Take Care Before Diving Into The Deep End On Austevoll Seafood ASA (OB:AUSS)

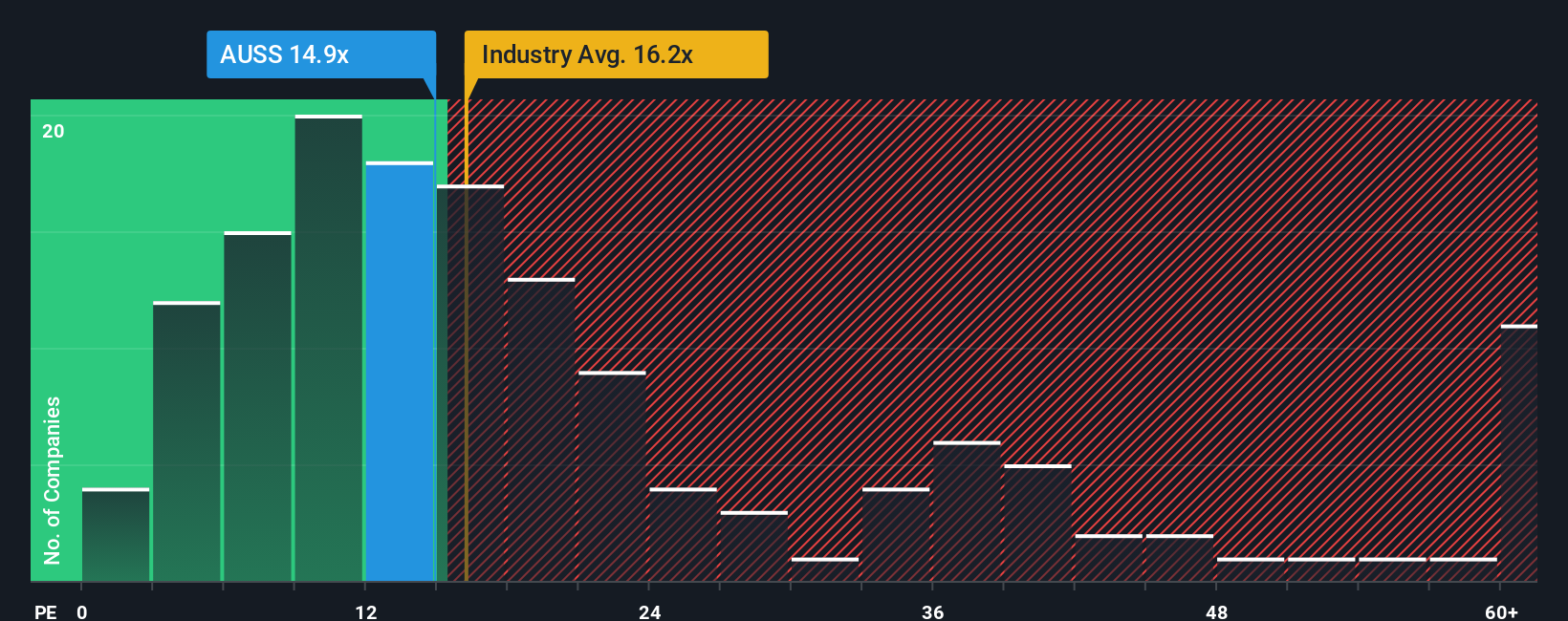

With a median price-to-earnings (or "P/E") ratio of close to 15x in Norway, you could be forgiven for feeling indifferent about Austevoll Seafood ASA's (OB:AUSS) P/E ratio of 14.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Austevoll Seafood hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Austevoll Seafood

How Is Austevoll Seafood's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Austevoll Seafood's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. The last three years don't look nice either as the company has shrunk EPS by 51% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 60% during the coming year according to the five analysts following the company. With the market only predicted to deliver 28%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Austevoll Seafood's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Austevoll Seafood currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Austevoll Seafood.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal