Assessing Trade Desk (TTD) Valuation After Recent Share Price Weakness

Why Trade Desk is on investors’ radar today

Trade Desk (TTD) has drawn attention after recent share price moves, with the stock now trading around $37.68. Investors are weighing this level against the company’s current fundamentals and its longer-term return history.

See our latest analysis for Trade Desk.

Recent trading has been choppy, with a 1 day share price return of 0.74% decline and a 90 day share price return of 29.56% decline. The 1 year total shareholder return of 70.23% decline suggests momentum has been fading over a longer horizon.

If you are comparing Trade Desk with other ad tech names, it can help to widen the lens and look across high growth tech and AI peers through high growth tech and AI stocks.

With Trade Desk posting annual revenue of about US$2.8b and net income of roughly US$438.6m, yet sitting on sharp recent share price declines, you have to ask: is this a reset worth considering, or is future growth already priced in?

Most Popular Narrative Narrative: 39.6% Undervalued

Compared with Trade Desk’s last close at US$37.68, the most followed narrative points to a much higher fair value, built on specific growth and margin assumptions.

The analysts have a consensus price target of $75.394 for Trade Desk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $34.0.

Curious what earnings and revenue path could support that higher value, and what kind of profit multiple it relies on by 2028? The narrative sets out a detailed mix of growth, margin expansion and future valuation that you may want to see in full.

Result: Fair Value of $62.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture could change quickly if large global advertisers cut budgets, or if walled gardens and retail media platforms absorb more digital ad spend than expected.

Find out about the key risks to this Trade Desk narrative.

Another angle on valuation

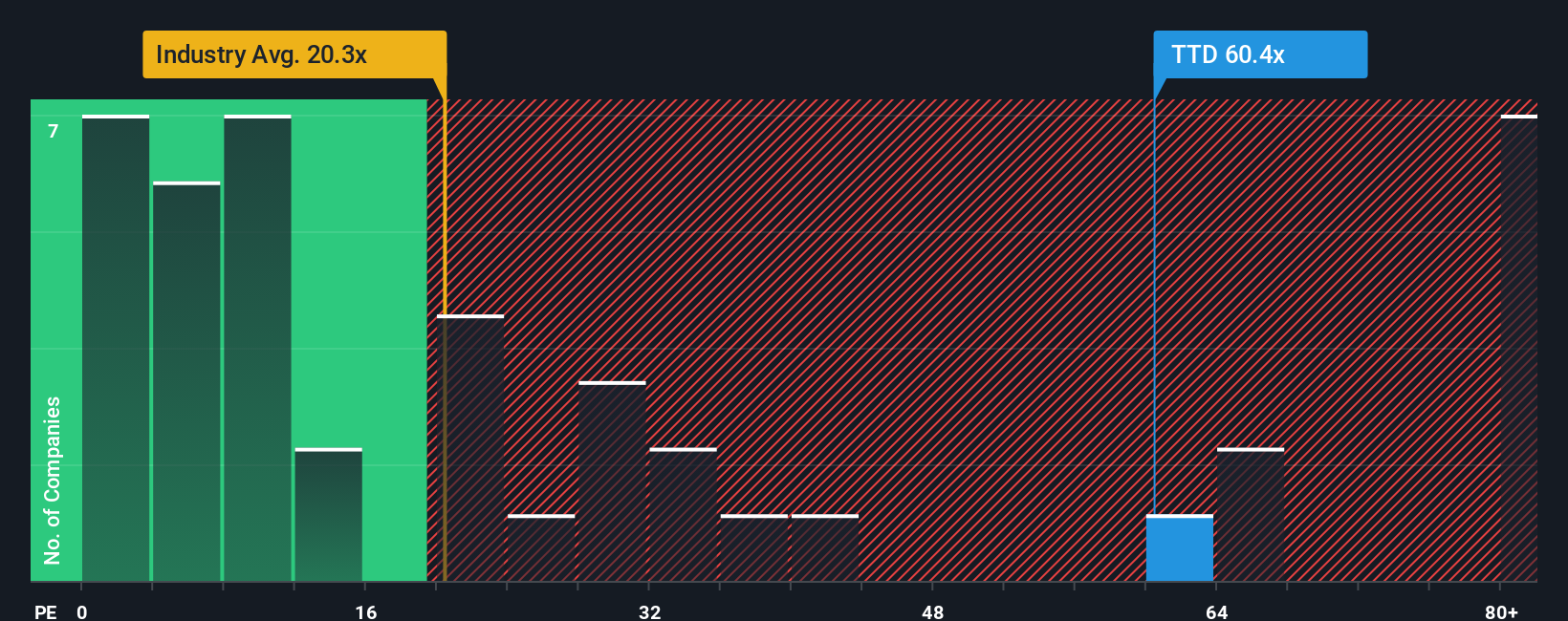

The narrative suggests Trade Desk looks undervalued, yet its current P/E of 41.5x is well above the US Media industry at 13.8x, the peer average at 39.7x, and even our fair ratio of 27.8x. That premium raises a simple question: how much optimism are you comfortable paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trade Desk Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a custom view of Trade Desk in a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Trade Desk.

Looking for more investment ideas?

If Trade Desk has sharpened your thinking, do not stop here. Use the screener tools to spot other opportunities that could fit your plan just as well.

- Target potential mispricing by scanning these 875 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Ride the wave of digital transformation by checking out these 25 AI penny stocks positioned around artificial intelligence themes.

- Add income angles to your watchlist by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal