How Investors May Respond To EMCOR Group (EME) Doubling Down With a Sharp Dividend Hike

- In early January 2026, EMCOR Group’s board approved a regular quarterly cash dividend of US$0.40 per share, payable on January 30, 2026 to shareholders of record as of January 14, 2026, marking a substantial uplift from the prior US$0.25 payout.

- This sizable dividend increase, on top of multi-year revenue and earnings growth and a 15-year payment streak, highlights EMCOR’s emphasis on returning more cash to shareholders while signaling confidence in its underlying cash generation.

- Next, we’ll examine how this materially higher recurring dividend interacts with EMCOR’s growth-focused investment narrative and analysts’ longer-term assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

EMCOR Group Investment Narrative Recap

To own EMCOR Group, you need to believe its record backlog, disciplined execution, and solid balance sheet can offset cyclical exposure in industrial and energy end-markets. The latest dividend lift to US$0.40 per share does not materially change the near term swing factor, which still centers on project timing and volumes in Industrial Services, while persistent labor and wage pressures remain a key margin risk to watch.

Among recent updates, EMCOR’s multi-year earnings growth and improving net margin provide essential context for this higher recurring dividend, as they underpin the capacity to fund larger cash returns while still supporting growth projects, acquisitions, and investments in technical talent that many investors view as central to the company’s backlog driven catalyst.

Yet behind this bigger dividend, one risk investors should be aware of is that rising labor costs could...

Read the full narrative on EMCOR Group (it's free!)

EMCOR Group's narrative projects $20.6 billion revenue and $1.4 billion earnings by 2028. This assumes 9.7% yearly revenue growth and an earnings increase of about $0.3 billion from $1.1 billion today.

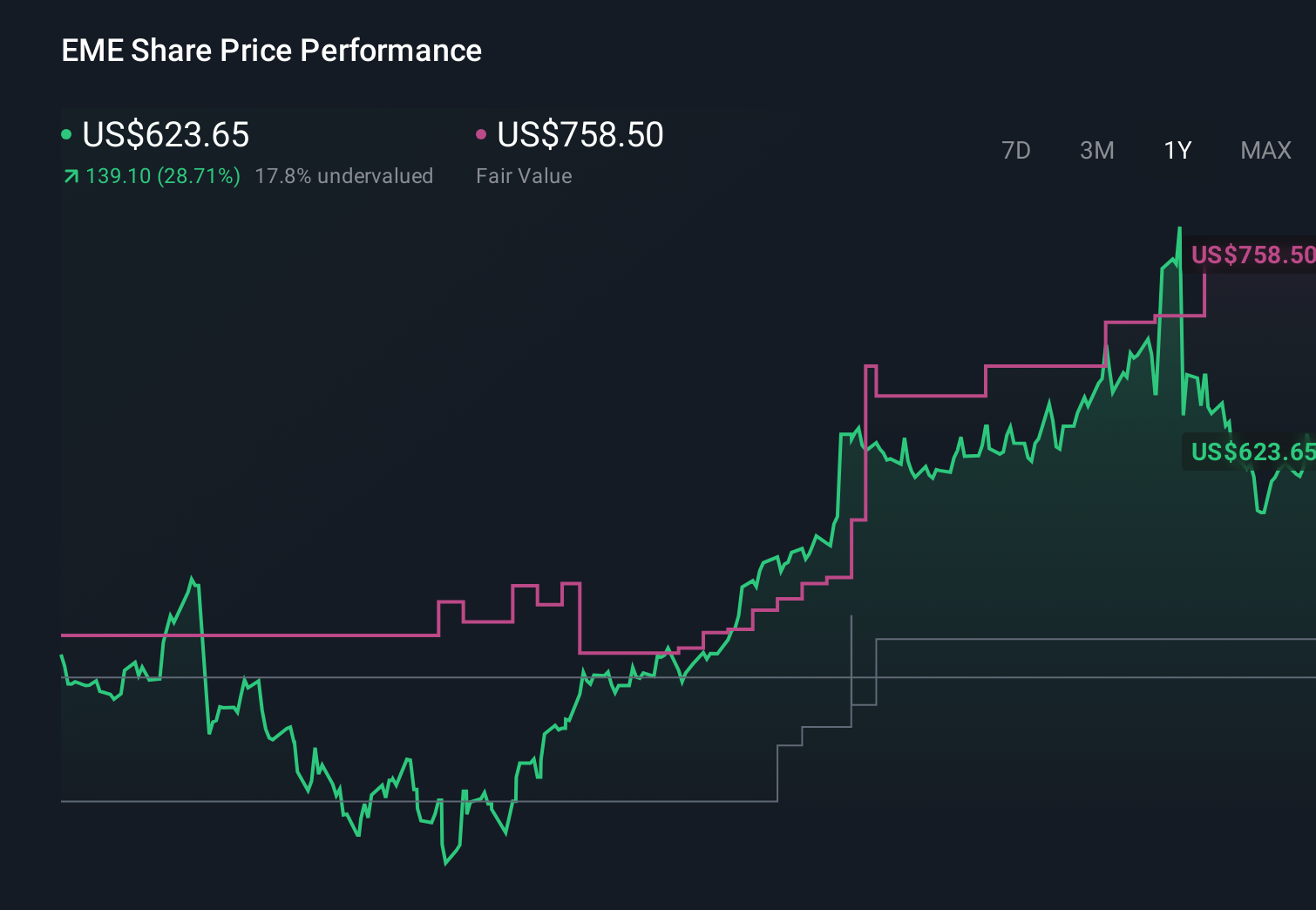

Uncover how EMCOR Group's forecasts yield a $758.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value EMCOR between US$468.79 and US$910.69 per share, underlining how far opinions can diverge. When you set those ranges against the company’s reliance on large industrial and energy projects, it becomes even more important to weigh how cyclical end markets might affect EMCOR’s ability to keep growing into those expectations over time.

Explore 8 other fair value estimates on EMCOR Group - why the stock might be worth 27% less than the current price!

Build Your Own EMCOR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal