Middle East Stocks And 2 Other Undiscovered Gems For Your Portfolio

As most Gulf markets have recently faced downturns due to weak oil prices and geopolitical uncertainties, investors are increasingly looking for resilient opportunities in the Middle East. In this environment, identifying stocks with strong fundamentals and potential for growth amidst economic diversification efforts can be key to building a robust portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Afcon Holdings (TASE:AFHL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Afcon Holdings Ltd, with a market cap of ₪1.93 billion, develops and executes construction projects both in Israel and internationally.

Operations: Afcon Holdings generates revenue through segments including Systems, EPC and Construction (₪787.25 million), Control and Technologies (₪465.89 million), Multimedia and Communication (₪312.68 million), Trade (₪194.67 million), and Renewable Energies (₪1.29 million).

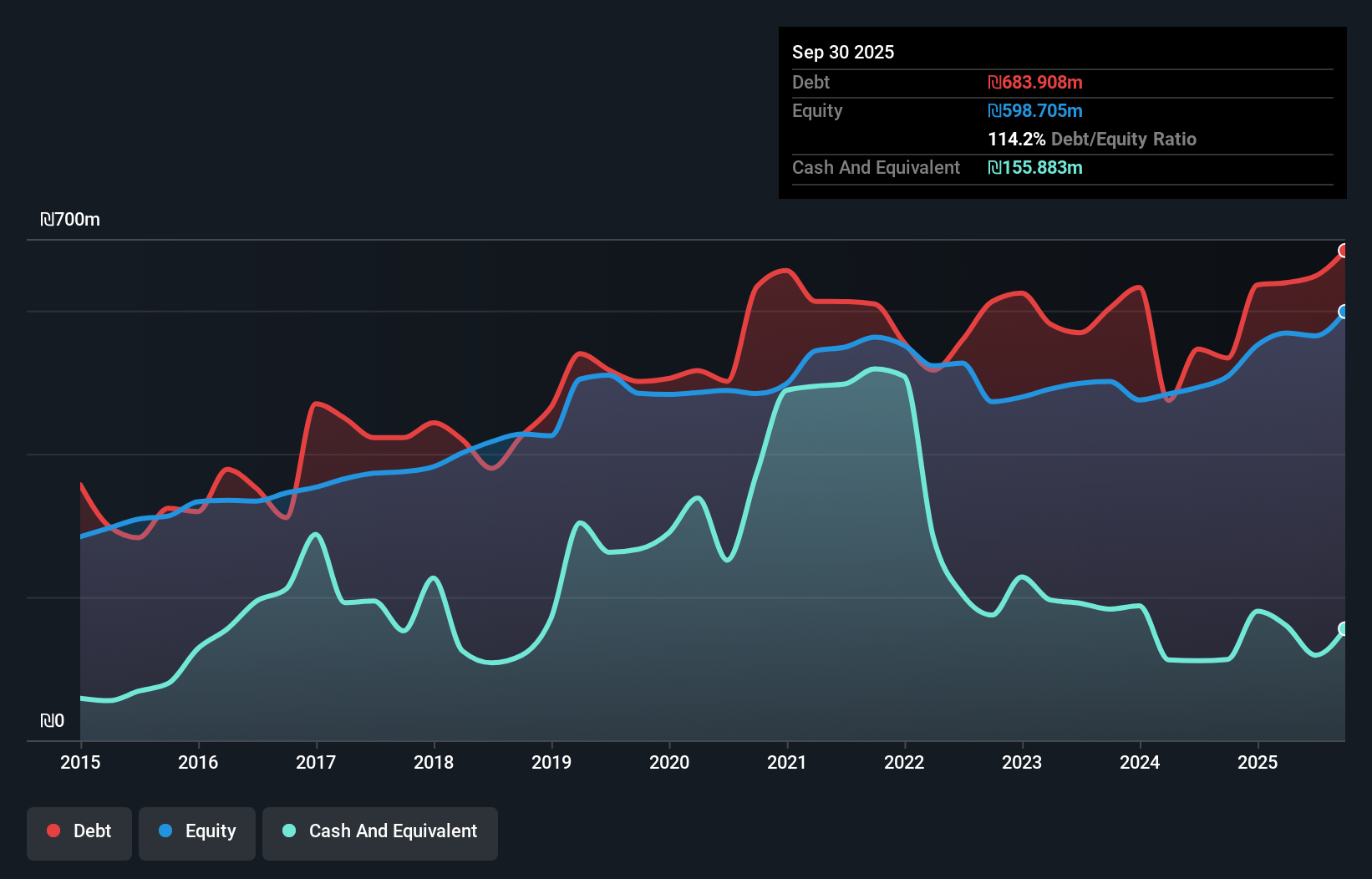

Afcon Holdings, with its price-to-earnings ratio at 25.6x, presents a value proposition below the industry average of 29.4x. Despite sales dipping to ILS 1.26 billion from ILS 1.34 billion over nine months compared to last year, net income rose significantly to ILS 57.5 million from ILS 36.84 million previously reported for the same period, reflecting robust earnings growth of 345%. However, its debt situation is notable; while the debt-to-equity ratio improved from 130% to around 114% in five years, it still holds a high net debt-to-equity ratio of approximately 88%.

- Take a closer look at Afcon Holdings' potential here in our health report.

Gain insights into Afcon Holdings' historical performance by reviewing our past performance report.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market capitalization of ₪1.40 billion.

Operations: Cohen Development Gas & Oil generates revenue primarily from the production and management of oil and gas exploration, amounting to $27.42 million.

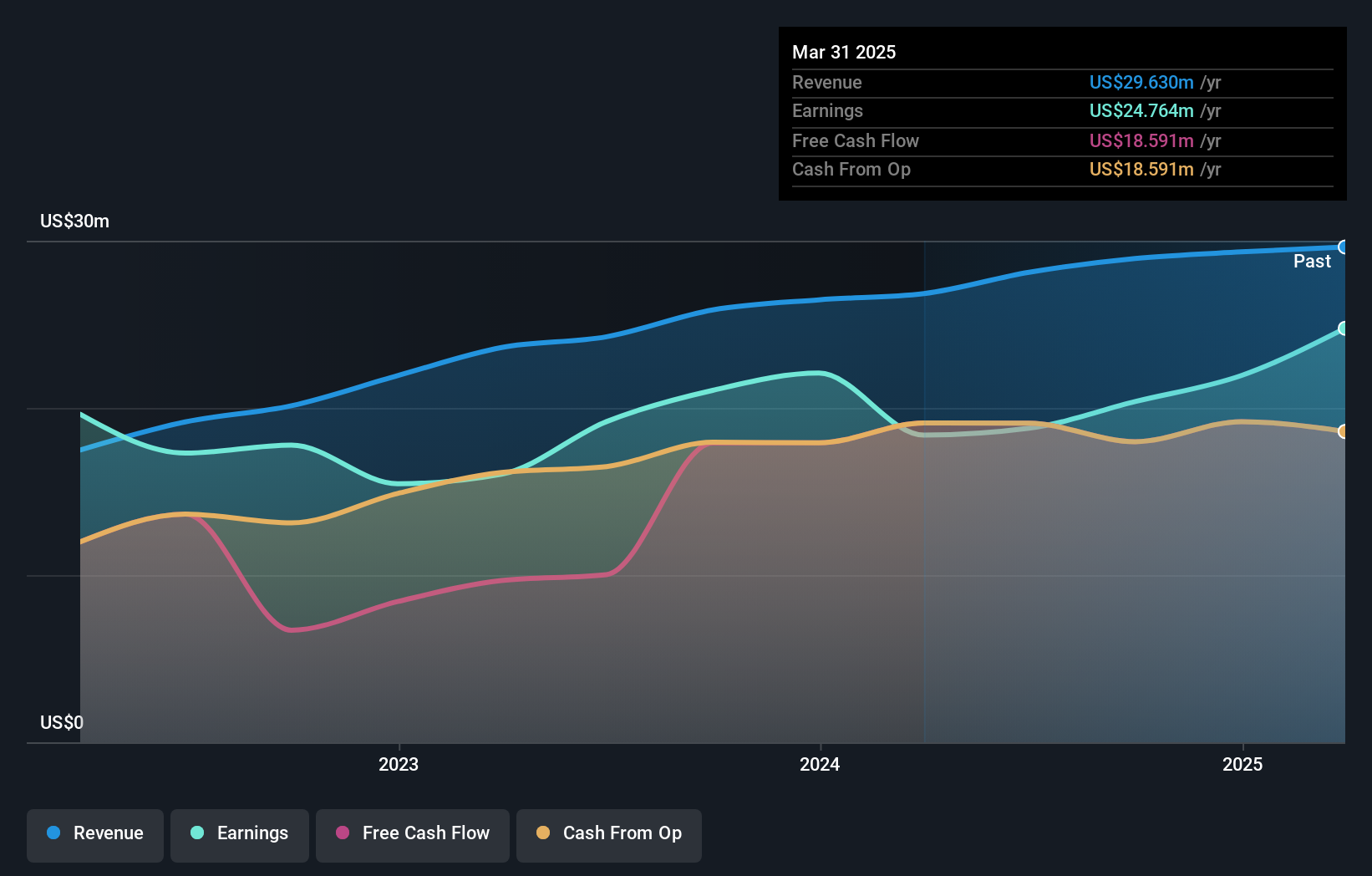

Cohen Development Gas & Oil, a nimble player in the energy sector, showcases robust financial health with no debt over the past five years. The company outpaces its industry peers, boasting a 50.5% earnings growth compared to the sector's -10%. Its price-to-earnings ratio of 14.3x is favorable against the IL market average of 16.4x, indicating potential value for investors. Recent private placements raised significant capital, with notable participation from Menora Mivtachim Holdings and others, enhancing liquidity and investor confidence. Despite a slight dip in quarterly net income to US$7.42 million from US$7.96 million last year, nine-month earnings surged to US$24.83 million from US$16.1 million previously.

- Navigate through the intricacies of Cohen Development Gas & Oil with our comprehensive health report here.

Understand Cohen Development Gas & Oil's track record by examining our Past report.

Villar International (TASE:VILR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Villar International Ltd., with a market cap of ₪3.07 billion, operates in the acquisition, development, and construction of real estate properties both in Israel and internationally through its subsidiaries.

Operations: The primary revenue streams for Villar International Ltd. include the rental of buildings, generating ₪262.54 million, and the provision of archival services at ₪93.19 million. The construction of buildings contributes an additional ₪67.46 million to their revenue profile.

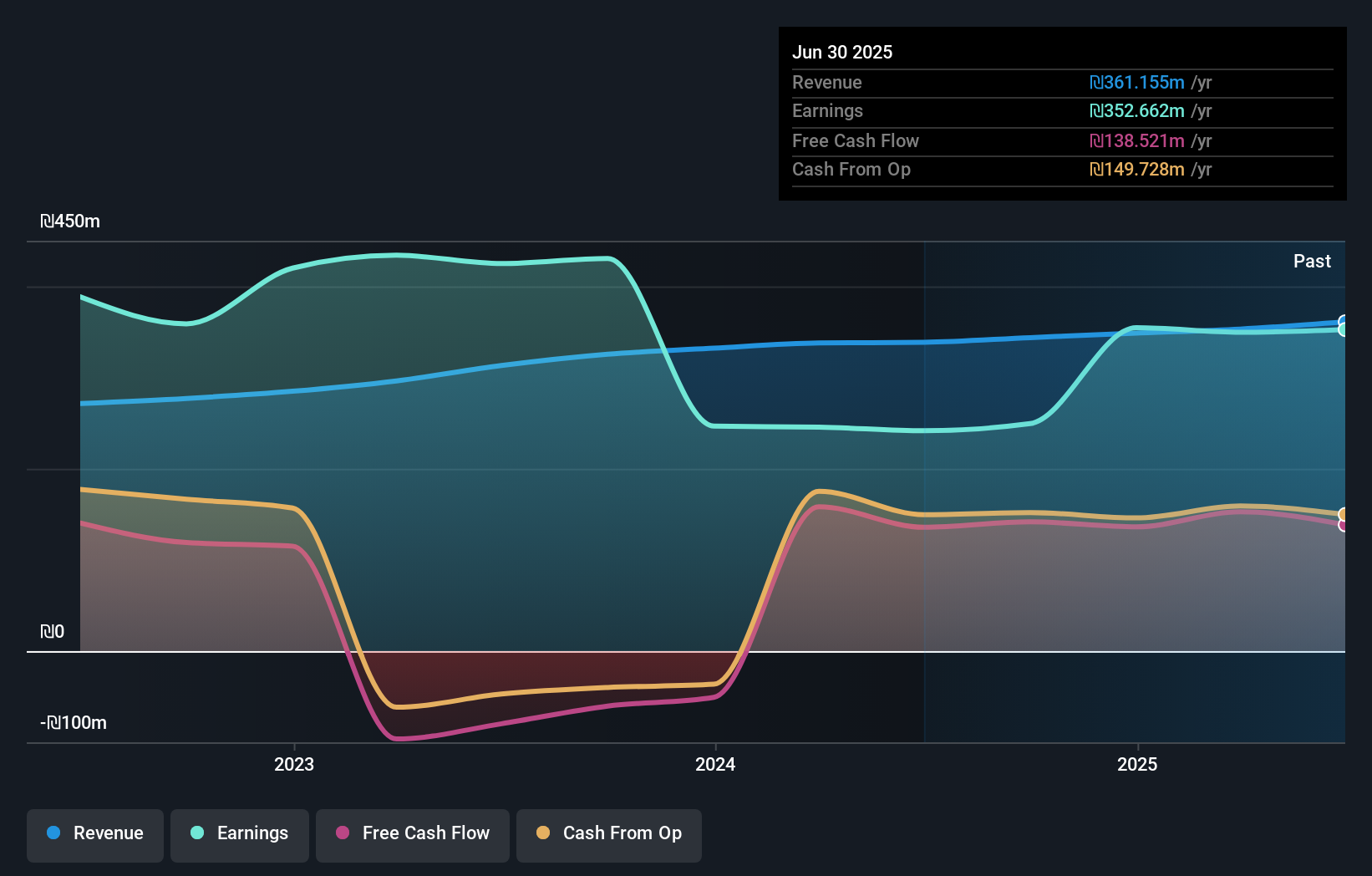

Villar International, a smaller player in the real estate sector, has shown notable financial resilience. With a price-to-earnings ratio of 8.8x, it sits comfortably below the IL market average of 16.4x, suggesting potential value for investors. The company's net debt to equity ratio stands at a satisfactory 12.1%, reflecting prudent financial management as debt levels have decreased from 33.6% to 19.3% over five years. Despite a one-off gain of ₪235M impacting recent results and net income slightly lower than last year at ₪44M for Q3, earnings growth outpaced industry peers by hitting an impressive 40%.

- Unlock comprehensive insights into our analysis of Villar International stock in this health report.

Where To Now?

- Delve into our full catalog of 185 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal