Fair Isaac (FICO): Taking Stock of Valuation After Recent Share Price Pullback

Fair Isaac (FICO) has quietly pulled back, with the stock down about 3% on the day, 6% for the week, and roughly 11% over the past 3 months from its recent highs.

See our latest analysis for Fair Isaac.

Zooming out, that recent slide in the share price sits against a flat year to date share price return and a softer 1 year total shareholder return of around minus 16 percent, even though the 3 year total shareholder return is still very strong.

If FICO has you rethinking how you spot momentum shifts, it could be a good moment to scan for other fast movers and discover fast growing stocks with high insider ownership.

With profits growing double digits and the share price lagging its highs, investors are left wondering if Fair Isaac is quietly slipping into undervalued territory, or if the market already sees and prices in its next leg of growth?

Most Popular Narrative: 19.1% Undervalued

With Fair Isaac last closing at $1643.27 against a narrative fair value near $2031.78, the story implies meaningful upside if its growth path holds.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability. Sustained investment in explainable AI and machine learning, as showcased by new FICO-focused foundation models and decisioning innovations, is enhancing competitive differentiation and supporting premium product offerings, increasing average selling prices and net margins.

Want to see what kind of revenue runway and margin profile could support that gap, and how rich the future earnings multiple really gets? Read on.

Result: Fair Value of $2031.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes in mortgage scoring and slower software platform adoption could pressure Fair Isaac’s growth assumptions and challenge the current undervaluation narrative.

Find out about the key risks to this Fair Isaac narrative.

Another Angle on Valuation

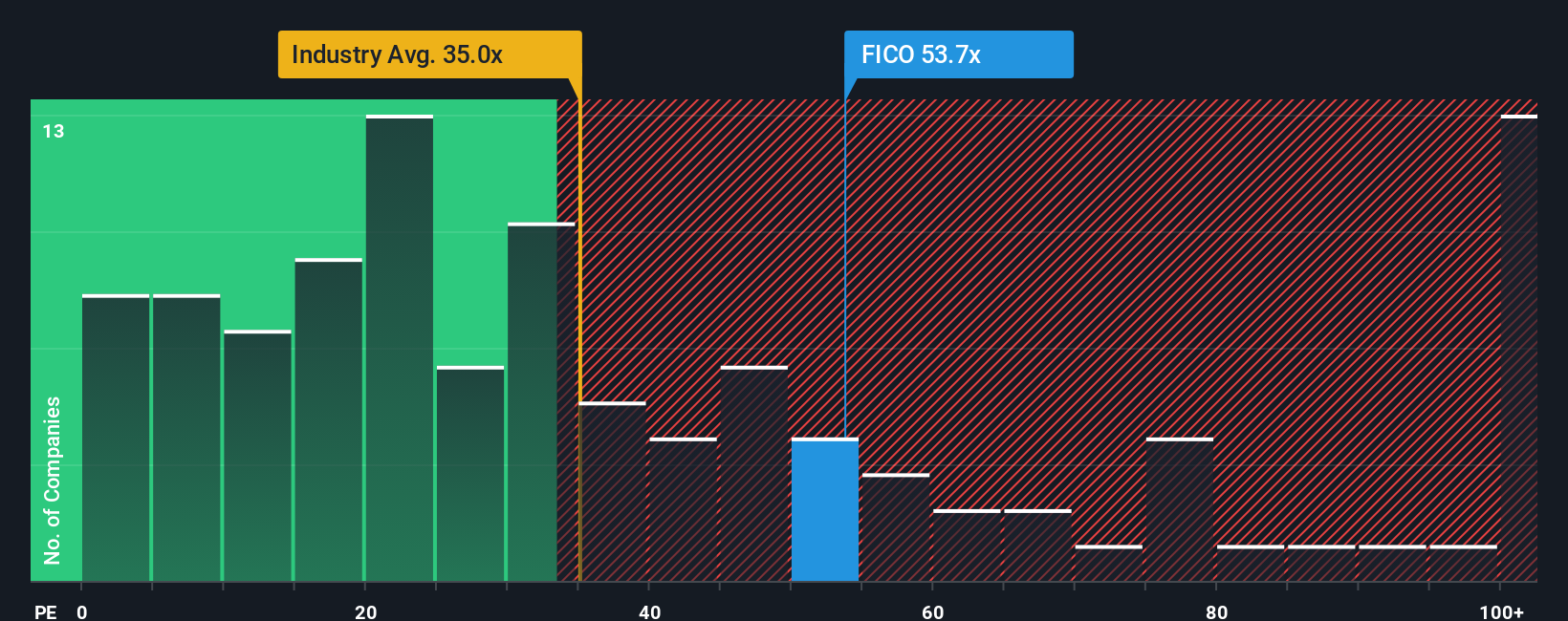

While the narrative fair value suggests upside, our look at FICO’s earnings multiple paints a tougher picture. The stock trades on a rich 59.8x P E versus 31.7x for the US software sector and a 37.9x fair ratio, signaling meaningful valuation risk if growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Fair Isaac research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winners with targeted screens that surface standout businesses you might otherwise overlook in a crowded market.

- Target potential multibaggers early by scanning these 3571 penny stocks with strong financials that already back their tiny market caps with real financial strength.

- Ride structural tailwinds in automation and data by focusing on these 29 healthcare AI stocks that leverage intelligent tools to transform patient outcomes and operating efficiency.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that balance reliable payouts with fundamentals built to endure shifting economic conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal