A Closer Look at BJ’s Wholesale Club (BJ) Valuation After Years of Steady Shareholder Returns

BJ's Wholesale Club Holdings (BJ) has quietly delivered steady gains over the past few years, and with annual revenue and net income both growing around mid single digits, investors are revisiting its long term potential.

See our latest analysis for BJ's Wholesale Club Holdings.

At around $91.92, BJ's one year total shareholder return of roughly 4.5 percent and five year total shareholder return above 140 percent suggest steady, if unspectacular, momentum as investors weigh resilient membership driven cash flows against a still reasonable valuation.

If BJ's measured gains have you thinking about what else could quietly compound in your portfolio, this is a good moment to explore fast growing stocks with high insider ownership.

With BJ's trading below analyst targets and our intrinsic estimates, yet already up strongly over five years, the key question now is simple: is there still a buying opportunity here, or has the market fully priced in its future growth?

Most Popular Narrative Narrative: 15.9% Undervalued

With BJ's last closing price at $91.92 against a narrative fair value near $109.26, the valuation case leans on resilient, recurring membership economics.

The stock is described as attractively priced and defensive, with a clear road map for mid single digit revenue growth and high single to low double digit EPS growth, which is cited as supporting upside to intrinsic value over the medium term.

Curious how steady club openings, rising digital baskets, and richer margins combine into that upside story? The narrative connects these levers in one tight valuation playbook.

Result: Fair Value of $109.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer general merchandise trends and potential margin pressure from tariffs and wage investments could quickly test how durable that upside story really is.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another View: Market Ratios Tell a Tighter Story

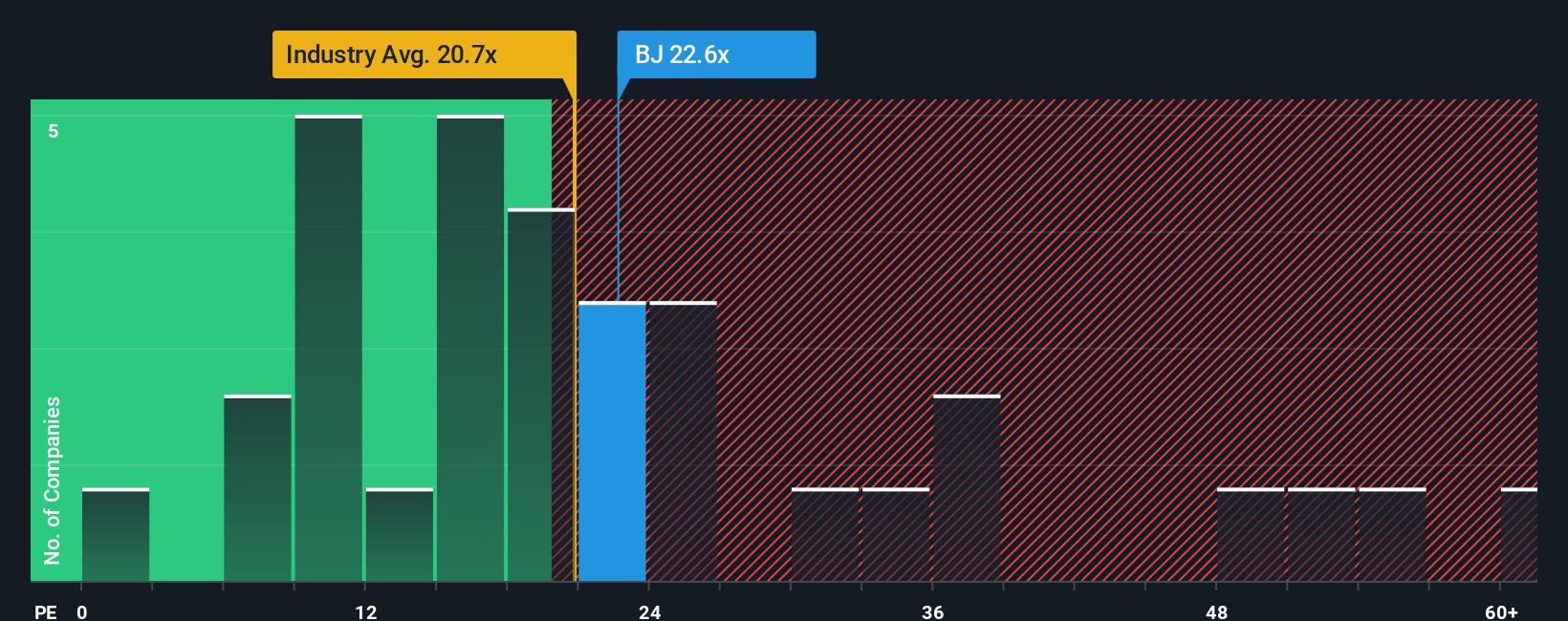

Our SWS fair ratio for BJ's points to a price to earnings of 19.2x, while the market currently pays about 20.9x, slightly richer than that fair ratio but still cheaper than the Consumer Retailing industry at 22.8x and close to peers around 21.2x. In practice, that means most of the valuation cushion comes from the narrative model rather than today’s earnings multiple. The key question is how much premium you are comfortable paying for those steady club economics.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If this perspective does not fully align with your own thinking, or you would rather test the numbers yourself, you can craft a custom narrative in just a few minutes, Do it your way.

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at BJ's when the market is full of overlooked opportunities. Use the Simply Wall St Screener to explore more potential investments.

- Find potential opportunities earlier by scanning these 3571 penny stocks with strong financials that already back their stories with improving fundamentals and disciplined balance sheets.

- Look for companies exposed to long-term trends by targeting these 25 AI penny stocks that could benefit as artificial intelligence changes how businesses operate and compete.

- Seek value-focused ideas by reviewing these 875 undervalued stocks based on cash flows where cash flow characteristics and price may still appear out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal