High Growth Tech Stocks in Asia with Promising Potential

As global markets navigate a complex landscape, Asian tech stocks have been drawing attention with their potential for high growth amid evolving economic conditions. In this dynamic environment, identifying promising tech stocks involves looking for companies that demonstrate innovation and adaptability in response to changing market demands and technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Fositek | 37.11% | 51.61% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

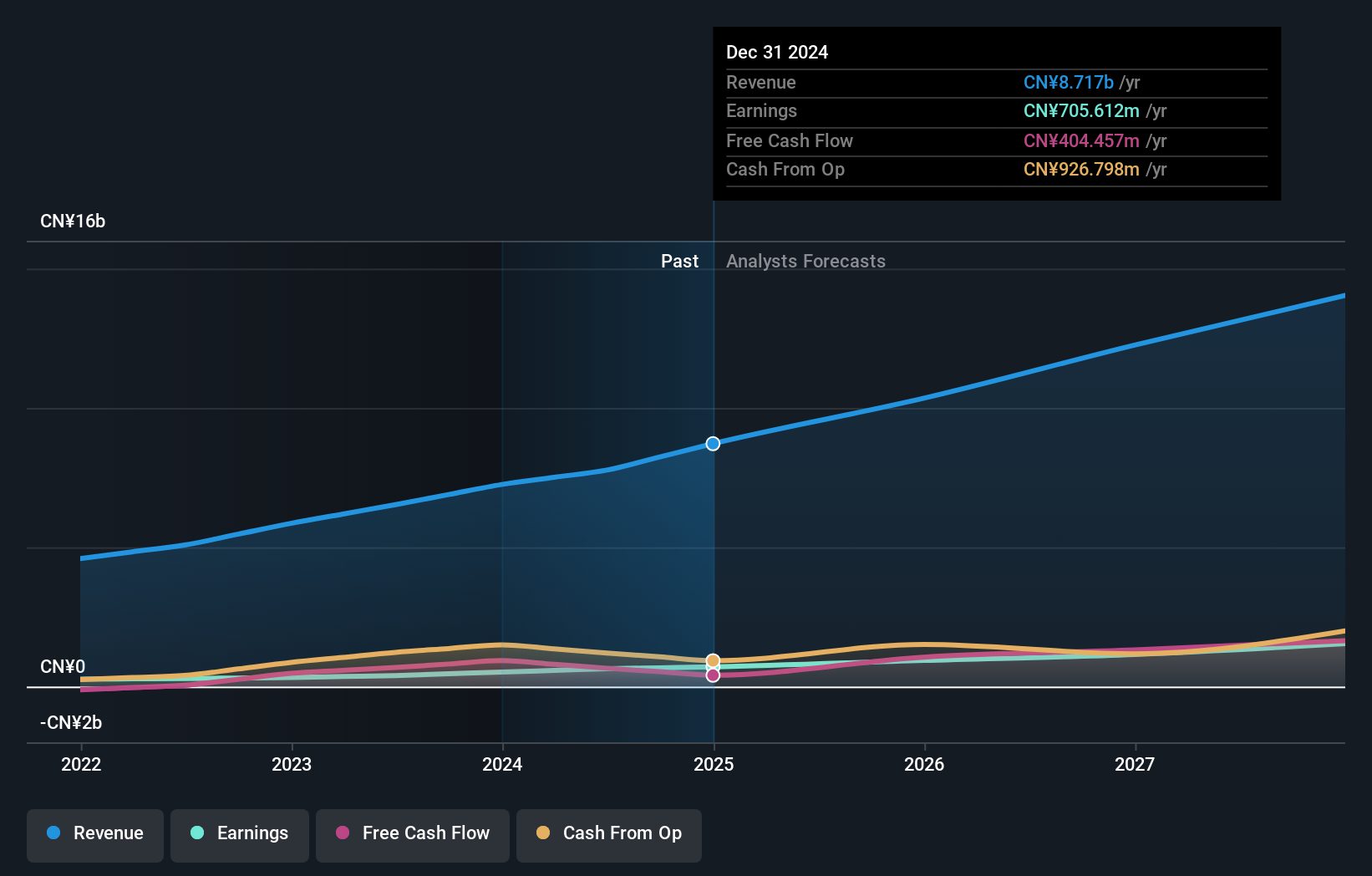

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for the energy supply industries, with a market capitalization of approximately HK$17.91 billion.

Operations: The company generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥3.65 billion), Advanced Distribution Operations (CN¥2.98 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.88 billion). These segments reflect its focus on providing comprehensive solutions in energy metering and efficiency management for the energy supply industries.

Wasion Holdings, with its recent contract win for the CPFL project in Brazil valued over RMB 80 million, underscores its expanding global footprint and brand recognition. This achievement comes as the company's earnings are projected to surge by an impressive 24.9% annually, outpacing the Hong Kong market's average of 11.9%. Additionally, Wasion has maintained a robust annual revenue growth rate of 20%, significantly above the local market trend of 8.3%. These figures not only reflect Wasion’s strong operational execution but also highlight its strategic positioning within the high-growth sectors of electronic instrumentation and energy solutions in emerging markets.

- Click here to discover the nuances of Wasion Holdings with our detailed analytical health report.

Explore historical data to track Wasion Holdings' performance over time in our Past section.

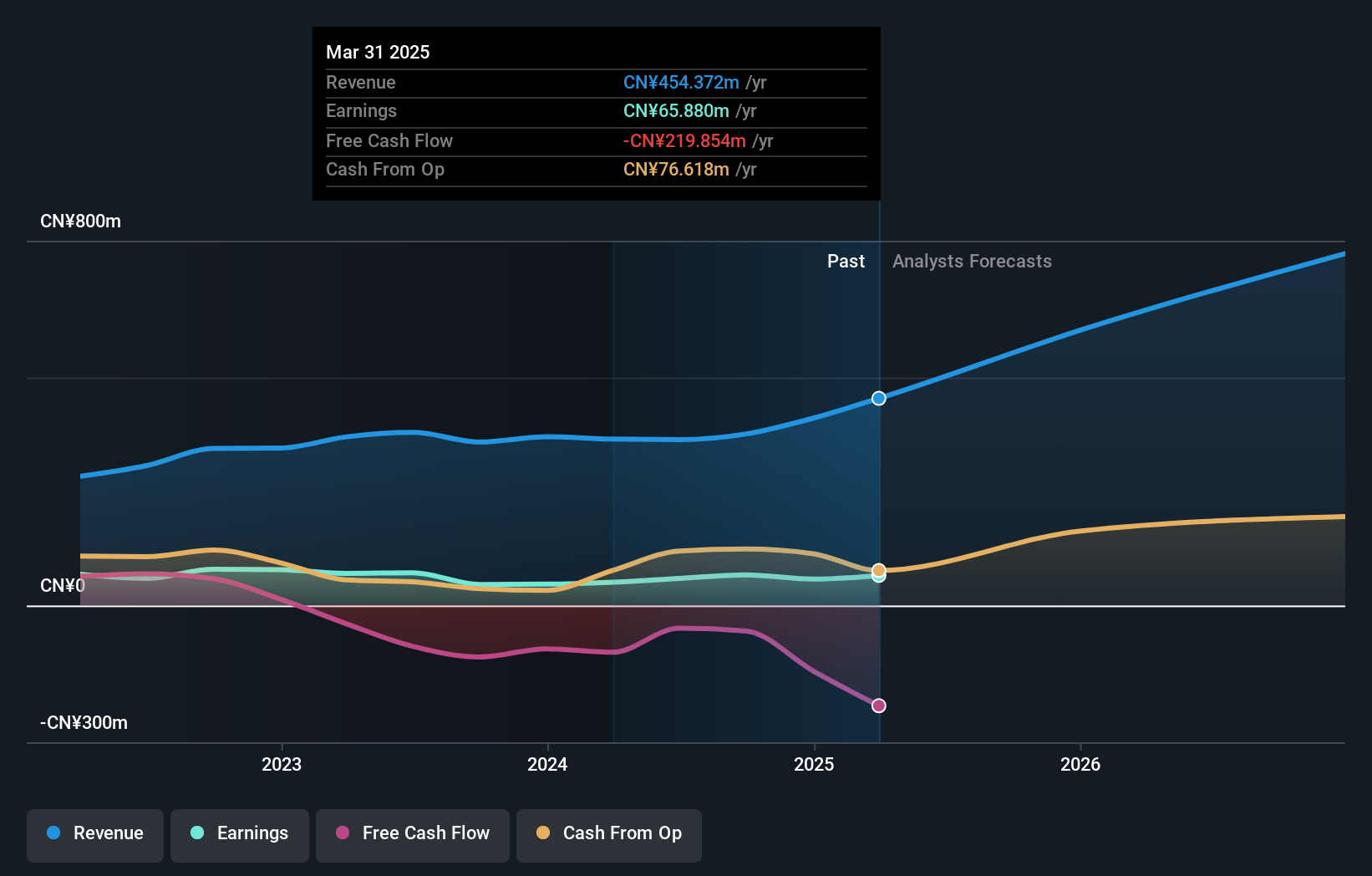

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cai Qin Technology Co., Ltd is involved in the research, development, production, and sale of microwave dielectric ceramic components both in China and internationally, with a market cap of CN¥11.81 billion.

Operations: The company generates revenue primarily from the communication equipment manufacturing segment, amounting to CN¥632.79 million.

Jiangsu Cai Qin Technology has demonstrated a robust financial performance, with revenue soaring to CNY 490.95 million from CNY 269.06 million year-over-year, and net income climbing to CNY 86.24 million from CNY 50.04 million in the same period. This growth trajectory is underscored by an annualized revenue increase of 35.8% and earnings growth of 39.7%, significantly outpacing the broader Chinese market's averages of 14.5% and 27.5%, respectively. The firm’s aggressive expansion is further evidenced by its recent special shareholders meeting, signaling strategic maneuvers that could influence its market position in high-tech sectors across Asia.

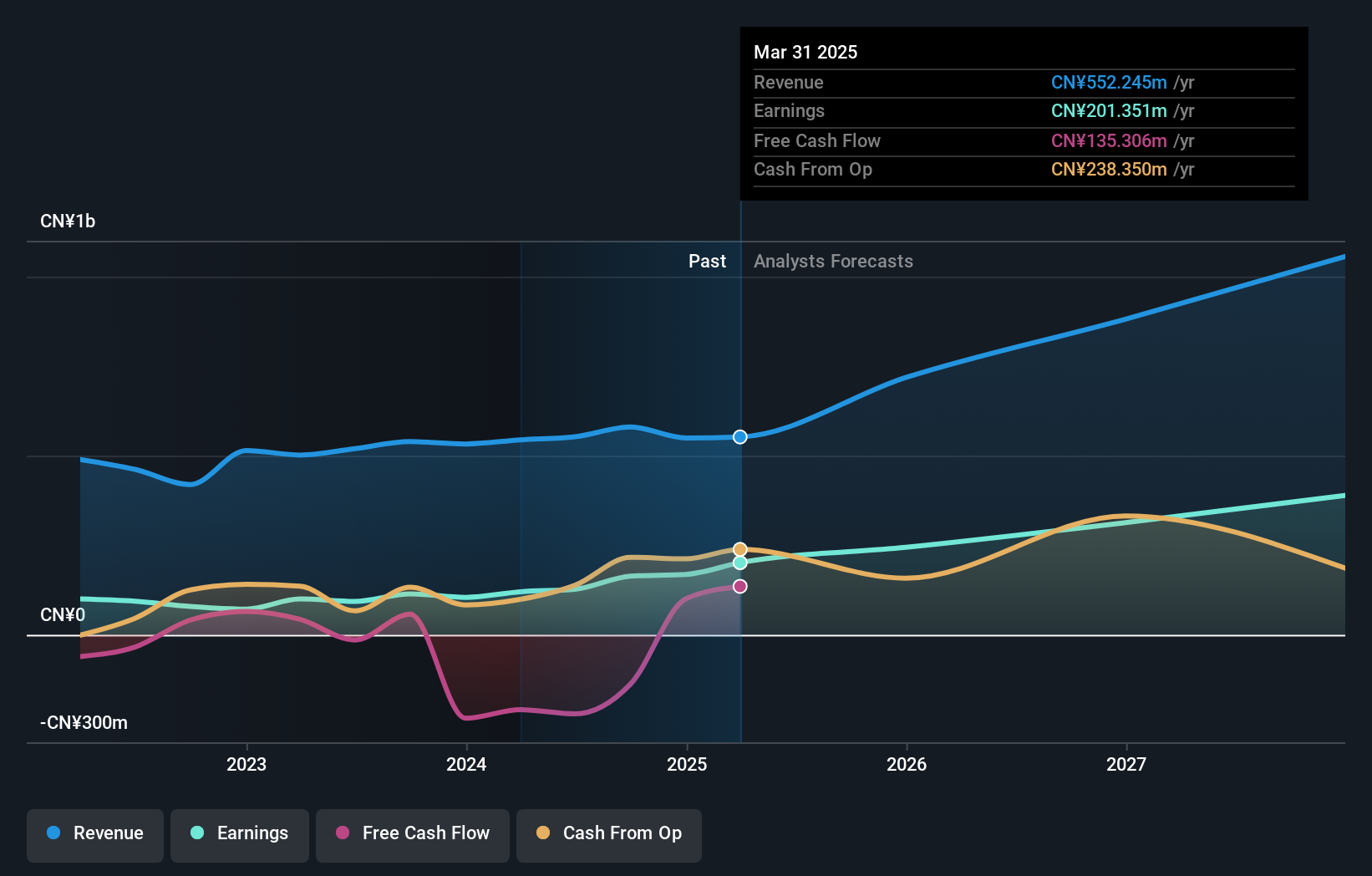

Guomai Technologies (SZSE:002093)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guomai Technologies, Inc. provides a range of services including internet of things technology, consulting and design, science park operation and development, as well as education services in China with a market capitalization of CN¥11.52 billion.

Operations: Guomai Technologies focuses on providing internet of things (IoT) services, consulting and design, science park operations, and education services in China. The company's revenue streams are primarily derived from its IoT technology and related services.

With a robust earnings growth of 25.8% per annum and revenue acceleration at 24.9% annually, Guomai Technologies is carving out a significant niche in the high-tech landscape of Asia. The company's commitment to innovation is evident from its R&D spending, which has been strategically increasing to fuel advancements and maintain competitive edge in the market. Recently, Guomai reported a notable increase in net income to CNY 195.96 million from CNY 148.11 million year-over-year, reflecting not only growth but also operational efficiency and market responsiveness. This performance underscores its potential amidst a rapidly evolving technology sector where strategic investments like these are crucial for long-term sustainability and leadership.

- Take a closer look at Guomai Technologies' potential here in our health report.

Gain insights into Guomai Technologies' past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 188 Asian High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal