Asian Growth Stocks Insiders Are Banking On January 2026

As we enter 2026, Asian markets are navigating a complex landscape with China's manufacturing sector showing signs of recovery and South Korea's export-driven economy continuing to thrive. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as insiders often have a deep understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| WinWay Technology (TWSE:6515) | 21.7% | 30.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩1.91 trillion.

Operations: The company's revenue primarily comes from semiconductor equipment, generating ₩349.63 billion, with an additional contribution of ₩15.30 billion from industrial gases for semiconductors.

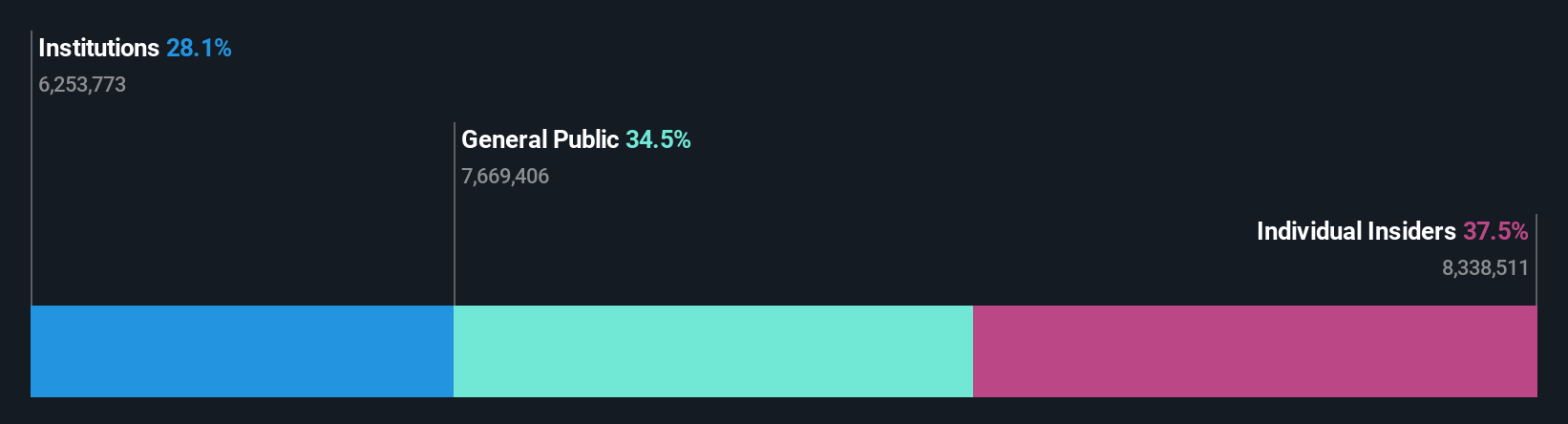

Insider Ownership: 37.5%

Revenue Growth Forecast: 26% p.a.

Eugene Technology Ltd. is experiencing significant growth, with earnings projected to increase over 36% annually in the next three years, outpacing the Korean market. Despite recent volatility in share price and a decline in net income for Q3 2025, revenue has surged to KRW 901.31 million from KRW 532.26 million year-on-year. However, its Return on Equity remains forecasted at a modest level of under 20%, indicating potential areas for improvement amidst robust insider ownership dynamics.

- Delve into the full analysis future growth report here for a deeper understanding of Eugene TechnologyLtd.

- In light of our recent valuation report, it seems possible that Eugene TechnologyLtd is trading beyond its estimated value.

Korea Circuit (KOSE:A007810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Korea Circuit Co., Ltd. specializes in the production and sale of printed circuit boards globally, with a market capitalization of approximately ₩1.18 trillion.

Operations: Korea Circuit Co., Ltd. generates its revenue primarily through the global production and sale of printed circuit boards.

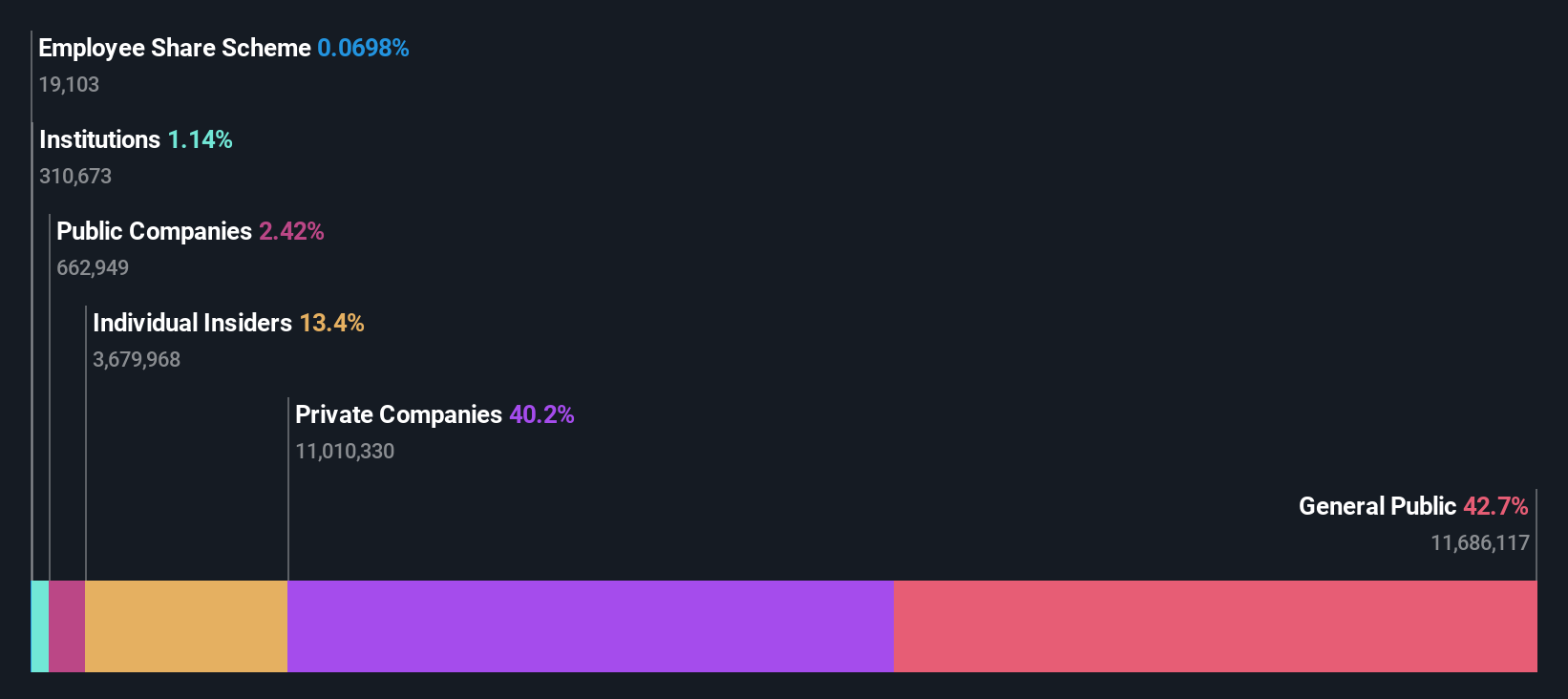

Insider Ownership: 12.6%

Revenue Growth Forecast: 11.6% p.a.

Korea Circuit is projected to see its earnings grow by 81.6% annually over the next three years, surpassing market averages and expected to achieve profitability within this period. Despite a highly volatile share price recently, revenue growth of 11.6% per year is anticipated to outpace the Korean market slightly. However, Return on Equity remains low at a forecasted 17.3%, suggesting room for improvement in efficiency despite substantial insider ownership dynamics supporting long-term growth prospects.

- Click here to discover the nuances of Korea Circuit with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Korea Circuit's share price might be too optimistic.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company focused on developing AI-powered photo, video, and design products for users in Mainland China and internationally, with a market cap of approximately HK$33.93 billion.

Operations: Meitu's revenue primarily comes from its Internet Business segment, generating approximately CN¥3.54 billion.

Insider Ownership: 22.7%

Revenue Growth Forecast: 20.3% p.a.

Meitu's earnings have surged by 97.9% over the past year, with future growth expected to significantly outpace the Hong Kong market at 21.6% annually. Revenue is also projected to grow rapidly at 20.3% per year, exceeding market averages. Despite trading at a substantial discount of nearly half its estimated fair value, Meitu's Return on Equity is forecasted to remain low in three years, and recent financial results were affected by large one-off items impacting quality perceptions.

- Click here and access our complete growth analysis report to understand the dynamics of Meitu.

- Our valuation report here indicates Meitu may be undervalued.

Make It Happen

- Click through to start exploring the rest of the 632 Fast Growing Asian Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal