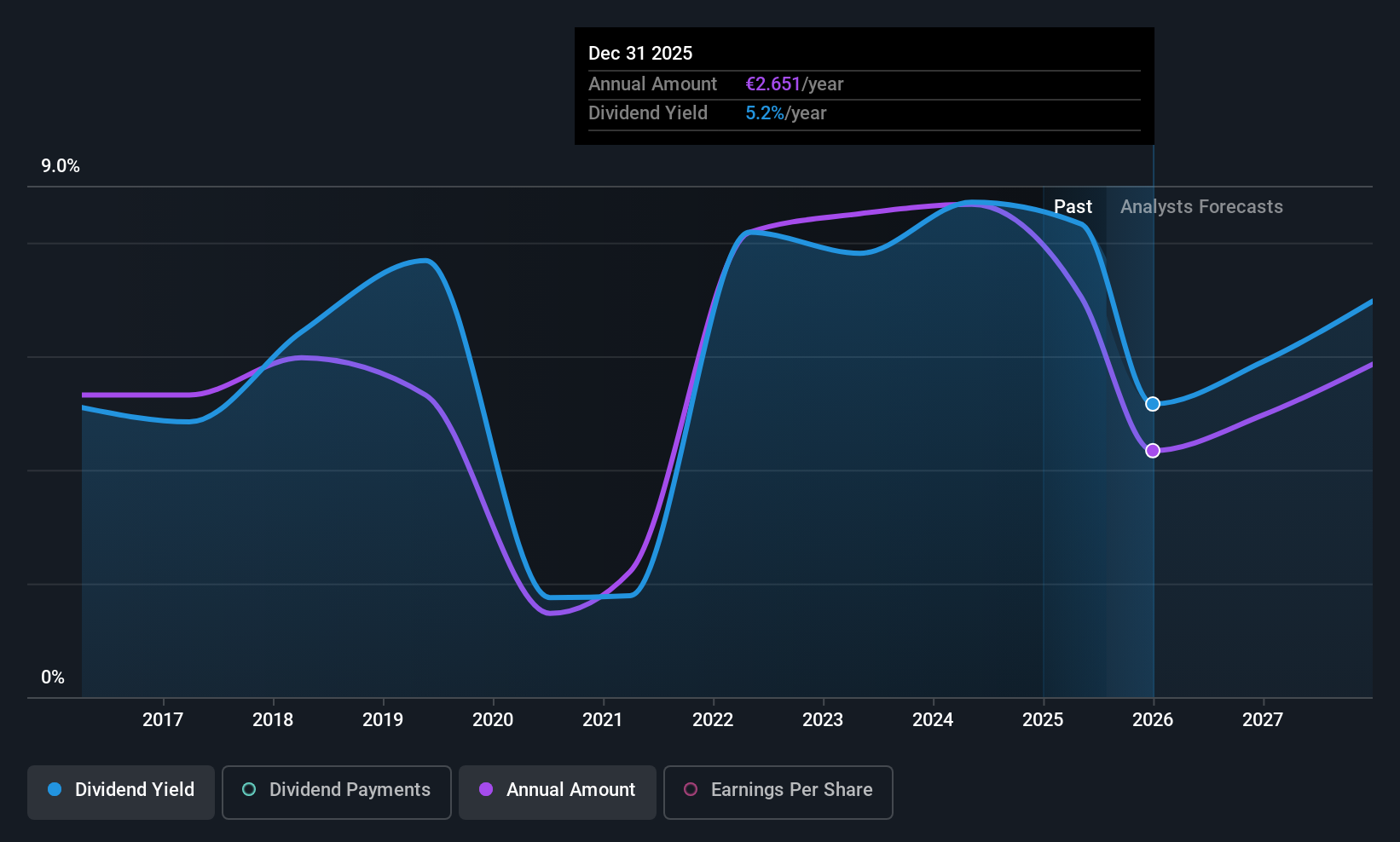

Mercedes-Benz Group (XTRA:MBG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG is a global automotive company based in Germany, with operations spanning internationally and a market capitalization of approximately €59.31 billion.

Operations: Mercedes-Benz Group AG generates revenue primarily from three segments: Mercedes-Benz Cars with €101.42 billion, Mercedes-Benz Vans with €17.36 billion, and Mercedes-Benz Mobility contributing €24.35 billion.

Dividend Yield: 6.9%

Mercedes-Benz Group's dividend yield of 6.94% places it among the top 25% in Germany, with payments increasing over the past decade despite volatility and an unstable track record. The company's dividends are well-covered by earnings and cash flows, boasting a payout ratio of 66.3% and a cash payout ratio of 34.4%. Recent earnings reports show declining sales and net income, which could affect future payouts amid high debt levels and new executive appointments aimed at strategic execution.

- Click here to discover the nuances of Mercedes-Benz Group with our detailed analytical dividend report.

- Our valuation report here indicates Mercedes-Benz Group may be undervalued.

Summing It All Up

- Gain an insight into the universe of 192 Top European Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal