Qorvo (QRVO) Valuation Check After Recent Pullback and Merger-Driven Upside Expectations

Qorvo (QRVO) has quietly outperformed over the past year, even as the stock has slipped in the past month and past 3 months, which sets up an interesting risk reward backdrop.

See our latest analysis for Qorvo.

With the share price now at $86.27, Qorvo’s recent pullback contrasts with a much stronger 1 year total shareholder return of 22.14 percent. This suggests momentum is cooling even as the longer term recovery story remains intact.

If Qorvo’s mixed momentum has you reassessing your options, this could be a good moment to explore high growth tech and AI stocks for other potential semiconductor and tech opportunities.

With shares still below analyst targets but long term returns lagging, investors face a key question: is Qorvo trading at a genuine discount today, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 15.2% Undervalued

Against Qorvo's last close at $86.27, the most widely followed narrative sees a meaningfully higher fair value anchored in merger driven upside.

Analysts have nudged their Qorvo price target slightly higher to approximately $102 per share, citing improving long term revenue growth and margin assumptions. These are supported by expected cost and valuation synergies from the planned Skyworks merger, partially offset by ongoing handset and regulatory risks.

Want to see how much growth and margin expansion this story bakes in? The real twist is how future earnings power reshapes Qorvo's valuation path.

Result: Fair Value of $101.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a single major customer and execution risks around diversification efforts could quickly undermine the merger-driven upside investors are banking on.

Find out about the key risks to this Qorvo narrative.

Another View: Market Ratio Signals Caution

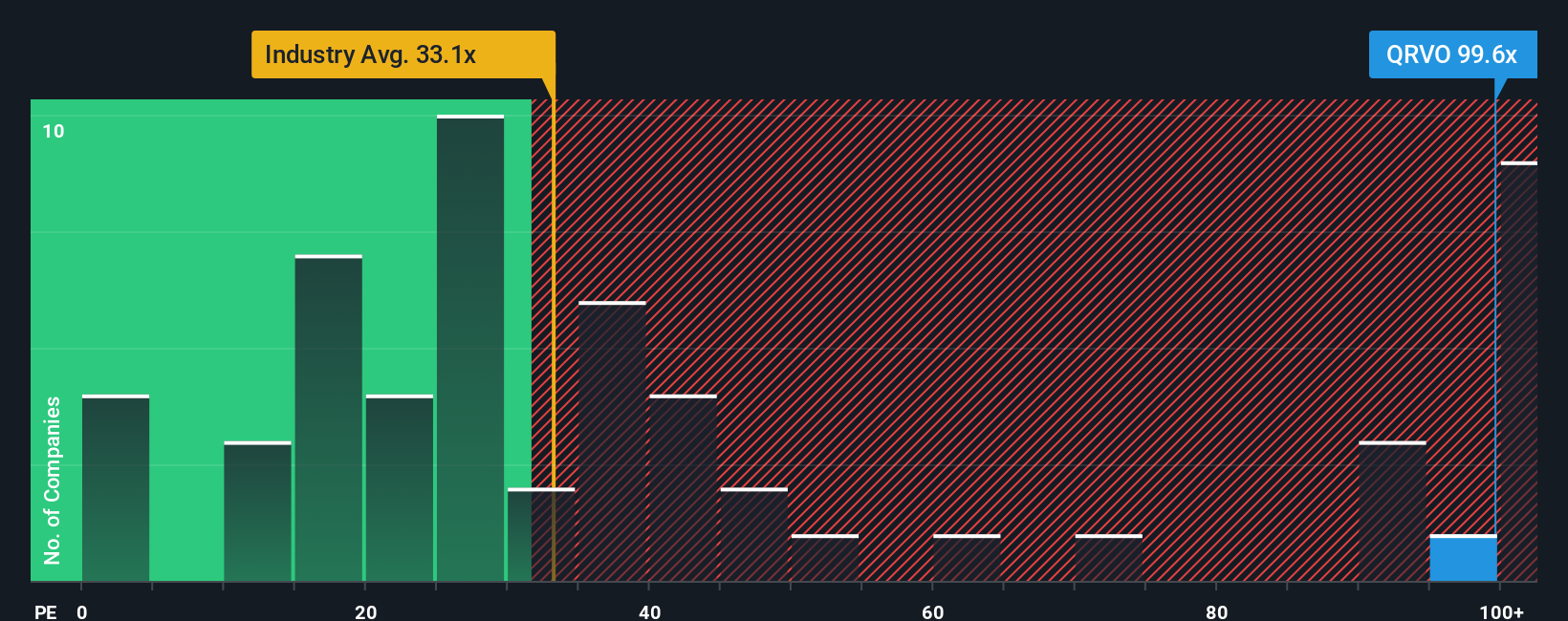

While the narrative fair value implies upside, Qorvo's current P/E of 36.6 times sits above its 29.3 times fair ratio and even above peer averages of 33 times, despite only matching the broader semiconductor sector at 37.3 times. That gap suggests less margin of safety if growth stumbles, so is this really a mispricing or just hope priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily craft a personalized narrative in minutes with Do it your way.

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider finding your next opportunity by using the Simply Wall St Screener to spot stocks that match your strategy and timing.

- Look for significant upside potential early by targeting these 3571 penny stocks with strong financials that already show financial strength instead of just speculative hype.

- Position your portfolio in the evolving area of intelligent automation by scanning these 25 AI penny stocks shaping everything from data centers to everyday consumer experiences.

- Focus on a margin of safety with these 875 undervalued stocks based on cash flows that our models flag as trading below their estimated intrinsic cash flow potential today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal