Assessing Viatris (VTRS) Valuation After Its Recent Share Price Rally

Why Viatris Stock Is Back on Investors Radar

Viatris (VTRS) has quietly put together a solid stretch of returns, with the stock up about 14% over the past month and roughly 23% in the past 3 months.

See our latest analysis for Viatris.

More importantly, that recent 30 day share price return of about 14% and 90 day gain near 23% suggest momentum is picking up, even as the one year total shareholder return sits at a steadier mid single digit level.

If Viatris has caught your eye, it could be worth seeing what else is working in healthcare right now by exploring healthcare stocks for fresh ideas.

With Viatris trading near analyst targets yet still showing a hefty estimated intrinsic discount, investors face a key question: is this recent rally just catching up to fair value, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 10% Overvalued

With Viatris last closing at $12.46 against a narrative fair value of $12.44, the story hinges less on price and more on future earnings power.

Analysts expect earnings to reach $419.7 million (and earnings per share of $0.38) by about September 2028, up from $-3.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $700.8 million in earnings, and the most bearish expecting $65 million.

Want to know what justifies paying a premium for a slow growing, turnaround name? The narrative quietly bakes in an earnings recovery and a valuation multiple usually reserved for faster growing franchises. Curious which profit and margin assumptions drive that outcome and how they stack up against the wider pharma space? Dive into the full narrative to see the logic behind this fair value call.

Result: Fair Value of $12.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure on mature generics and any delays in key product approvals could quickly undermine the earnings recovery implied in this narrative.

Find out about the key risks to this Viatris narrative.

Another Angle on Valuation

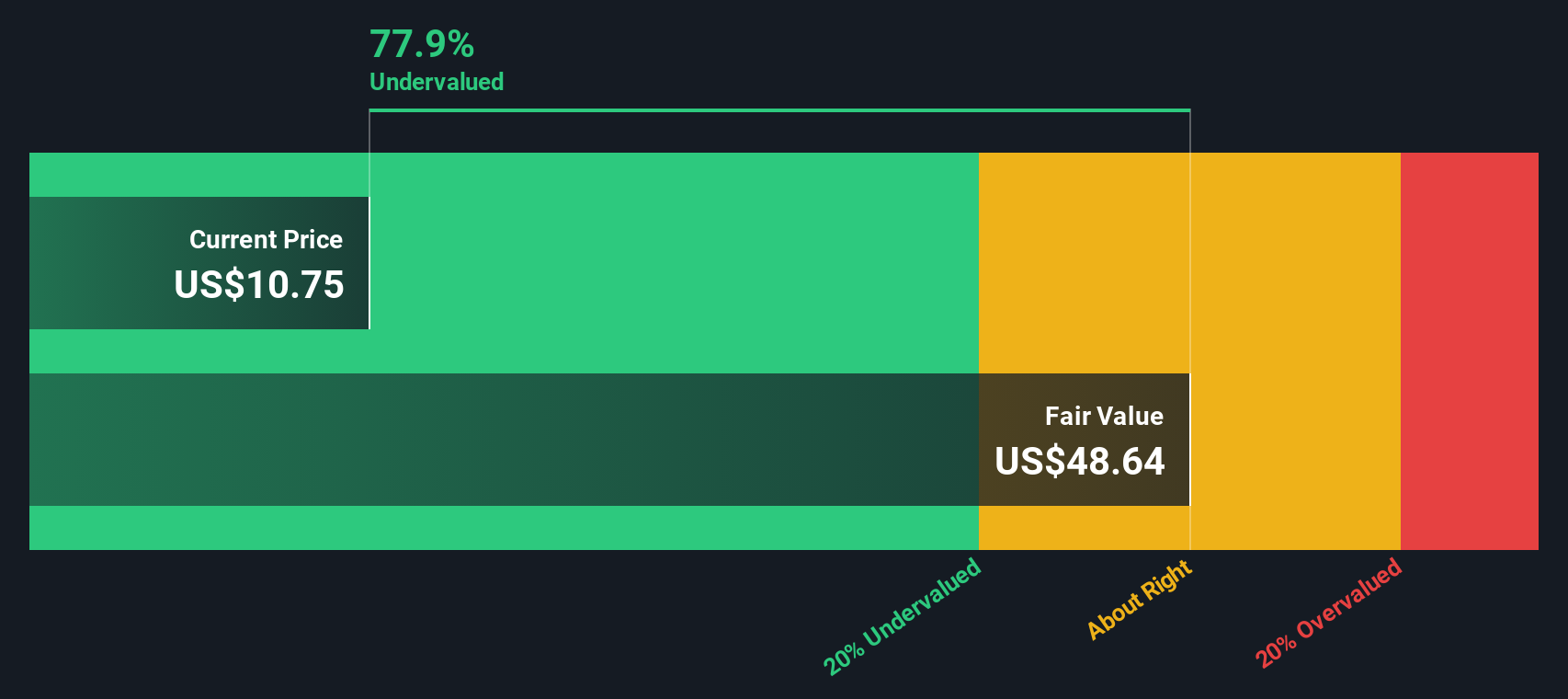

While the narrative suggests Viatris is modestly overvalued around $12.44, our DCF model paints a very different picture, with fair value near $49.78 and the stock trading about 75% below that level. Is the market correctly discounting risk, or is it overlooking a deep value setup?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viatris Narrative

If you are not fully sold on this perspective or would rather dig into the fundamentals yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Viatris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research momentum to work by using the Simply Wall St Screener to uncover fresh opportunities that could strengthen and diversify your portfolio.

- Capture potential bargains by scanning these 875 undervalued stocks based on cash flows that are trading below what their cash flows suggest they are worth.

- Ride structural shifts in technology by focusing on these 25 AI penny stocks positioned to benefit from long term adoption of intelligent automation.

- Lock in steady portfolio income by reviewing these 14 dividend stocks with yields > 3% that can help support returns through varied market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal