Cognex (CGNX) Valuation After Q3 Revenue Beat, EPS Guidance Cut and Subsequent Share Price Decline

Cognex (CGNX) has landed in the spotlight after its latest Q3 earnings, where revenue climbed 18% year on year and topped expectations, but weaker full year EPS guidance sent the stock sliding.

See our latest analysis for Cognex.

That earnings miss has clearly reset expectations, with a roughly 21% 3 month share price return decline to around $36.93, while the 1 year total shareholder return of about 3% shows only modest long term progress and suggests momentum has been fading rather than building.

If Cognex’s volatility has you rethinking your tech exposure, this could be a good moment to explore other innovative names through high growth tech and AI stocks.

With shares now trading at a sizeable discount to analyst targets but long term returns still lagging, is Cognex quietly undervalued after a guidance reset, or is the market already pricing in all the growth still ahead?

Most Popular Narrative Narrative: 24.1% Undervalued

With Cognex last closing at $36.93 against a narrative fair value near $48.65, the current price reflects a sizable valuation gap that hinges on execution.

Analysts expect earnings to reach $241.2 million (and earnings per share of $1.39) by about September 2028, up from $122.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $279.1 million in earnings, and the most bearish expecting $210 million.

Want to see how double digit growth, rising margins and a still rich earnings multiple all fit together in this story, and where assumptions really stretch?

Result: Fair Value of $48.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in commoditized hardware and a slower shift to higher margin AI software could easily derail today’s undervaluation narrative.

Find out about the key risks to this Cognex narrative.

Another View on Valuation

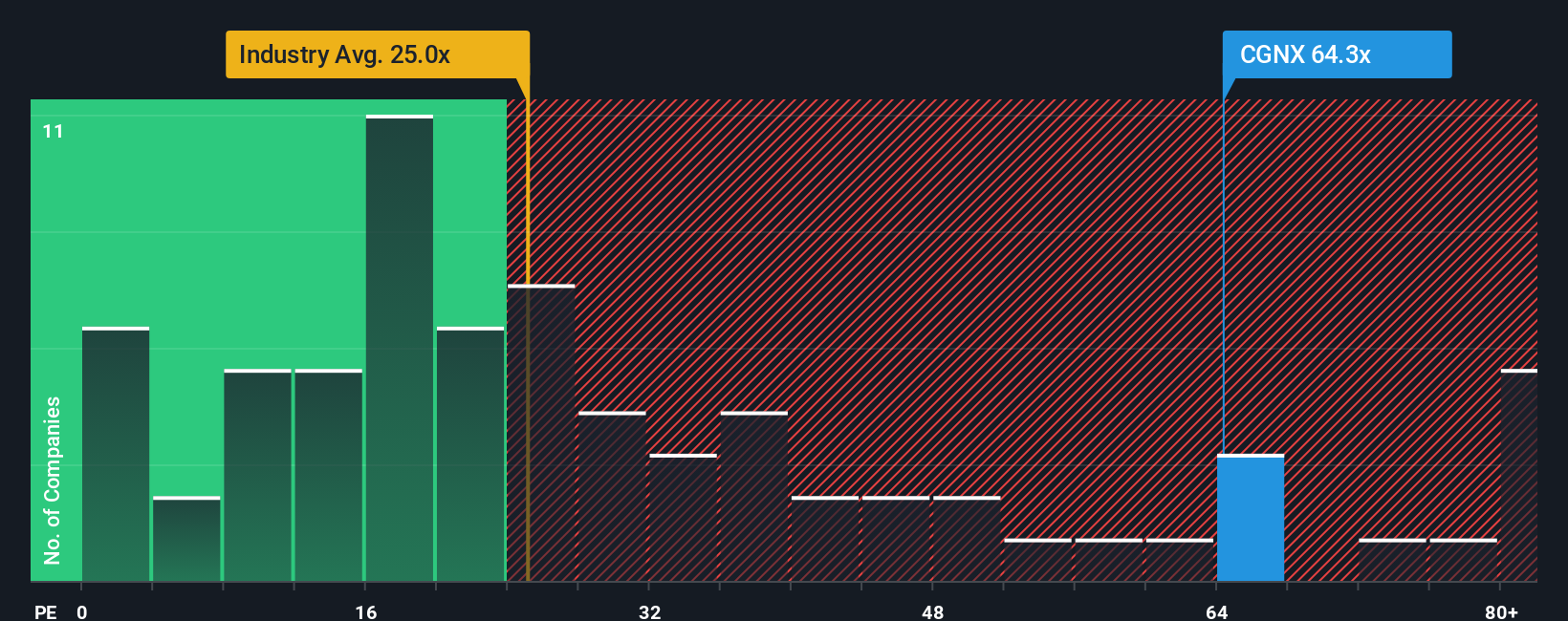

On earnings, the picture flips. Cognex trades on a rich 56.2x price to earnings ratio versus about 24.7x for the US Electronic industry and a fair ratio of roughly 33x, suggesting meaningful downside risk if sentiment turns and the market pushes that multiple closer to peers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cognex.

Looking for more investment ideas?

If you stop at Cognex, you risk missing compelling opportunities our screeners surface daily, so take a moment now to compare these alternative setups.

- Capture potential high risk or high reward setups by scanning these 3571 penny stocks with strong financials that already show improving fundamentals and balance sheet strength.

- Capitalize on the AI transformation by targeting these 25 AI penny stocks that pair cutting edge innovation with accelerating revenue traction.

- Lock in stronger income prospects by filtering for these 14 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal