Kinder Morgan (KMI): Revisiting Valuation as Major Pipeline Expansion and Western Gateway Progress Advance

Kinder Morgan (KMI) just gave investors another reason to revisit the stock, as shipper commitments on its Western Gateway Pipeline advance a broader 9.3 billion dollar expansion push supported by another 10 billion in potential projects.

See our latest analysis for Kinder Morgan.

Those Western Gateway commitments arrive as Kinder Morgan’s 1 year total shareholder return of 2.33 percent has barely moved the needle, even though the 3 year and 5 year total shareholder returns of 75.85 percent and 155.77 percent show that long term momentum is firmly intact.

If this kind of infrastructure story has your attention, it could be a good moment to widen your search and explore fast growing stocks with high insider ownership.

With a meaningful intrinsic discount, solid growth in earnings, and a double digit gap to analyst targets, Kinder Morgan looks underappreciated on the surface. The key question for investors is whether this represents a genuine buying opportunity or whether the market is already pricing in future expansion.

Most Popular Narrative Narrative: 10.8% Undervalued

With Kinder Morgan last closing at 27.71 dollars, the most widely followed narrative sees room for upside when compared with its implied fair value.

The surging U.S. LNG export market, with U.S. gas feed to export terminals projected to double by 2030 and Kinder Morgan already transporting about 40% of this feed gas, is likely to significantly increase future earnings, especially as additional U.S. capacity comes online and new contracts are signed.

Curious how steady revenue growth, rising margins, and a richer future earnings multiple all combine into that upside case? Want to see the full playbook behind this valuation call?

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high leverage and the risk of overbuilding key basins could squeeze returns if recontracting happens at lower rates than analysts currently expect.

Find out about the key risks to this Kinder Morgan narrative.

Another View: Multiples Tell a Different Story

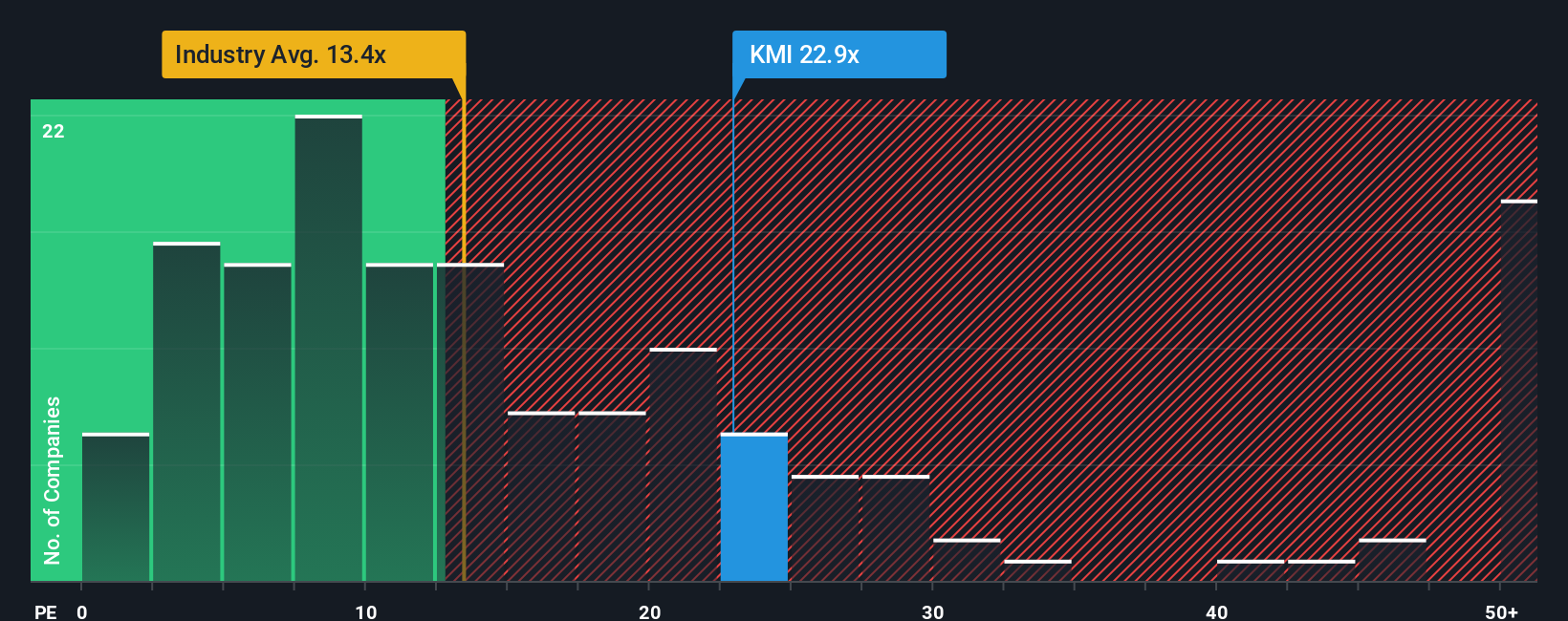

While narratives and fair value estimates suggest upside, Kinder Morgan’s 22.7x earnings multiple looks rich next to its 21x fair ratio, the 13.2x sector average, and 17x peers. That premium narrows the margin of safety, so how much optimism are you really paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you see things differently, or prefer to dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover focused stock ideas other investors might overlook.

- Target reliable income streams by hunting for companies in these 14 dividend stocks with yields > 3% that aim to keep paying you while markets move around them.

- Ride powerful secular trends by zeroing in on innovators behind these 25 AI penny stocks shaping the next wave of intelligent technology.

- Seize potential bargains early by scanning these 875 undervalued stocks based on cash flows where market prices may still lag behind underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal